XAUUSD, “Gold vs US Dollar”

As we can see in the H4 chart, XAUUSD has formed several reversal patterns, such as Inverted Hammer, not far from the support area. At the moment, the asset may reverse in the form of a new correctional impulse. In this case, the upside correctional target may be the resistance level at 1778.00. At the same time, an opposite scenario implies that the price may continue falling to reach 1750.50 without any pullbacks.

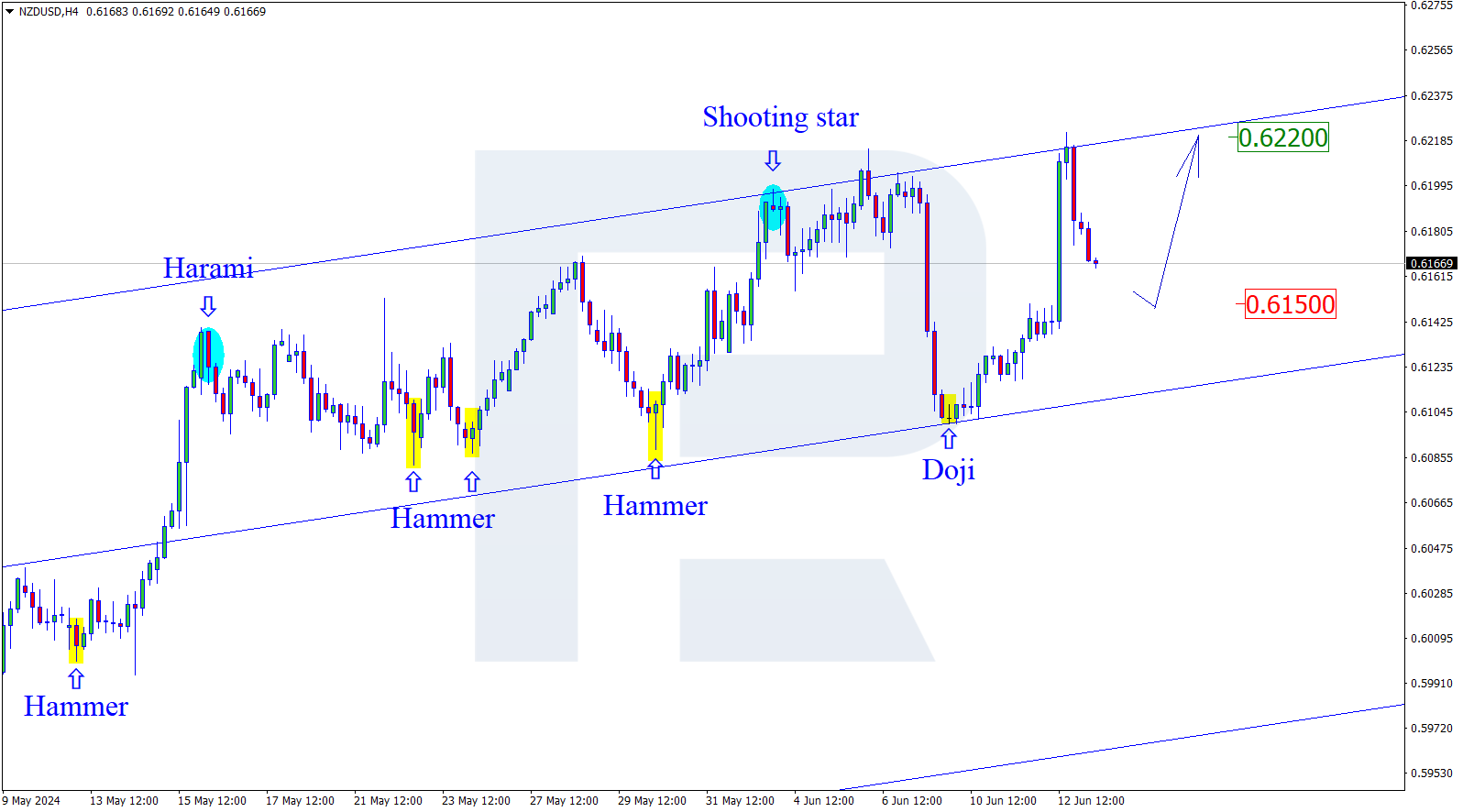

NZDUSD, “New Zealand vs US Dollar”

As we can see in the H4 chart, NZDUSD has formed a Hammer reversal pattern close to the support area. At the moment, the asset may reverse in the form of another correctional impulse. In this case, the upside correctional target may be at 0.6200. After that, the asset may rebound from the resistance level and resume moving downwards. However, an alternative scenario implies that the price may continue falling to reach 0.6085 without any corrections.

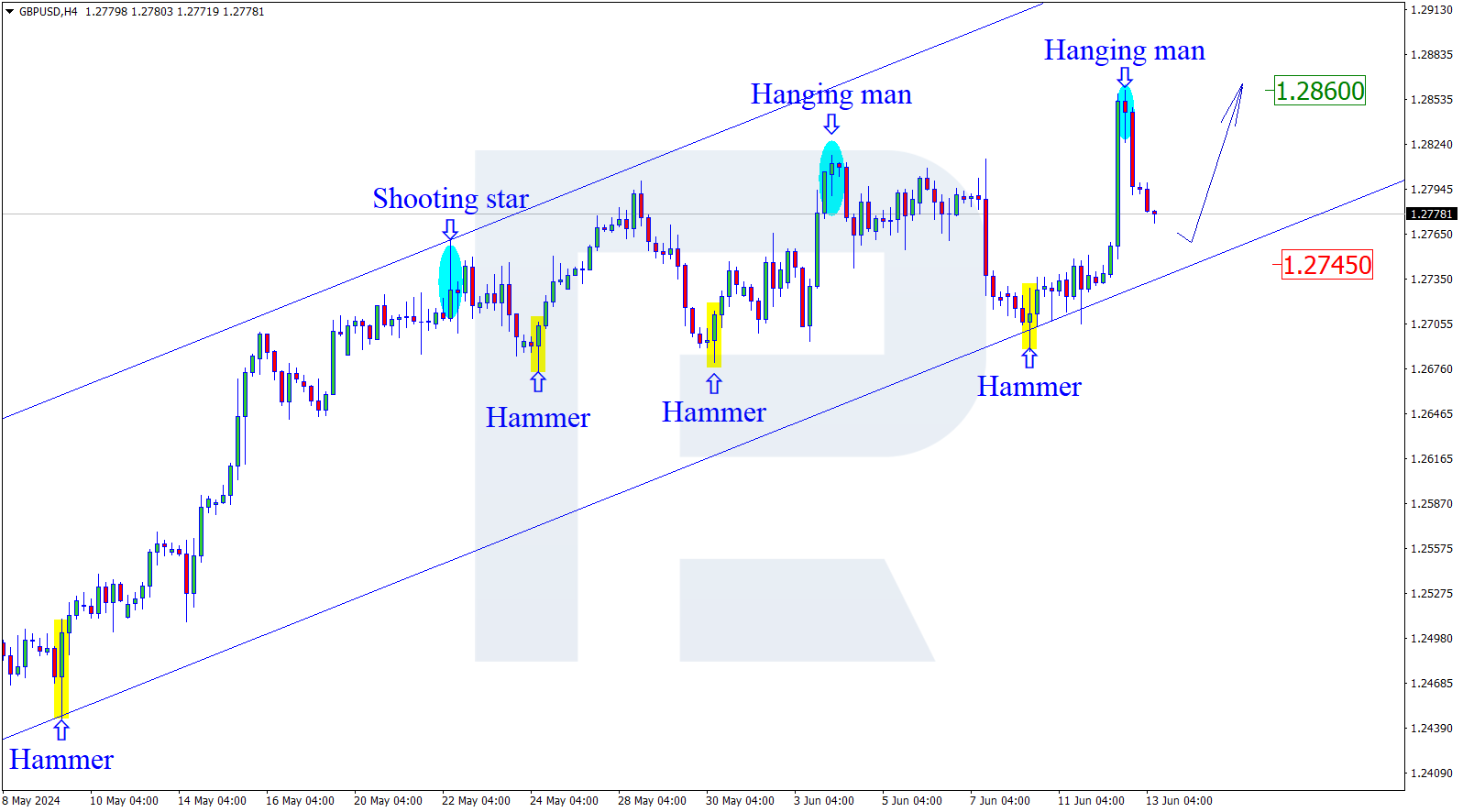

GBPUSD, “Great Britain Pound vs US Dollar”

As we can see in the H4 chart, GBPUSD has formed a Hammer reversal pattern near the support level. At the moment, the pair is reversing in the form of a new correctional impulse. In this case, the upside correctional target may be the resistance area at 1.2000. Later, the market may rebound from this level and resume falling to reach the target at 1.1825.