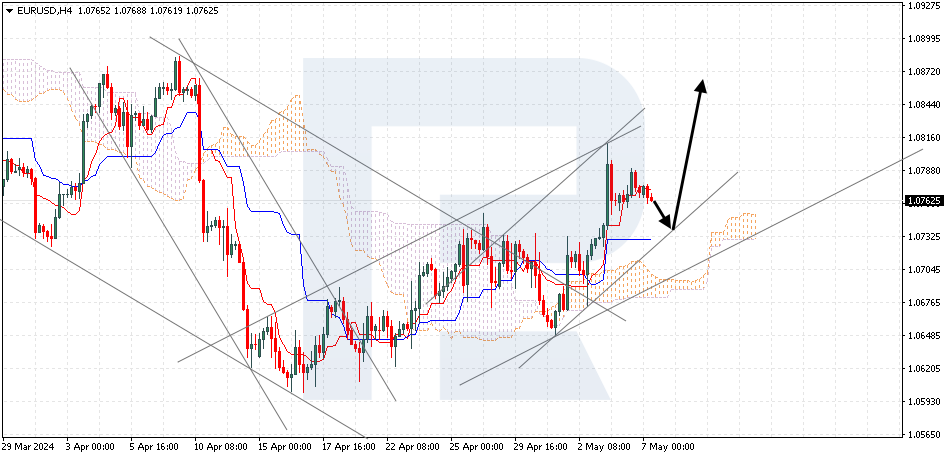

EURUSD, “Euro vs US Dollar”

EURUSD is pushing off the Tenkan-Sen line. The instrument is going below the Ichimoku Cloud, which suggests a downtrend. A test of the lower boundary of the Cloud at 1.0585 is expected, followed by a decline to 1.0485. An additional signal confirming the decline will be a rebound from the upper boundary of the bearish channel. The scenario can be cancelled by a breakout of the upper boundary of the Cloud with the price securing above 1.0635, which will indicate further growth to 1.0725.

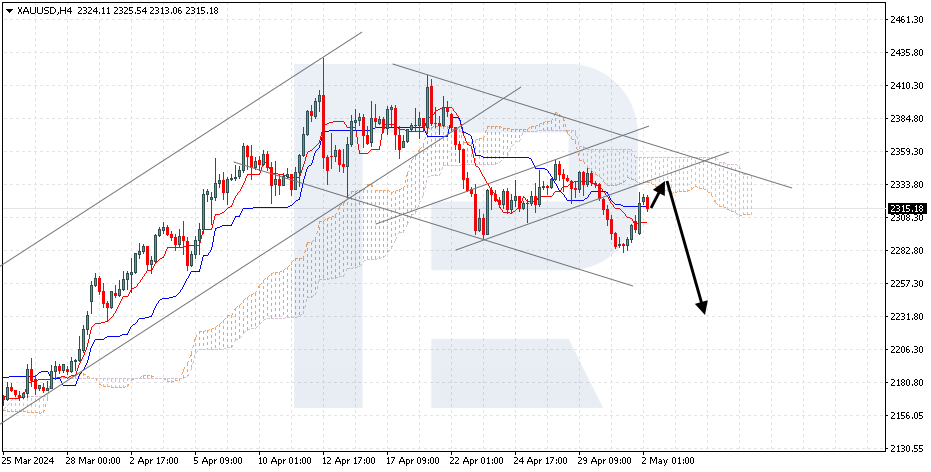

XAUUSD, “Gold vs US Dollar”

Gold is testing the lower boundary of the descending channel. The instrument is going below the Ichimoku Cloud, which suggests a bearish trend. A test of the Tenkan-Sen line of the indicator at 1905 is expected, followed by a decline to 1875. An additional signal confirming the decline will be a rebound from the upper boundary of the bearish channel. The scenario can be cancelled by a breakout of the upper boundary of the Cloud with the price securing above 1920, which will signal further growth to 1955.

BRENT

Brent has gained a foothold above the upper boundary of the descending channel. The instrument is going above the Ichimoku Cloud, which implies a bullish trend. A test of the Tenkan-Sen line at 92.35 is expected, followed by a rise to 95.75. An additional signal confirming the rise will be a rebound from the upper boundary of the bearish channel. The scenario can be cancelled by a breakout of the lower boundary of the Cloud with the price securing below 90.85, which will indicate a further decline to 85.65.