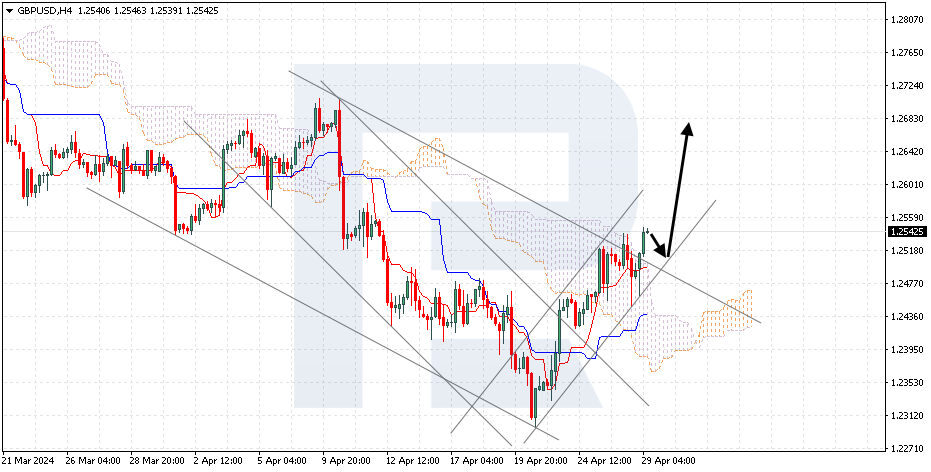

GBPUSD, “Great Britain Pound vs US Dollar”

GBPUSD is correcting after a rebound from the support level. The instrument is going inside the Ichimoku Cloud, which suggests a sideways trend. A test of the upper boundary of the Cloud at 1.2715 is expected, followed by a decline to 1.2555. The decline could be additionally supported by a rebound from the upper boundary of the bearish channel. The scenario can be cancelled by a breakout of the upper boundary of the Cloud with the price finding a foothold above 1.2755, which will mean further growth to 1.2845. Meanwhile, the decline could be confirmed by a breakout of the lower boundary of the bullish channel with the price finding a foothold under 1.2665.

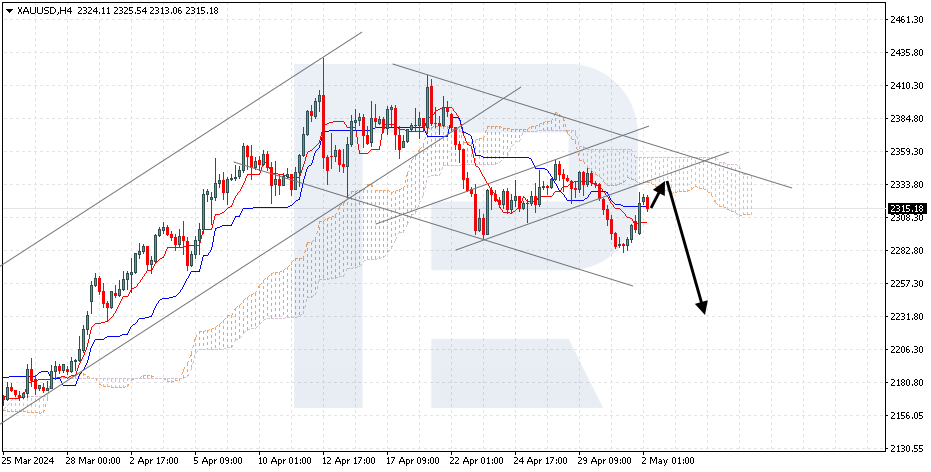

XAUUSD, “Gold vs US Dollar”

Gold is testing the signal lines of the indicator. The instrument is going below the Ichimoku Cloud, which suggests a downtrend. A test of the Kijun-Sen line at 2035 is expected, followed by a decline to 1975. An additional signal confirming the decline could be a rebound from the upper boundary of the bearish channel. The scenario can be cancelled by a breakout of the upper boundary of the Cloud with the price finding a foothold above 2055, which will mean further growth to 2085.

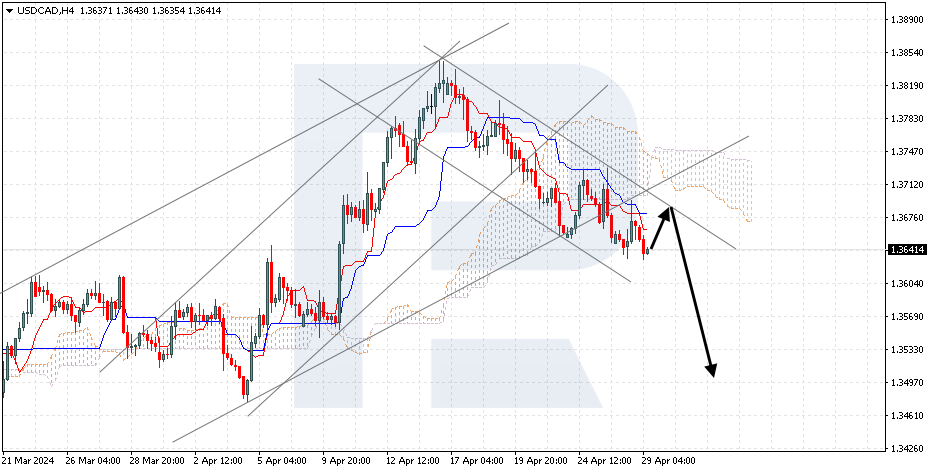

USDCAD, “US Dollar vs Canadian Dollar”

USDCAD is rising within a bullish channel. The instrument is going above the Ichimoku Cloud, which suggests an uptrend. A test of the Kijun-Sen line at 1.3475 is expected, followed by a rise to 1.3640. An additional signal confirming the rise could be a rebound from the lower boundary of the bullish channel. The scenario can be cancelled by a breakout of the lower boundary of the Cloud with the price finding a foothold under 1.3305, which will mean a further decline to 1.3205.