Inflation risks and geopolitics bolster the demand for gold (XAUUSD)

Gold is rising amid increasing uncertainty ahead of the US election. Discover more in our analysis for 23 October 2024.

XAUUSD forecast: key trading points

- Gold has set a new record, testing the 2,753 USD level

- Stronger demand is due to the upcoming US election, which creates uncertainty in the markets

- Both US presidential candidates propose inflationary measures that support growth in gold prices

- Gold remains a popular risk-hedging instrument amid a potential escalation of the conflict in the Middle East

- XAUUSD forecast for 23 October 2024: 2,765 and 2,820

Fundamental analysis

The XAUUSD price reached a new record on Wednesday, testing the 2,753 USD level. More robust demand for safe-haven assets is due to the upcoming US election, destabilising the markets. Analysts note that both candidates proclaim anti-inflationary measures that could significantly bolster gold prices. Although some of these expectations have already been factored into the current prices, today’s XAUUSD analysis shows that gold is poised to strengthen further.

Gold remains a popular risk-hedging instrument amid economic and geopolitical uncertainty. Investors are also closely following developments in the Middle East, as they are concerned about an escalation of conflict in the region, which increases uncertainty in the markets.

The US Federal Reserve has started an interest rate-cutting cycle, lowering rates by 50 basis points last month. However, the odds of such a move in November have been nearly ruled out: according to the CME FedWatch Tool, traders estimate the likelihood of a 25-basis-point rate cut at 88.9%.

In general, lower interest rates make gold more appealing to investors as it does not generate interest income. Its potential to grow even under unfavourable macroeconomic conditions suggests strong demand for the asset, which may also indicate that the uptrend could continue in the short term.

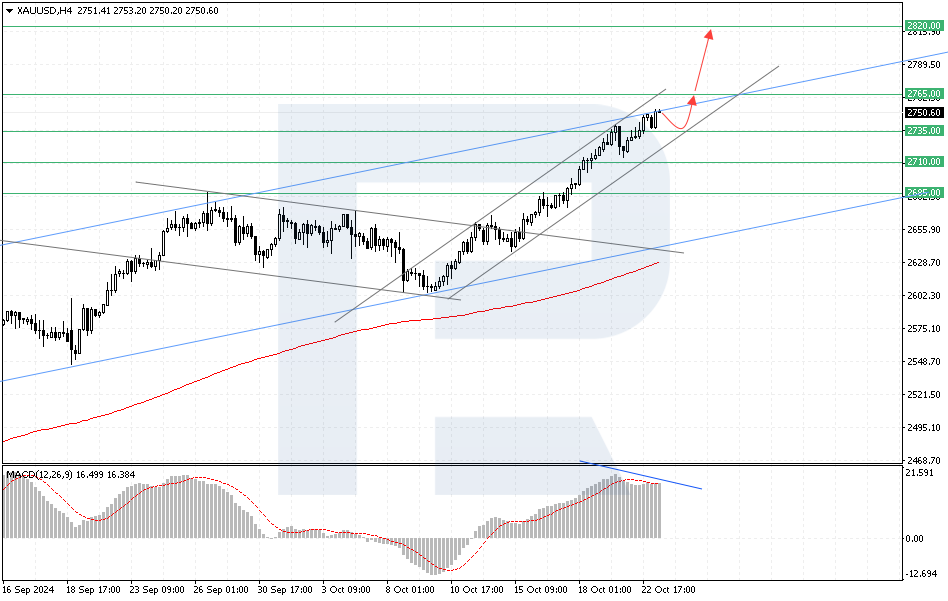

XAUUSD technical analysis

XAUUSD quotes have reached the upper boundary of the ascending channel, where they encountered resistance from sellers. Before the quotes can continue their ascent, there is a risk of a downward correction. A bearish divergence on the MACD indicator signals a decline.

The XAUUSD price forecast does not rule out a price decline to 2,735, followed by a rise to 2,765. A breakout above this level will indicate that the price has exited the ascending channel. This may accelerate a bullish trend in gold, with the first target at 2,820. The pessimistic scenario for buyers will occur if the price secures below 2,710, indicating a breakout below the lower boundary of the bullish channel and a potential decline to 2,685.

Summary

The Federal Reserve’s interest rate cut and persistent economic and geopolitical uncertainty boost demand for gold, supporting the current uptrend. Although the expectations have already been priced in, high inflationary risks and the upcoming US election may propel asset prices further up.

From the technical analysis perspective, the XAUUSD price forecast suggests the previous boundaries of the uptrend. However, there is a risk of a short-term downward correction, signalled by a bearish divergence on the MACD indicator. A breakout above the 2,765 USD level could drive growth to 2,820 USD. Conversely, a fall below the 2,710 USD level may indicate a further decline.