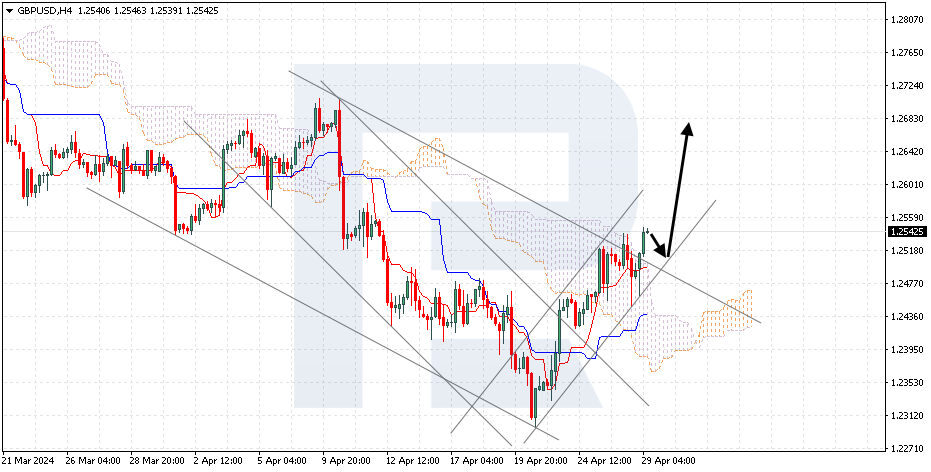

GBPUSD, “Great Britain Pound vs US Dollar”

GBPUSD is testing the upper border of the Triangle pattern. The instrument is going above the Ichimoku Cloud, which suggests an uptrend. A test of the upper border of the Cloud at 1.2455 is expected, followed by growth to 1.2625. An additional signal confirming the growth will be a rebound from the lower border of the Triangle pattern. The scenario can be cancelled by a breakout of the lower border of the Cloud and securing under 1.2375, which will mean further falling to 1.2285. The growth, meanwhile, can be confirmed by a breakout of the upper border of the Triangle pattern and securing above 1.2535.

NZDUSD, “New Zealand Dollar vs US Dollar”

NZDUSD is pushing off the signal lines of the indicator. The instrument is going below the Ichimoku Cloud, which suggests a downtrend. A test of the lower border of the Cloud at 0.6165 is expected, followed by falling to 0.6035. An additional signal confirming the decline will be a rebound from the upper border of the descending channel. The scenario can be cancelled by a breakout of the upper border of the Cloud and securing above 0.6245, which will mean further growth to 0.6335.

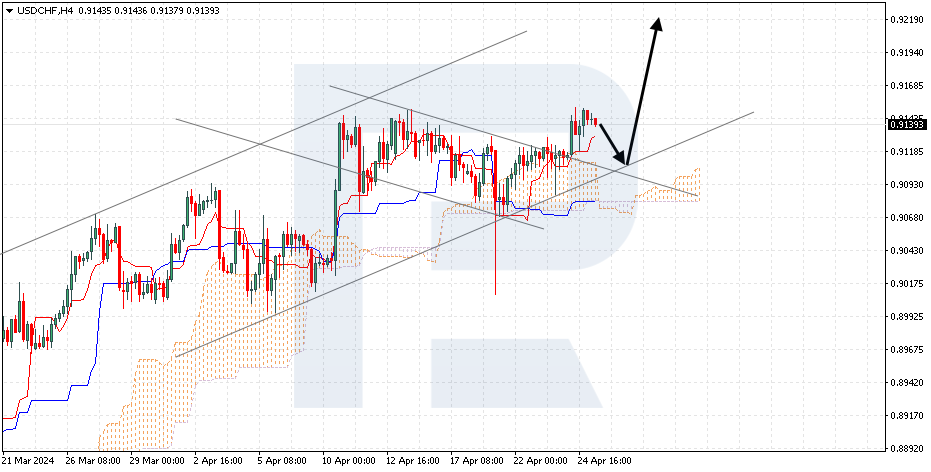

USDCHF, “US Dollar vs Swiss Franc”

USDCHF is correcting after three failed attempts to break a support level. The instrument is going below the Ichimoku Cloud, which suggests a downtrend. A test of the lower border of the Cloud at 0.8925 is expected, followed by falling to 0.8755. An additional signal confirming the decline will be a rebound from the upper border of the descending channel. The scenario can be cancelled by a breakout of the upper border of the Cloud and securing above 0.8995, which will mean further growth to 0.9085.