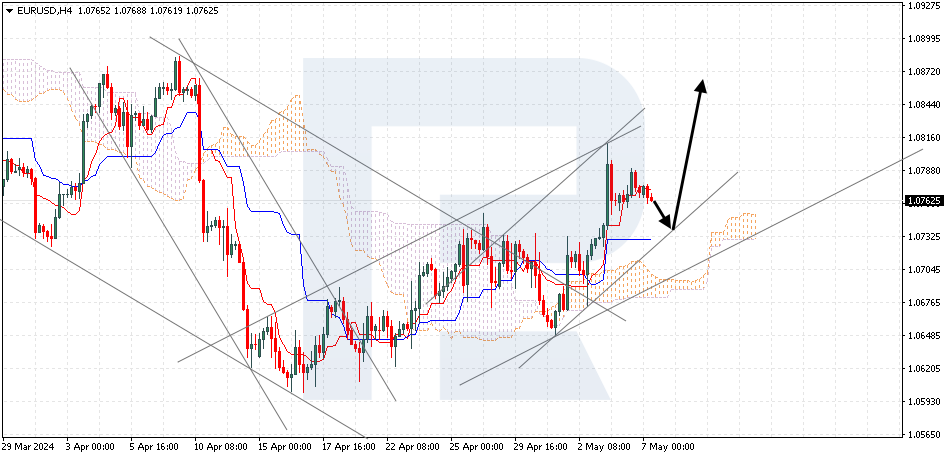

EURUSD, “Euro vs US Dollar”

EURUSD is correcting after a rebound from the support. The instrument is going below the Ichimoku Cloud, which suggests a bearish trend. A test of the lower boundary of the Cloud at 1.0780 is expected, followed by a decline to 1.0625. An additional signal confirming the decline could be a rebound from the upper boundary of the bearish channel. The scenario can be cancelled by a breakout of the upper boundary of the Cloud with the price finding a foothold above 1.0835, which will mean further growth to 1.0925.

NZDUSD, “New Zealand Dollar vs US Dollar”

NZDUSD is squeezed within a Triangle pattern. The instrument is going below the Ichimoku Cloud, which suggests a downtrend. A test of the upper boundary of the Cloud at 0.6110 is expected, followed by a decline to 0.6005. An additional signal confirming the decline could be a rebound from the lower upper of the Triangle pattern. The scenario can be cancelled by a breakout of the upper boundary of the Cloud with the price finding a foothold above 0.6140, which will mean further growth to 0.6230. Meanwhile, the decline could be confirmed by a breakout of the lower boundary of the Triangle pattern with the price finding a foothold under 0.6020.

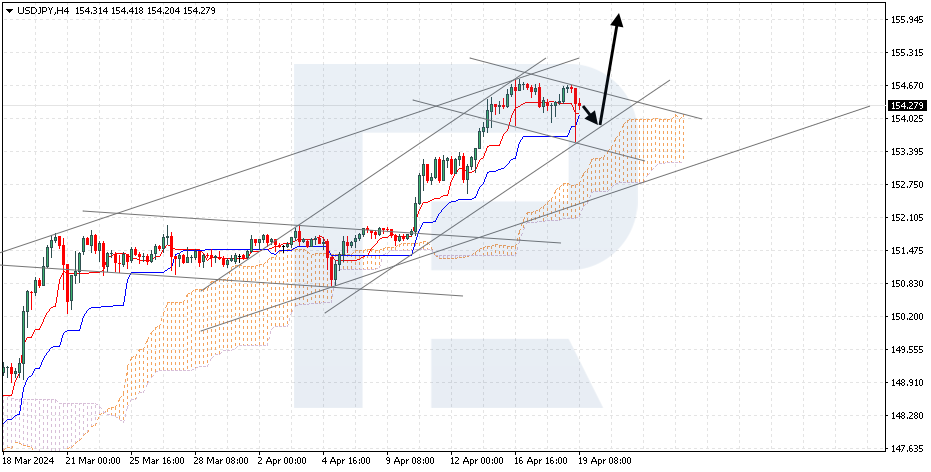

USDJPY, “US Dollar vs Japanese Yen”

USDJPY has found a foothold above the Tenkan-Sen line. The instrument is going above the Ichimoku Cloud, which suggests an uptrend. A test of the Kijun-Sen line at 149.85 is expected, followed by a rise to 152.75. An additional signal confirming the rise might be a rebound from the lower boundary of the bullish channel. The scenario can be cancelled by a breakout of the lower boundary of the Cloud with the price finding a foothold under 147.10, which will mean a further decline to 146.25. Meanwhile, the growth could be confirmed by a breakout of the upper boundary of the bullish channel with the price finding a foothold above 151.45.