Gold (XAUUSD) weekly forecast: record after record, gold does not stop

Gold (XAUUSD) set a new all-time high, testing the 4,242 per ounce level. The metal is supported by expectations of further Federal Reserve rate cuts following the September policy easing and robust demand for safe-haven assets amid the ongoing US government shutdown. Additional drivers include central bank purchases, reciprocal tariffs between China and the US, and persistent geopolitical tensions.

This overview examines the key factors that will shape gold price dynamics for the week of 20–24 October.

XAUUSD forecast for this week: quick overview

- Weekly dynamics: XAUUSD is hovering near its all-time high of 4,200 per ounce with strong bullish momentum. Growth is driven by dovish Fed rhetoric, demand for safe-haven assets, and the ongoing US government shutdown, creating market uncertainty

- Support and resistance: the nearest support level is at 4,170, followed by 4,120 and 4,05The resistance level is located at 4,242. An upward breakout would open the way for a move to 4,350, while a consolidation below 4,170 would signal a correction towards the 4,050–4,000 range

- Fundamentals: expectations of two additional Fed rate cuts this year, a weakening dollar, and paused macroeconomic data releases due to the shutdown form a bullish backdrop for gold. Additional support comes from the central bank and institutional demand

- Outlook: the baseline scenario for 20–24 October is consolidation above 4,200 with potential for new record highs in the 4,350–4,400 area. A downward breakout would indicate a moderate correction, but the overall trend remains bullish

Gold (XAUUSD) fundamental analysis

Gold (XAUUSD) ends the week near 4,200 per ounce, slightly down after reaching a record high above 4,242. The pullback was mainly due to profit-taking and a partial easing of geopolitical tensions. The fundamental backdrop for gold remains firmly bullish.

The main growth driver remains the Federal Reserve's dovish policy. After the 25-basis-point rate cut in September, markets fully price in another cut in October and nearly 90% odds of one more in December. The FOMC minutes confirmed the Fed’s concerns about labour market conditions and lingering inflation risks, reinforcing expectations for continued monetary easing.

Additional support comes from the ongoing US government shutdown, now in its third week, which delays macroeconomic data releases, including the crucial employment report for September. With official statistics paused, investors have turned to private indicators, which suggest job losses and declining business activity – factors that boost demand for safe-haven assets and reduce dollar appeal.

Geopolitically, signs of easing tensions in the Middle East temporarily affected prices. A statement by Donald Trump about an agreement between Israel and Hamas on the first phase of a peace plan triggered a brief dip in gold. However, investor interest, especially from central banks and institutional funds, remains strong.

Since the start of the year, gold has surged more than 60%, marking its strongest performance since 1979.

XAUUSD technical analysis

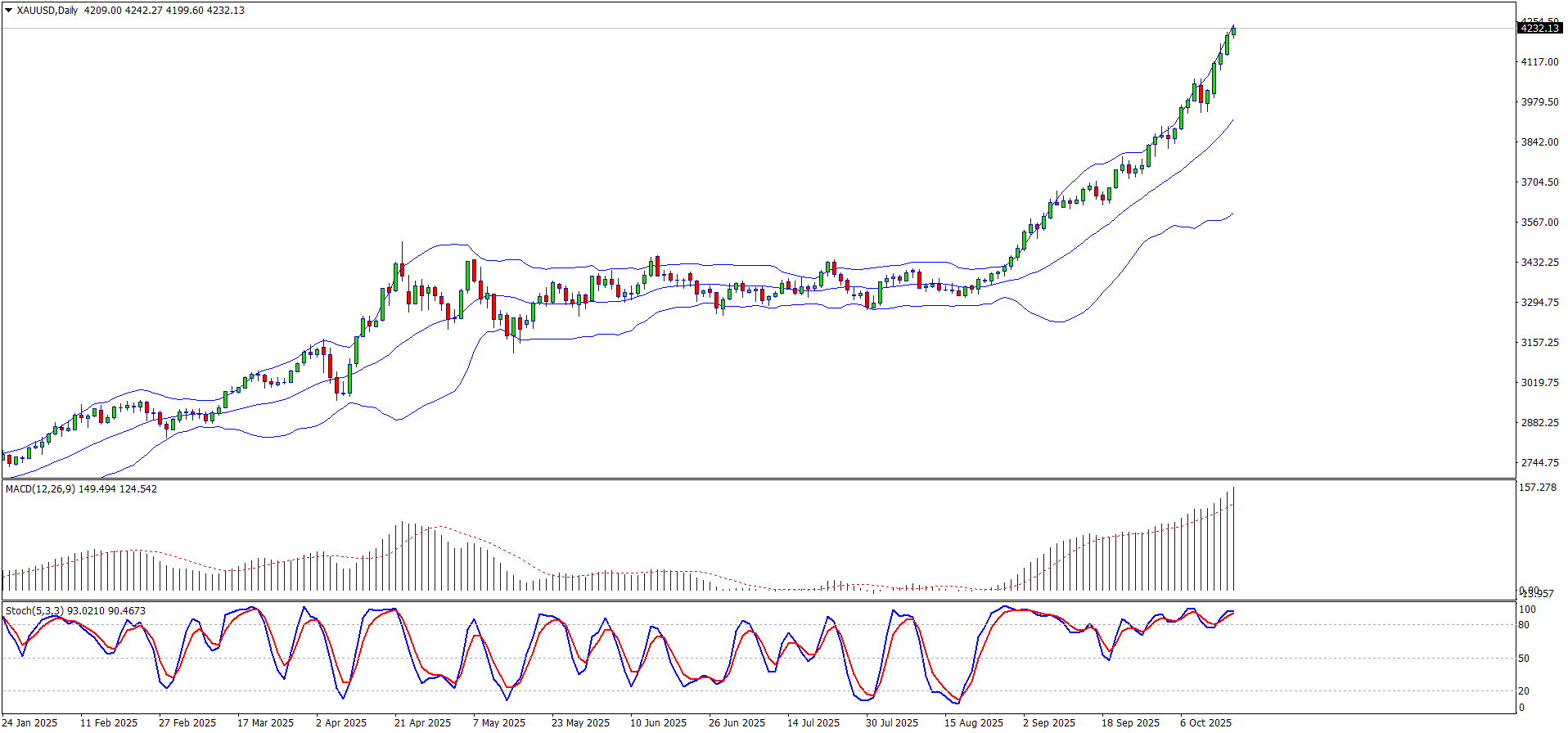

On the daily chart, XAUUSD shows strong upward momentum that began in mid-September following a long consolidation phase between 3,245 and 3,625. Since the breakout, gold has been steadily climbing and recently tested the all-time high at 4,242.

Bollinger Bands are expanding, indicating increased volatility and confirming bullish momentum. Prices are moving along the upper boundary of the channel, with only minor pullbacks. MACD is firmly in positive territory and continues to rise, indicating prevailing buyer strength.

The Stochastic Oscillator remains in overbought territory, signalling a potential for a short-term pause or technical correction following the strong rally.

The nearest support level is at 4,170, with key resistance at 4,242. A solid breakout above 4,242 would open the way to new all-time highs at 4,350–4,500. A drop below 4,170 could lead to a pullback towards the 4,000–4,050 range.

XAUUSD trading scenarios

The fundamental backdrop for gold remains bullish: expectations of further Fed rate cuts, a weak dollar, and strong demand for safe-haven assets continue to support buyers. An additional factor is the US government shutdown, which adds to the uncertainty and strengthens gold’s appeal as an alternative asset.

- Buy scenario

Long positions remain in focus while the price stays above the 4,170 support level. A rebound from this level may push prices to 4,350–4,400, and consolidation above this area could lead to a move towards 4,500. Additional growth could be fuelled by dovish Fed commentary and weak private US labour data.

- Sell scenario

Short positions become viable if prices break below 4,170. In this case, targets shift towards 4,000–4,050. Selling pressure will increase with a strengthening dollar and rising US Treasury yields.

Conclusion: Gold remains in the 4,200–4,242 range. The baseline scenario for the week is consolidation above 4,240 with the potential for a move towards 4,350–4,500. A breakout below the support level may trigger a moderate correction, but the overall bullish trend remains intact.

Summary

Gold (XAUUSD) is hovering near all-time highs around 4,242, bolstered by expectations of continued Fed policy easing, dollar weakness, and strong safe-haven demand. Additional support comes from institutional and central bank purchases.

Gains are limited by profit-taking and moderate increases in US bond yields. Key levels include the 4,170 support level and resistance at 4,242. A breakout above 4,242 would open the path to new highs around 4,350, while a consolidation below 4,170 would increase the risk of a correction towards the 4,000–4,050 zone.

In the coming days, gold’s performance will depend on Fed commentary, expectations of upcoming rate cuts, news about the US government shutdown, and geopolitical developments.