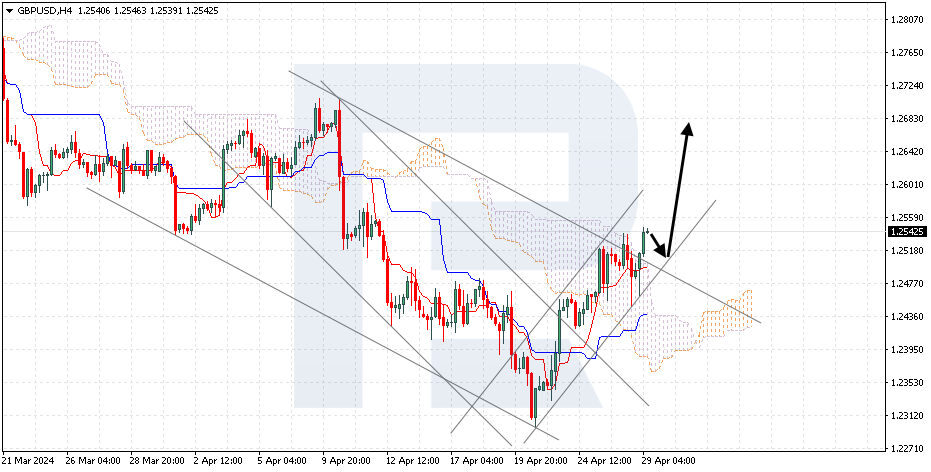

GBPUSD, “Great Britain Pound vs US Dollar”

GBPUSD is declining after bouncing off the upper boundary of the bullish channel. The pair is moving within the Ichimoku Cloud, suggesting a sideways trend. A test of the upper boundary of the Cloud at the level of 1.2700 is expected, followed by a decline to 1.2525. A rebound from the upper boundary of the bearish channel would be another signal confirming the decline. The scenario could be invalidated by a breakout of the upper boundary of the Cloud, with the price securing above the level of 1.2735, indicating further growth to 1.2825. Confirmation of the decline in quotes will be a breakout of the lower boundary of the bullish channel and their consolidation below the level of 1.2625.

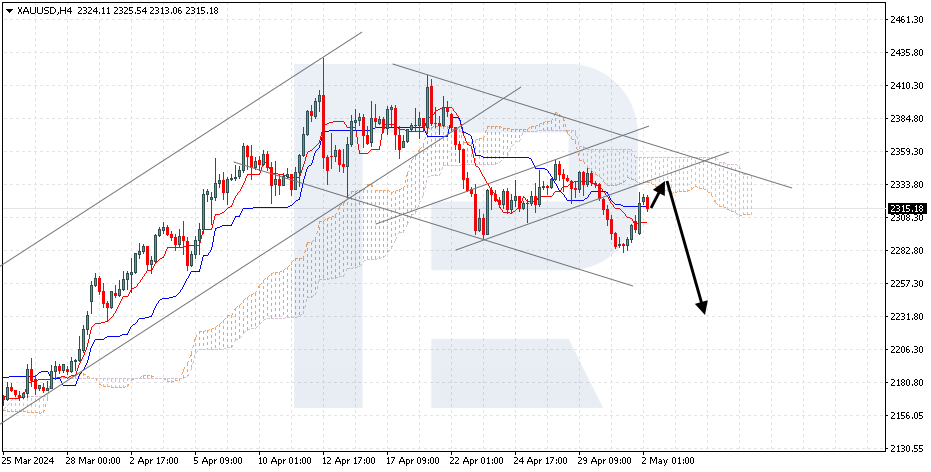

XAUUSD, “Gold vs US Dollar”

Gold has settled below the lower boundary of the bearish “Flag” pattern. The pair is moving below the Ichimoku Cloud, suggesting a downtrend. A test of the Tenkan-Sen line at 2335 is expected, followed by a decline to 2265. A rebound from the upper bearish channel would confirm the decline. The scenario could be invalidated by a breakout of the upper boundary of the Cloud, with the price securing above 2395, indicating further growth to 2445.

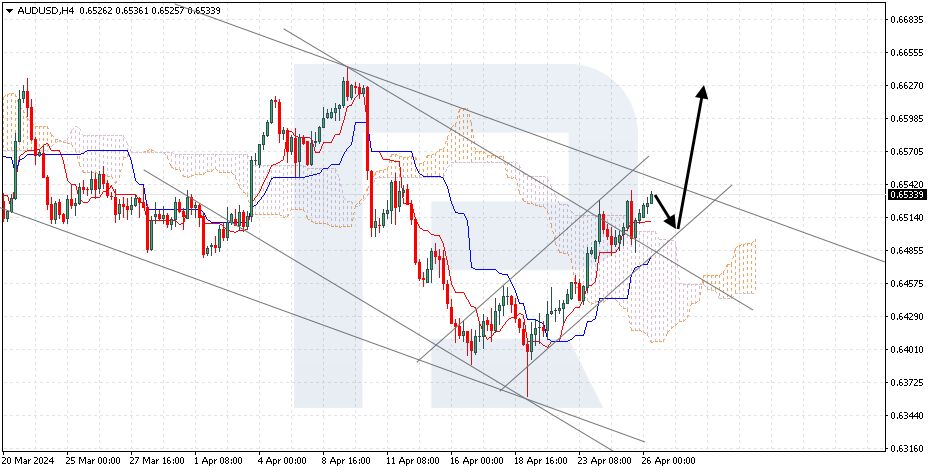

AUDUSD, “Australian Dollar vs US Dollar”

AUDUSD is testing the “Neckline” line of the “Head and Shoulders” reversal pattern. The pair is moving below the Ichimoku Cloud, suggesting a downtrend. A test of the Tenkan-Sen line at 0.6605 is expected, followed by a decline to 0.6460. A rebound from the upper boundary of the bearish channel would be another signal confirming the decline. The scenario could be invalidated by a breakout of the upper boundary of the indicator Cloud, with the price securing above 0.6665, indicating further growth to 0.6755.