Gold (XAUUSD) weekly forecast: with support, prices poised to reach new highs

Gold (XAUUSD) is hovering around 3,380-3,390 USD per ounce, with demand for the metal supported by expectations of a dovish Fed and a high probability of a rate cut in September. This increases interest in safe-haven assets even as volatility declines.

A restraining factor remains Fed officials' statements pointing to ongoing inflation risks.

Gold continues to balance between hopes for policy easing and uncertainty about Fed actions. Let us look at what to expect this week.

XAUUSD forecast for this week: quick overview

- Weekly dynamics

Gold (XAUUSD) ended the week near 3,390 USD per ounce, staying within the 3,350-3,439 range. Attempts to break upwards remain limited by the 3,380-3,416 resistance area, while the lower boundary is located at 3,350.

- Support and resistance

The key support level lies at 3,350-3,345. A breakout below it would open the way to 3,283 and 3,245. Resistance sits in the 3,380-3,416 area, followed by 3,439 and the all-time high of 3,501.

- Fundamentals

The fundamental backdrop appears mixed. Gold is supported by expectations of a Federal Reserve rate cut in September, soft US inflation data, and ongoing political uncertainty. On the other hand, rising stock indices limit demand for safe-haven assets.

- Outlook

The baseline scenario suggests consolidation within the 3,350-3,439 range. A breakout above 3,439 would pave the way to 3,500, while consolidation below 3,350 increases downside risks.

Gold (XAUUSD) fundamental analysis

Gold (XAUUSD) prices ended the week near 3,380 USD per ounce, close to a two-week high. Despite a local pullback, the metal remains near historical levels due to political and institutional uncertainty surrounding the Fed and the White House.

The main event of the week was the escalation of the conflict regarding the Fed’s independence. US President Donald Trump initiated the dismissal of Federal Reserve Board member Lisa Cook. However, her legal team plans to challenge the decision in court. This fuelled doubts about the Fed’s ability to act independently of the administration.

Amid such developments, markets increased their expectations for monetary easing. The likelihood of a 25-basis-point Federal Reserve rate cut in September rose to 89% from 82% the previous week. The dovish tone was also reinforced by comments from Federal Reserve Bank of New York President John Williams, who confirmed that the rate cut discussion aligns with signals from Jerome Powell at Jackson Hole.

In Asia, demand for gold remains strong. In July, net gold imports to China via Hong Kong rose by 126.8% m/m, essentially doubling from June. This confirms sustained interest in the metal from the world’s largest consumer and remains a key supporting factor.

Thus, gold continues its sideways movement amid conflicting signals. Political pressure in the US adds to uncertainty, while expectations of rate cuts support interest in the asset. Asian demand confirms fundamental stability.

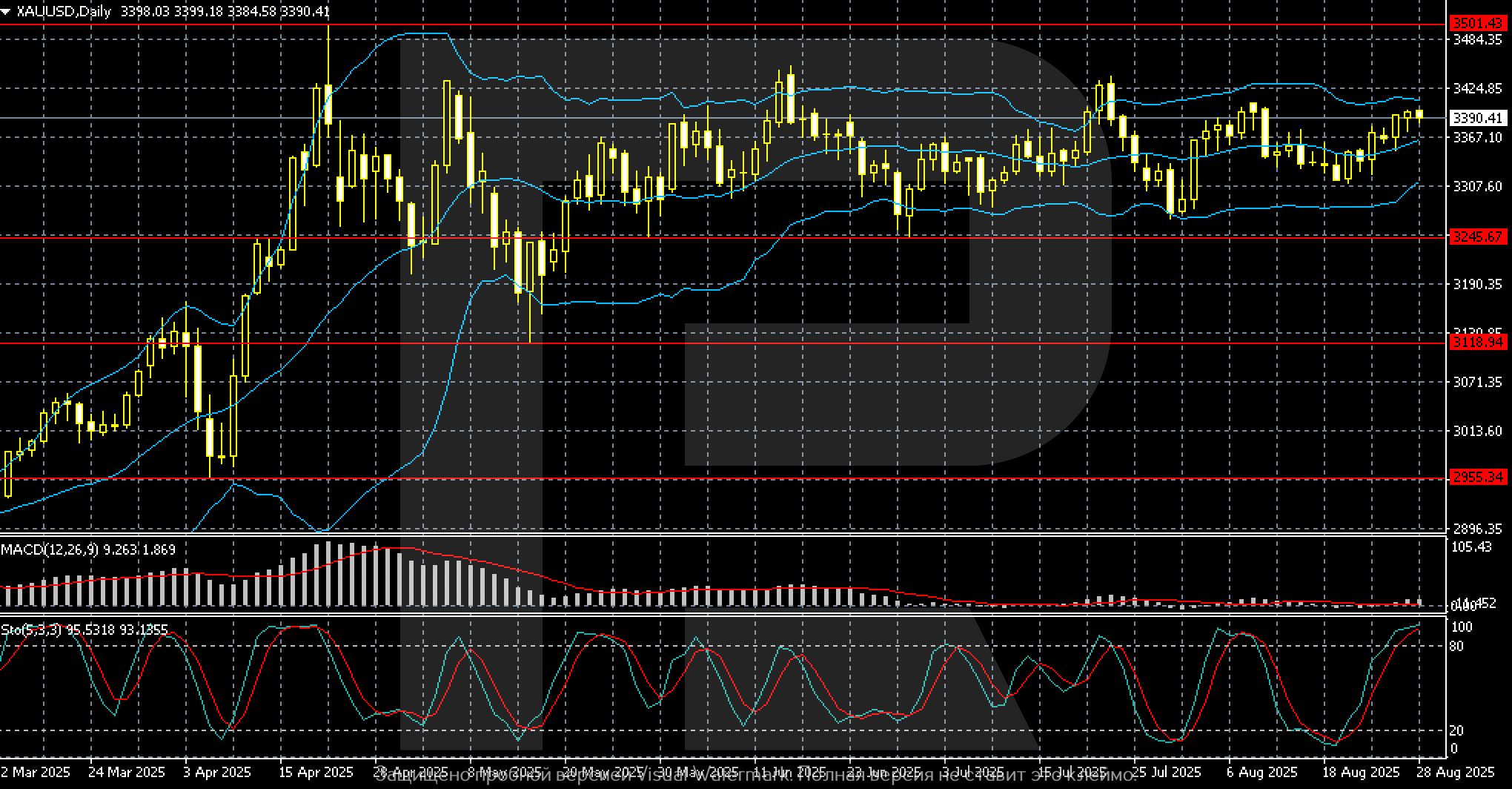

XAUUSD technical analysis

After a strong rally in March–April 2025, Gold (XAUUSD) reached a high around 3,500 USD per ounce before entering a consolidation phase. Since mid-May, gold has traded sideways in the 3,350-3,420 range, remaining below the all-time high of 3,501.

The range’s upper boundary lies near 3,420-3,439, forming key resistance. Attempts to break above this area in July and August were unsuccessful. The support levels lie at 3,350 and 3,245, preventing a deeper correction.

The MACD and Stochastic indicators show signs of waning downward momentum. The MACD histogram has stabilised near zero, and the Stochastic has entered overbought territory, indicating possible short-term overheating.

Overall, gold maintains sideways movement near 3,390. For continued growth, the market needs to break and hold above 3,420-3,439. Otherwise, there is a risk of testing the lower support levels around 3,350 and below.

XAUUSD trading scenarios

The fundamental backdrop remains mixed. Gold receives support from soft US inflation data, a high likelihood of a Federal Reserve rate cut, and ongoing geopolitical risks. At the same time, rising equity indices and general market optimism limit demand for safe-haven assets.

- Buy scenario

Long positions remain preferable if the 3,350-3,345 support area holds. A rebound from this level, coupled with a positive news backdrop, could push prices towards 3,439 and further to the 3,500 area. Additional catalysts include weak US macroeconomic data.

- Sell scenario

Short positions become relevant if prices break below 3,350. In this case, targets shift to 3,283 and 3,245. The scenario strengthens with rising US bond yields and hawkish Fed comments.

Conclusion

Gold remains in the 3,350-3,439 sideways range. The baseline scenario suggests consolidation with moderate upside potential. A breakout above 3,439 would signal movement towards 3,500, while consolidation below 3,350 would open the way to new lows.

Summary

Gold (XAUUSD) ended the week near 3,390 USD per ounce, in the middle of the recent months’ range. Prices found support from soft US inflation data, the high probability of a Fed rate cut in September, and ongoing political uncertainty.

Growth is restrained by record-high equity indices and capital market optimism, which reduce interest in safe-haven assets. Additional risks stem from potential US trade actions and currency market fluctuations, impacting both the dollar and gold.

The key support level lies at 3,350, with resistance at 3,439.

A breakout above 3,439 would pave the way to 3,500, while a breakout below 3,350 would increase the likelihood of a decline towards 3,283 and 3,245. While prices remain within the range, the market continues to react primarily to macroeconomic data and political news.