Japan’s GDP growth adds to pressure on USDJPY

The USDJPY rate is strengthening after rebounding from the 151.20 support level. Discover more in our analysis for 18 February 2025.

USDJPY forecast: key trading points

- Japan’s economy grew by 0.7% in Q4 2024

- BoJ interest rate hike in March remains in question

- USDJPY forecast for 18 February 2025: 151.60 and 150.20

Fundamental analysis

The USDJPY rate is on the rise after falling for three consecutive trading sessions as traders focus on the upcoming release of the Federal Reserve’s January meeting minutes. The regulator is adopting a wait-and-see approach, while the market is more focused on the prospects of an interest rate cut.

Meanwhile, the USDJPY pair remains under pressure after unexpectedly strong GDP growth data from Japan. Monday’s quarterly statistics showed that the country’s economy grew by 0.7% in Q4 2024, up from 0.4% in the previous quarter and above the forecast of 0.3%. GDP rose 2.8% year-on-year, aligning with expectations and exceeding 1.7% in Q3.

The data reinforces hawkish sentiment towards the BoJ monetary policy. While there is still uncertainty over a potential rate hike in March, further tightening of monetary conditions during the year is considered quite likely, which may help the yen strengthen as part of today’s USDJPY forecast.

USDJPY technical analysis

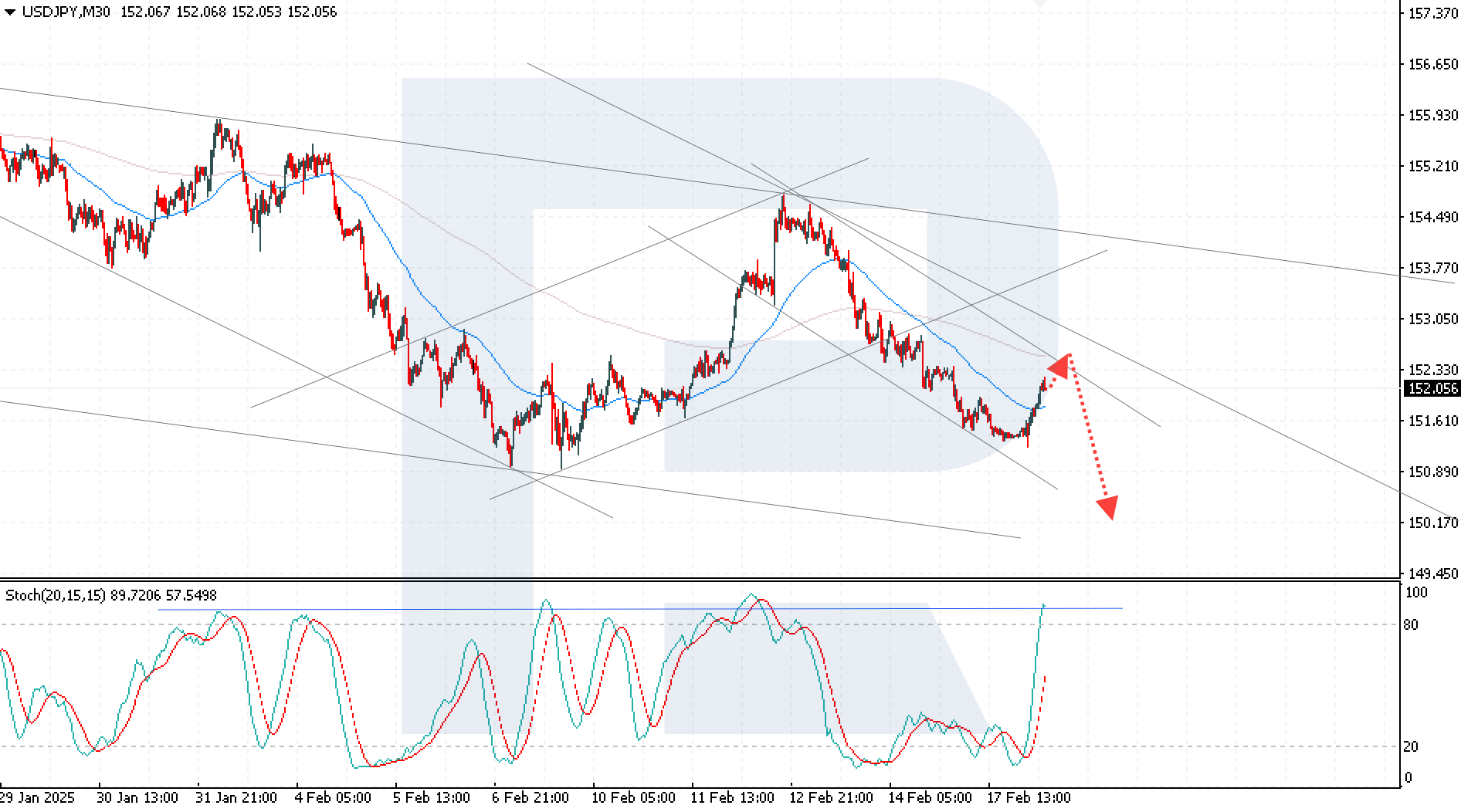

The USDJPY rate remains in a descending channel, correcting after a sharp decline. Today’s USDJPY forecast suggests a rebound from the 152.30 resistance level, followed by a decline to 150.20. Technical indicators also signal the end of the bullish correction. The quotes are approaching the channel’s upper boundary, with the Stochastic Oscillator in the overbought area, increasing the likelihood of a reversal. An alternative scenario suggests a breakout above the 152.30 level, followed by growth to 153.00.

Summary

Japan’s robust GDP data fuels expectations of BoJ policy tightening, which may support the yen. The USDJPY technical analysis shows that the currency pair could fall after rebounding from the 152.30 resistance level and move further to the 151.60 and 150.20 targets.