XAUUSD quotes continue their powerful rally, climbing confidently towards the 3,350 USD area, driven by trade tensions between the US and other countries. Discover more in our analysis for 17 April 2025.

XAUUSD forecast: key trading points

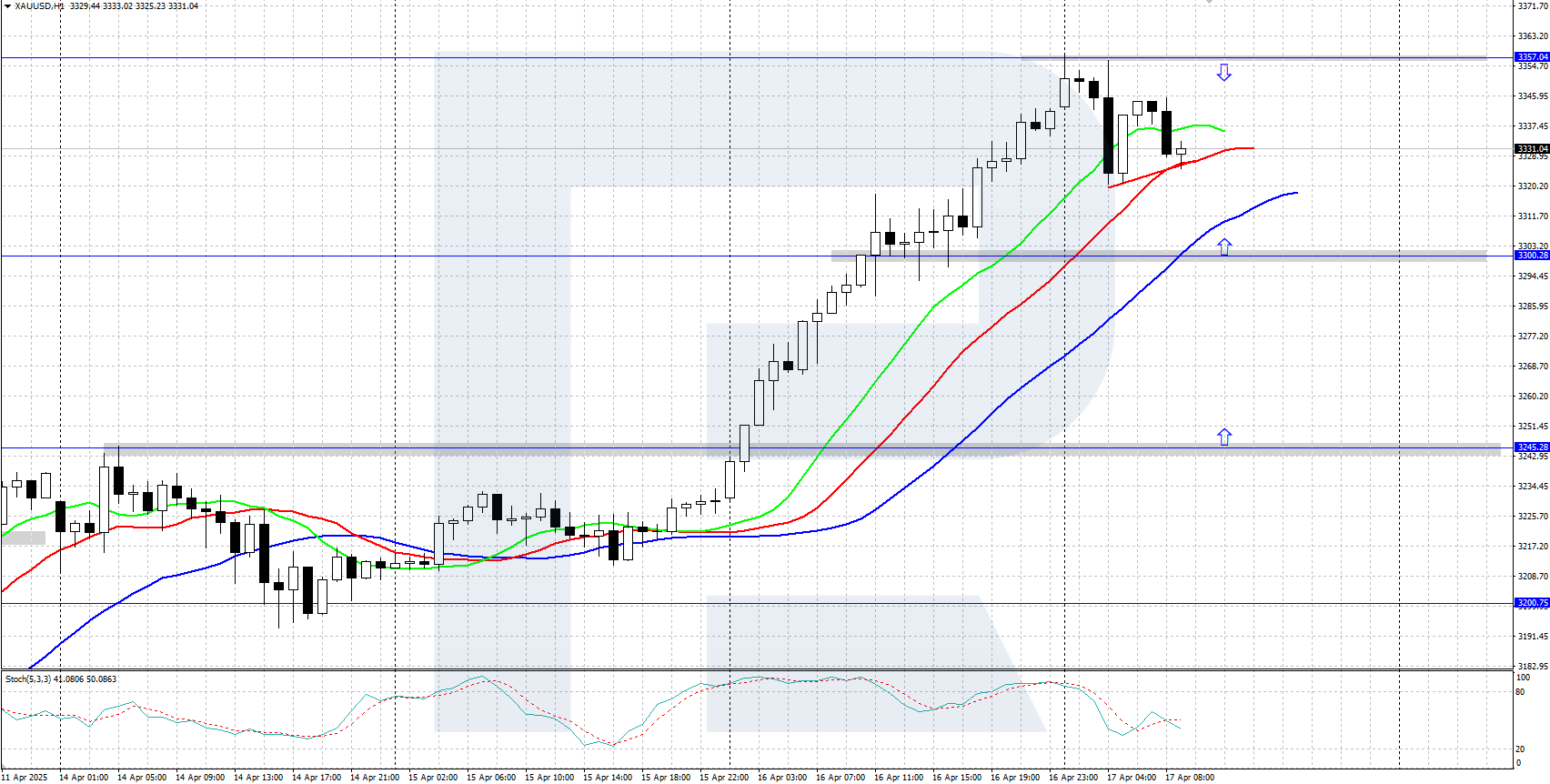

- Gold set a new all-time high at 3,357 USD today

- Current trend: strong uptrend

- XAUUSD forecast for 17 April 2025: 3,400 and 3,300

Fundamental analysis

Gold (XAUUSD) prices maintain their upward momentum, repeatedly hitting new all-time highs. Safe-haven demand continues to drive the rally as uncertainty around US trade policy and the potential economic fallout from new tariffs fuels investor caution.

On Wednesday, Federal Reserve Chairman Jerome Powell stated that the Fed will wait for greater clarity before adjusting interest rates. He acknowledged that new tariffs introduced by President Trump are expected to push inflation higher and slow economic growth.

Should the Fed clearly signal that it will refrain from cutting interest rates in the near term, this could support the US dollar and trigger a downside correction in XAUUSD prices.

XAUUSD technical analysis

Gold remains in a strong uptrend, currently trading near 3,350 USD. The Alligator indicator confirms bullish momentum. The nearest support level is located at 3,300 USD.

The short-term XAUUSD price forecast suggests that further growth towards 3,400 USD is likely if bulls retain the initiative. Conversely, if bears push prices below 3,300 USD, a correction may follow towards 3,245 USD.

Summary

Gold is rising steadily, reaching around 3,350 USD today. A downward correction could be triggered by easing trade tensions or a possible change in the Federal Reserve’s plans to lower interest rates.