NZDUSD, “New Zealand Dollar vs US Dollar”

NZDUSD is testing the upper boundary of the descending channel. The pair is moving above the Ichimoku Cloud, suggesting an uptrend. A test of the Tenkan-Sen indicator at 0.6205 is expected, followed by the rise to 0.6355. The rebound from the bottom boundary of the bullish channel will be an additional signal in favor of the pair's ascending. A break-down of the lower boundary of the indicator Cloud and its consolidation under 0.6105 will become a cancellation of the bullish pattern, which will indicate the continuation of decline to the level of 0.6005. Rise in price will be confirmed by the breakdown of the resistance area and its consolidation above the level of 0.6295. Such price movement will indicate completion of the reversal pattern "Double Bottom". The pattern breakout target is the level of 0.6410.

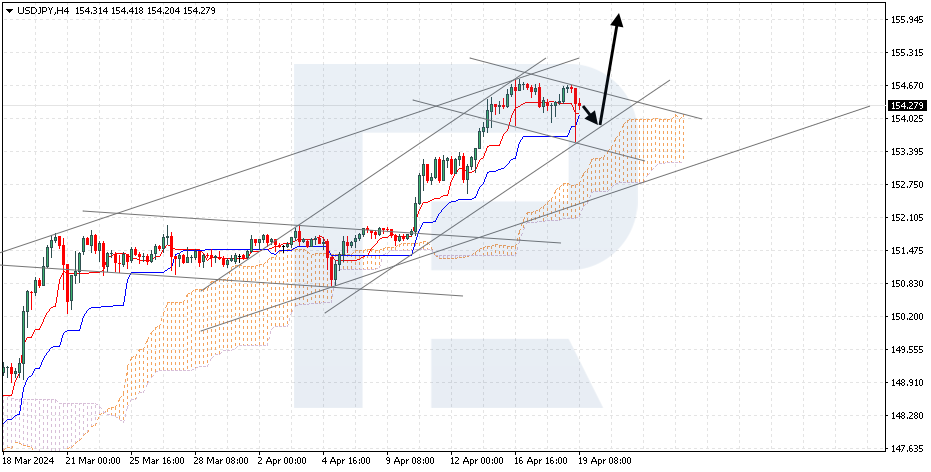

USDJPY, “US Dollar vs Japanese Yen”

USDJPY is pushing away from the fast indicator line. The pair is moving under the Ichimoku Cloud, suggesting a downtrend. Another test of the Tenkan-Sen indicator line at 136.05 is expected, followed by a drop to 129.65. The rebound from the upper boundary of the descending channel will be an additional signal for the pair to decline. A break of the upper boundary of the indicator Cloud and its consolidation above the level of 137.55 will become a cancellation of the downside variant, which will indicate the continuation of the rise to the level of 138.45.

XAUUSD, “Gold vs US Dollar”

Gold is rising within a bullish momentum. The instrument is moving above the Ichimoku Cloud, which suggests an uptrend. Gold is expected to test the Tenkan-Sen line at 1890, followed by a rise to 1945. A rebound from the lower boundary of the bullish channel will be an additional upside signal for the instrument. A break of the lower boundary of the indicator Cloud with its fixation under the level of 1820, which will indicate the continuation of the fall to the level of 1785, will cancel the option of price rise.