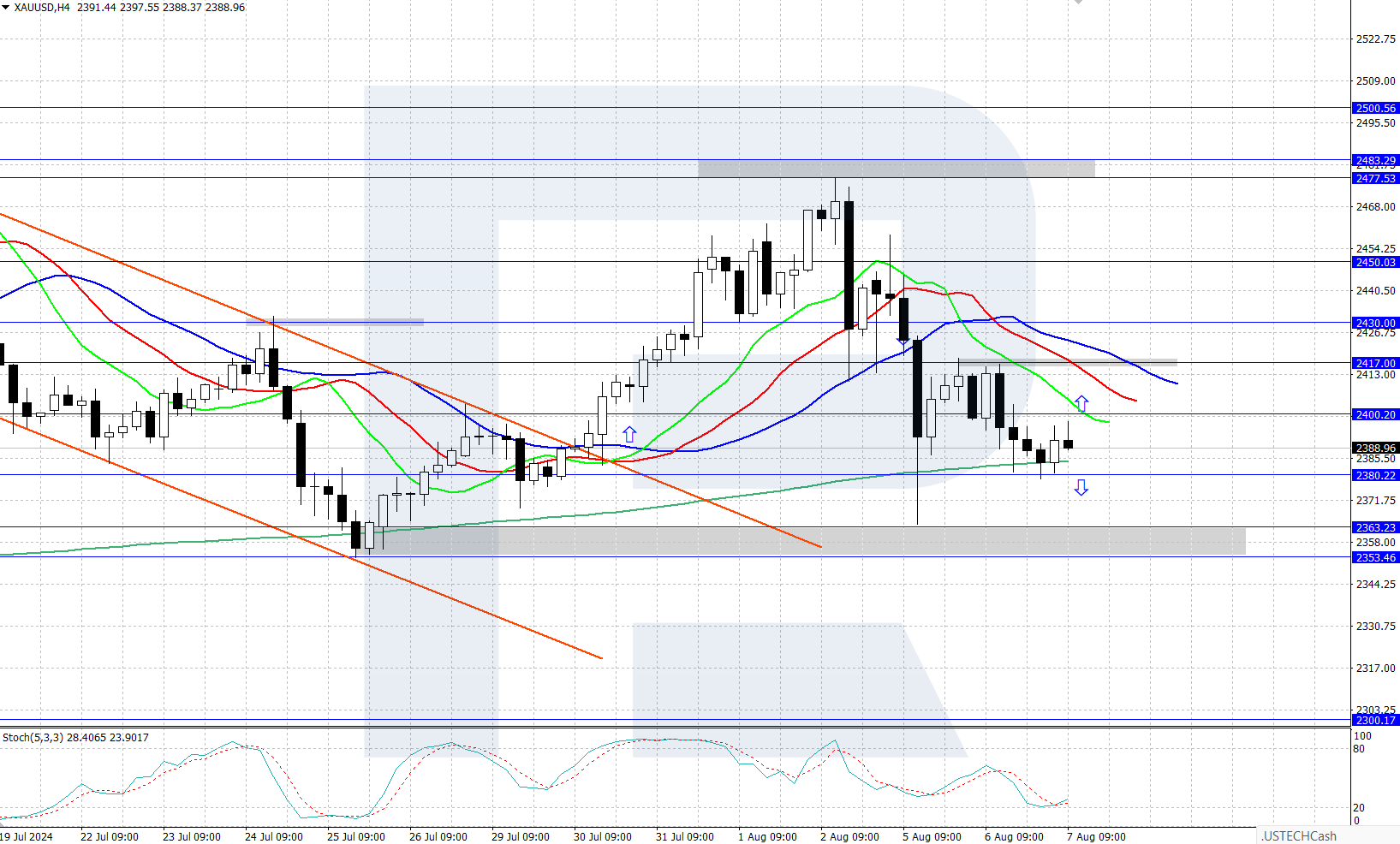

Although the XAUUSD price has dipped below 2,400 USD from its all-time high area, the uptrend persists, and growth may resume. Find out more in our XAUUSD analysis for today, 7 August 2024.

XAUUSD trading key points

- Market focus: markets are under pressure from weak US employment data

- Current trend: gold is undergoing a downward correction as part of a long-term uptrend

- XAUUSD forecast for 7 August 2024: 2,417 and 2,380

Fundamental analysis

XAUUSD quotes have undergone a downward correction on the daily chart, falling below 2,400 after rising to an all-time high of 2,483 USD amid weak US employment data. This decline may be attributed to profit-taking by buyers and local strengthening of the US dollar against other currencies.

Overall, the potential for XAUUSD growth remains as the US dollar will soon come under pressure from an interest rate reduction. Given gold's status as a popular safe-haven asset, another round of geopolitical tensions in the Middle East may positively impact gold prices.

XAUUSD technical analysis

XAUUSD quotes are currently hovering just below the 2,400 level, where bulls are attempting to push the price higher following the downward correction. The trend remains upward. However, whether the downward correction will continue or end at these levels remains to be determined.

The 2,453-2,463 USD area is now vital support. The short-term XAUUSD price forecast suggests that the downward correction could extend if bears break through this level, potentially reaching 2,300. Conversely, if bulls push the price above 2,400 USD, XAUUSD could rise to the 2,417 resistance level and higher.

Summary

After testing an all-time high of 2,483 USD, gold corrected downward. Growth potential remains as long as prices stay above the 2,453-2,463 USD support area.