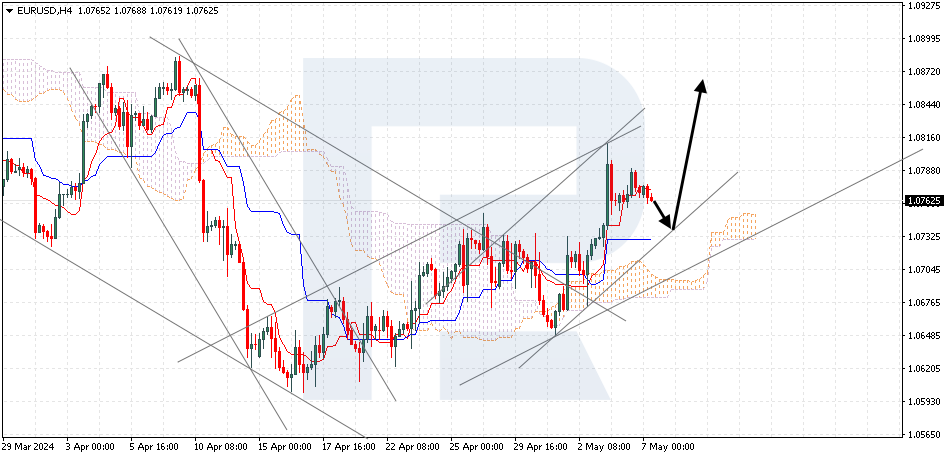

EURUSD, “Euro vs US Dollar”

The currency pair is pushing off the signal lines of the indicator. The instrument is going above the Ichimoku Cloud, implying an uptrend. A test of the Kijun-Sen line is expected at 1.0775, followed by growth to 1.1005. An additional signal confirming the growth will be a bounce off the lower border of the bullish channel. The scenario can be cancelled by a breakaway of the lower border of the Cloud and securing under 1.0575, which will indicate further falling to 1.0485.

BRENT

Oil is testing the Tenkan-Sen line of the indicator. The instrument is going above the Ichimoku Cloud, which implies an uptrend. A test of the support area at 84.00 is expected, followed by growth to 90.00. An additional signal confirming the growth will be a bounce off the lower border of the ascending channel. The scenario can be cancelled by a breakaway of the lower border of the Cloud and securing under 77.00, which will entail further falling to 73.00.

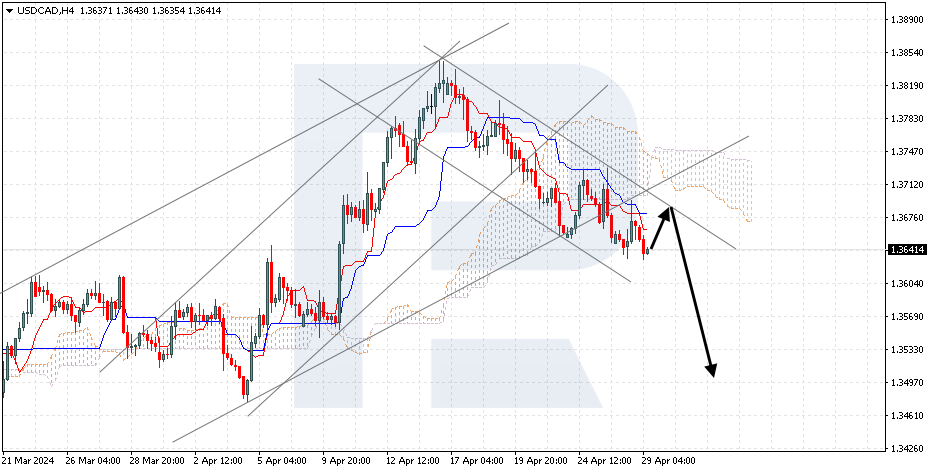

USDCAD, “US Dollar vs Canadian Dollar”

The currency pair is correcting inside a Triangle pattern. The instrument is going under the Ichimoku Cloud, which implies a downtrend. A test of the resistance level at 1.3405 is expected, followed by falling to 1.3165. An additional signal confirming the decline will be a bounce off the upper border of the Triangle pattern. The scenario can be cancelled by a breakaway of the upper border of the Cloud and securing above 1.3545, which will indicate growth to 1.3635. The decline may be confirmed by a breakaway of the lower border of the Triangle pattern and securing above 1.3295.