Gold (XAUUSD) storms new records: on the way to 4,000 USD

Gold (XAUUSD) continues to hit new record highs, with an intermediate upside target likely at the 3,920 USD mark. Find more details in our analysis for 30 September 2025.

XAUUSD forecast: key trading points

- The US CB Consumer Confidence Index: previously at 97.4, projected at 96.0

- The US JOLTS job openings: previously at 7.181 million, projected at 7.190 million

- Current trend: moving upwards

- XAUUSD forecast for 30 September 2025: 3,799 and 3,820

Fundamental analysis

The XAUUSD forecast for today shows that gold continues its upward momentum, setting new price records, with prices currently hovering around 3,864 USD per ounce.

The US CB Consumer Confidence Index reflects households’ assessment of economic resilience in the current environment. It is a leading indicator that predicts consumer spending, which is a vital part of economic activity. A high reading indicates consumer optimism.

The XAUUSD forecast for 30 September 2025 suggests that the index may decline to 96.0 points, reflecting weaker consumer sentiment, compared to the previous value of 97.4.

The US Job Openings and Labor Turnover Survey (JOLTS) is an economic indicator reflecting the number of unfilled jobs at the end of the month. Published by the Bureau of Labor Statistics (BLS), it provides insights into labour demand, economic activity, and the balance between employers and job seekers.

JOLTS helps evaluate labour market dynamics: a high number of job openings indicates economic activity and growing demand for workers, while a low number points to business difficulties and slower economic growth. The data is used by analysts, investors, and the government in decision-making.

Today’s XAUUSD analysis suggests that job openings could rise to 7.190 million. If the actual figure exceeds expectations, it may have a positive effect on the US dollar, while a weaker-than-expected reading could trigger further XAUUSD growth.

XAUUSD technical analysis

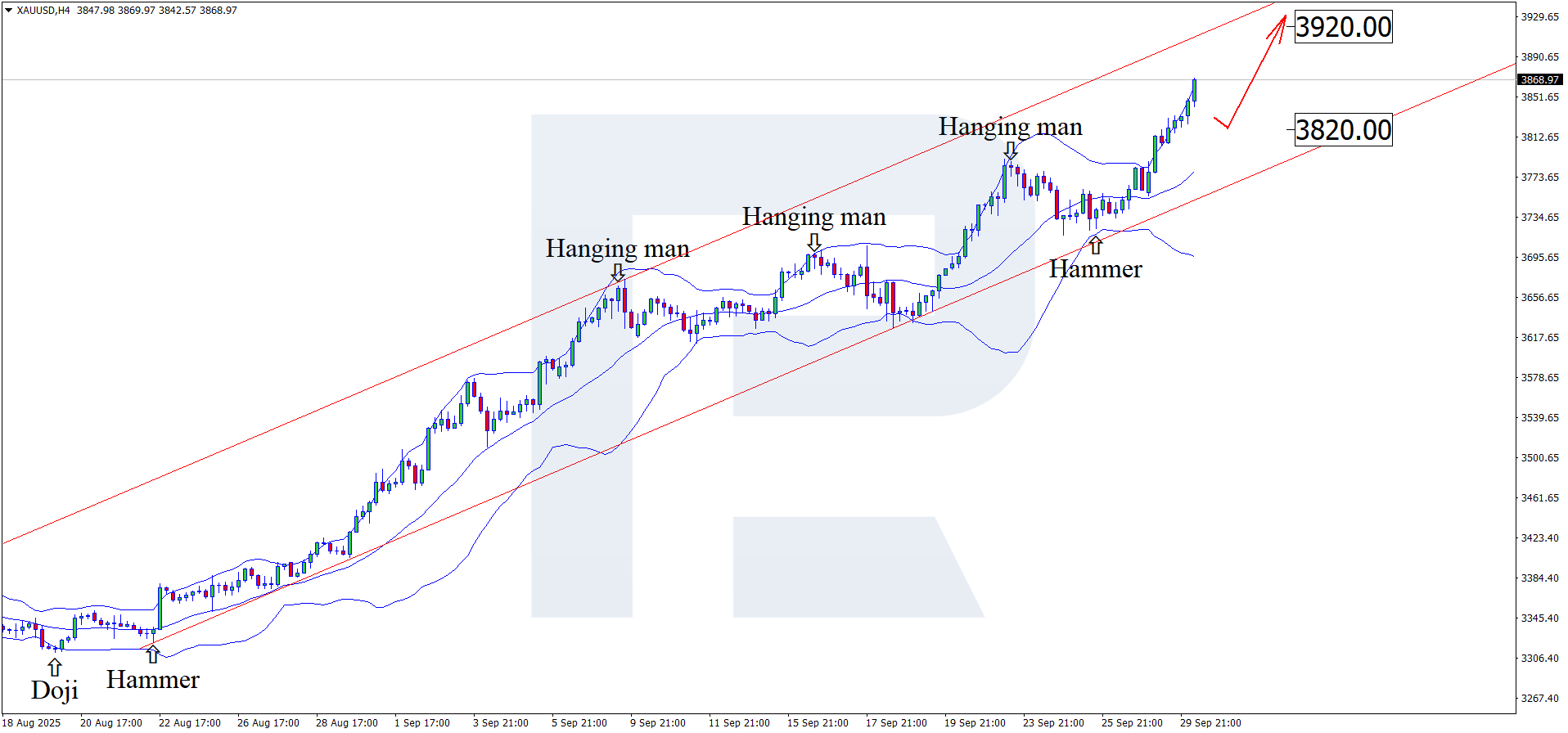

On the H4 chart, XAUUSD prices formed a Hammer reversal pattern near the lower Bollinger Band. At this stage, quotes continue their upward trajectory following the signal from the pattern. Since XAUUSD remains within an ascending channel and given economic data, the uptrend may continue after a potential pullback. Currently, the upside target is the 3,920 USD level.

At the same time, today’s XAUUSD technical analysis suggests an alternative scenario, where prices correct towards 3,820 USD before resuming growth.

The potential for continued upward movement remains, and in the near term, XAUUSD prices could head towards the next psychological mark of 4,000 USD.

Summary

The USD continues to lose ground amid disappointing US economic indicators. XAUUSD technical analysis suggests growth towards the 3,920 USD level.