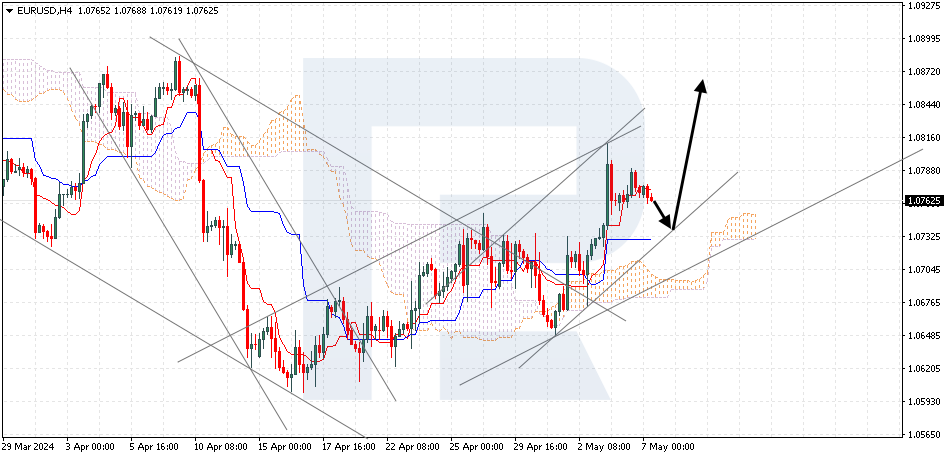

EURUSD, “Euro vs US Dollar”

EURUSD has consolidated under the lower border of the bullish channel. The pair is moving inside the Ichimoku Cloud, suggesting a sideways movement. A test of the upper boundary of the Cloud indicator at 1.0845 is expected, followed by a fall to 1.0695. A rebound from the lower boundary of the bullish channel would signal a decline in quotes. This scenario can be invalidated by the upper boundary of the Cloud, with the price securing above 1.0885, indicating a rise to 1.0975. Conversely, a decrease could be confirmed by a breakout of the lower boundary of the ascending channel, with the price securing below 1.0785.

NZDUSD, “New Zealand Dollar vs US Dollar”

NZDUSD is testing the indicator signal lines. The pair is going above the Ichimoku Cloud, which suggests an uptrend. A test of the upper boundary of the Cloud at 0.6095 is expected, followed by a rise to 0.6235. An additional signal confirming the surge will be a rebound from the lower boundary of the bullish channel. A breakout below the lower boundary of the Cloud would invalidate this scenario, with the price securing below 0.6045, indicating a decline to 0.5955. Conversely, the rise could be confirmed by a breakout of the upper boundary of the bearish correction channel, with the price securing above 0.6155.

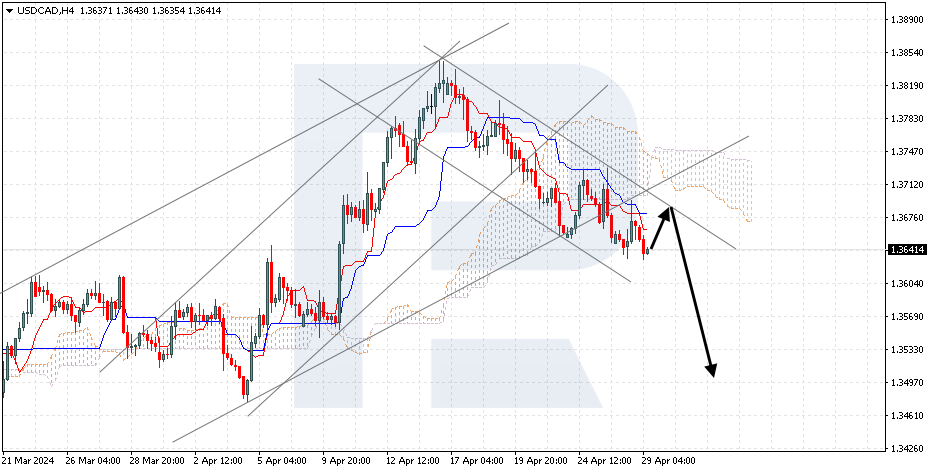

USDCAD, “US Dollar vs Canadian Dollar”

USDCAD is moving away from the upper boundary of the bullish channel and above the Ichimoku Cloud, indicating a potential uptrend. A test of the Kijun-Sen line at 1.3640 is expected, followed by a rise to 1.3830. An additional signal confirming the surge will be a rebound from the lower boundary of the bullish channel. The scenario can be negated by a breakout below the lower boundary of the Cloud, with the price securing below 1.3595, indicating a decline to 1.3505. Conversely, the rise could be confirmed by a breakout of the upper boundary of the bearish channel, with the price securing above 1.3745.