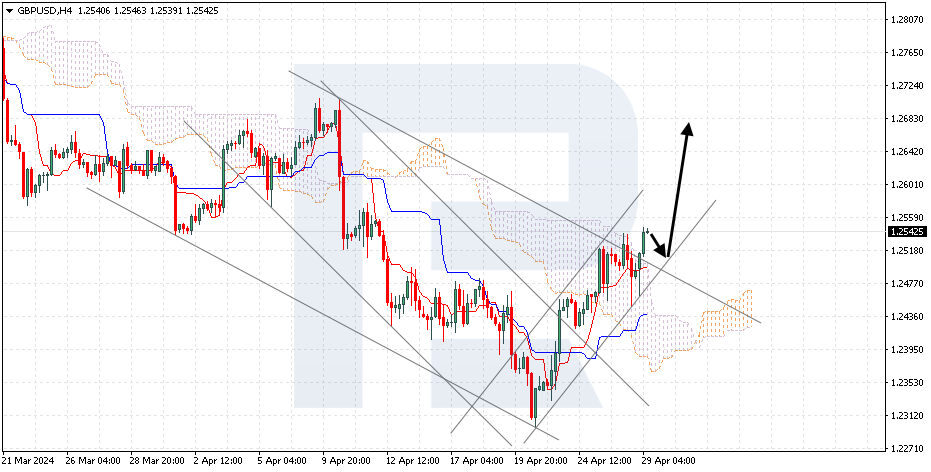

GBPUSD, “Great Britain Pound vs US Dollar”

GBPUSD has pushed back from the support level. The pair is moving above the Ichimoku Cloud, suggesting an uptrend. A test of the Kijun-Sen indicator line at 1.2105 is expected, followed by a rise to 1.2375. An additional signal in favor of the pair's rise will be a rebound from the lower boundary of the bullish channel. A b reakdown of the bottom line of the indicator Cloud and its consolidation under 1.1935, which will indicate the continuation of falling to the level of 1.1845, will cancel the upside variant.

NZDUSD, “New Zealand Dollar vs US Dollar”

NZDUSD is rising as part of the completion of a reversal pattern. The pair is moving above the Ichimoku Cloud, suggesting an uptrend. A test of the Kijun-Sen indicator line at 0.6215 is expected, with further growth to the level of 0.6355. The rebound from the support level will be an additional signal in favour of the pair's rise. A breakdown of the lower boundary of the indicator Cloud and its consolidation under 0.6120 will cancel the growth scenario, indicating the continuation of decline to the level of 0.6025. A rise in price will be confirmed by the breakdown of the "Neck" line of the "Head & Shoulders" divergence pattern and its fixation above the level 0.6295.

XAUUSD, “Gold vs US Dollar”

Gold is testing the resistance level. The instrument is moving above the Ichimoku Cloud, which suggests an uptrend. A test of the Kijun-Sen indicator line at 1910 is expected, followed by an uptrend towards 1985. An additional signal in favour of the instrument's rise will be a rebound from the lower boundary of the bullish channel. A break of the lower boundary of the indicator Cloud with its fixation under the level of 1855, which will indicate the continuation of the fall to the level of 1805, will cancel the option of aprice rise.