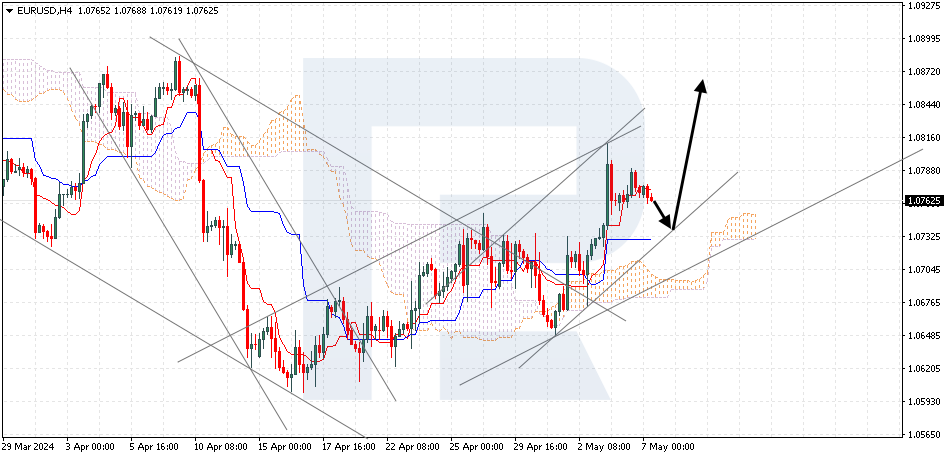

EURUSD, “Euro vs US Dollar”

EURUSD is rising after a rebound from the upper boundary of the descending channel. The instrument is going above the Ichimoku Cloud, which suggests an uptrend. A test of the lower boundary of the Cloud at 1.0820 is expected, followed by a rise to 1.0915. An additional signal confirming the rise might be a rebound from the lower boundary of the bullish channel. The scenario can be cancelled by a breakout of the lower boundary of the Cloud with the price finding a foothold under 1.0775, which will mean a further decline to 1.0685.

NZDUSD, “New Zealand Dollar vs US Dollar”

NZDUSD has found a foothold above the Tenkan-Sen line. The instrument is going below the Ichimoku Cloud, which suggests a downtrend. A test of the Kijun-Sen line at 0.6105 is expected, followed by a decline to 0.6005. An additional signal confirming the decline could be a rebound from the upper boundary of the bearish channel. The scenario can be cancelled by a breakout of the upper boundary of the Cloud with the price finding a foothold above 0.6170, which will mean further growth to 0.6280. Meanwhile, the decline could be confirmed by a breakout of the lower boundary of the ascending channel with the price finding a foothold under 0.6065.

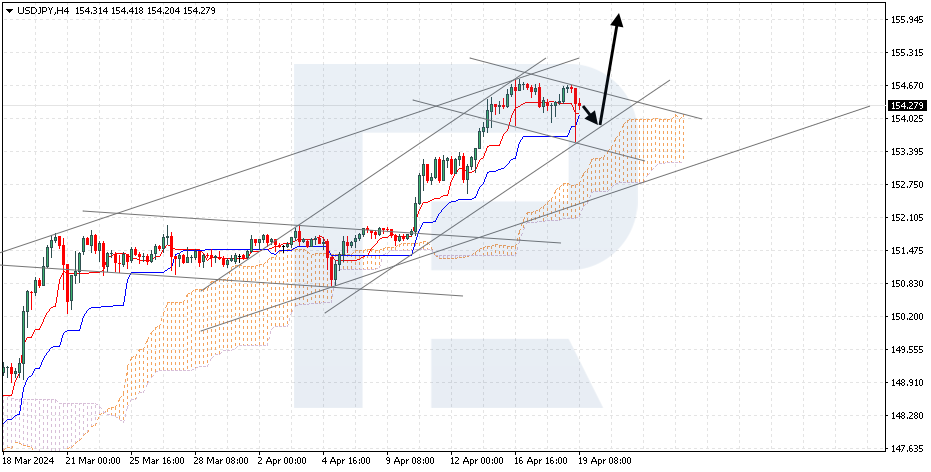

USDJPY, “US Dollar vs Japanese Yen”

USDJPY is correcting within a reversal pattern. The instrument is going inside the Ichimoku Cloud, which suggests sideways dynamics. A test of the lower boundary of the Cloud at 150.15 is expected, followed by a rise to 151.65. An additional signal confirming the rise might be a rebound from the lower boundary of the Head and Shoulders reversal pattern. The scenario can be cancelled by a breakout of the lower boundary of the Cloud with the price finding a foothold under 149.55, which will mean a further decline to 148.65. Meanwhile, the growth could be confirmed by a breakout of the upper boundary of the pattern with the price finding a foothold above 151.10.