XAUUSD, “Gold vs US Dollar”

Gold has formed a Shooting Star reversal pattern near resistance. At this stage, the signal from the reversal candlestick pattern is being worked out in a downtrending wave. The 1900.00 level may be the target for the decline. After the support is tested, the price has a chance to rebound and continue the upward trend. However, the market situation should not be excluded and the growth of quotations may reach the level of 1940.00 without the pullback.

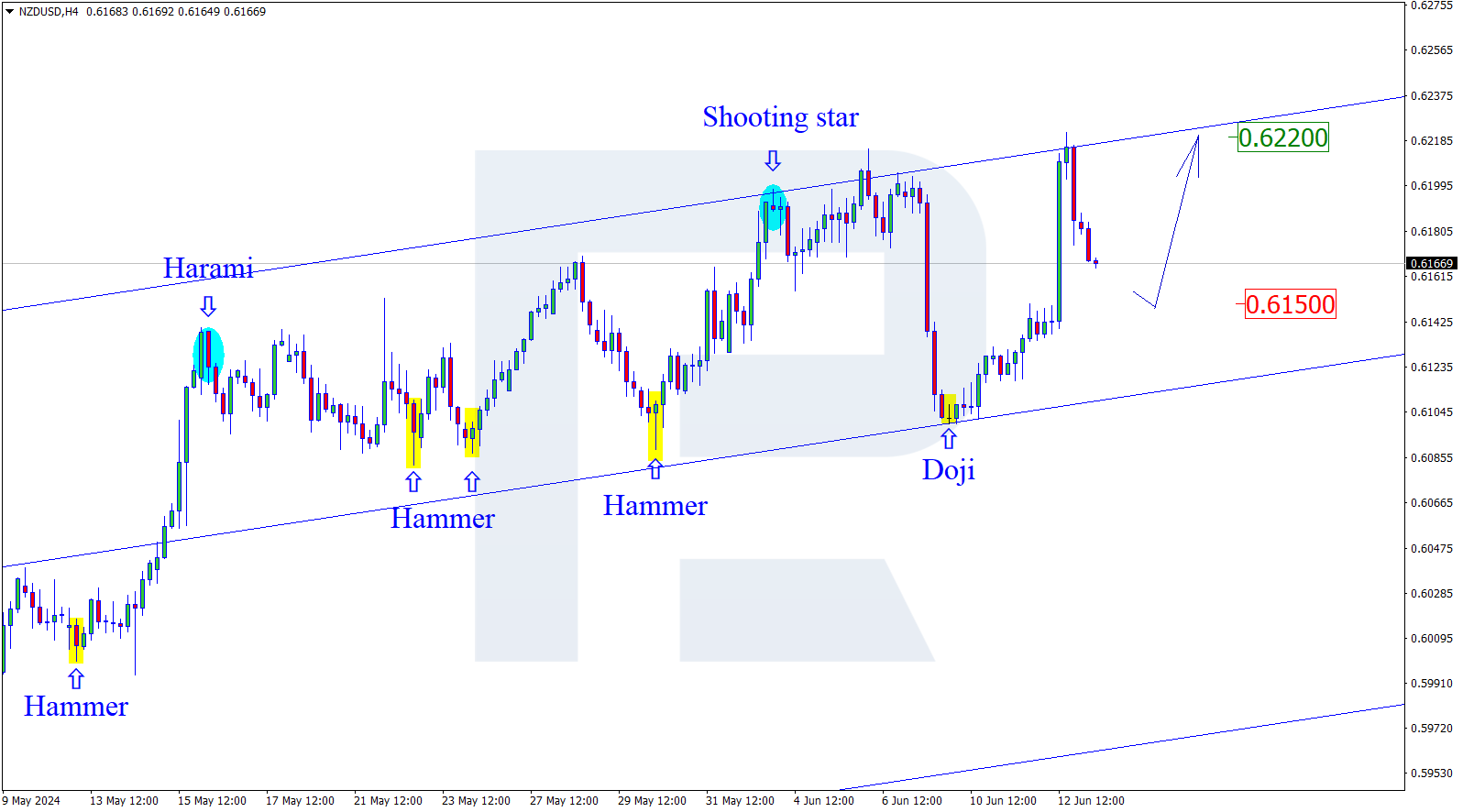

NZDUSD, “New Zealand Dollar vs US Dollar”

On H4, NZDUSD has formed a Inverted Hammer pattern near the support. At this stage, the signal from the reversal candlestick pattern may be implemented in an ascending wave. The target for the correction may be the level of 0.6200. After the rebound from the resistance the quotes will have the chance to continue the downward trend. However, it should not exclude the possibility of the price decline to the level of 0.6080 without testing the resistance.

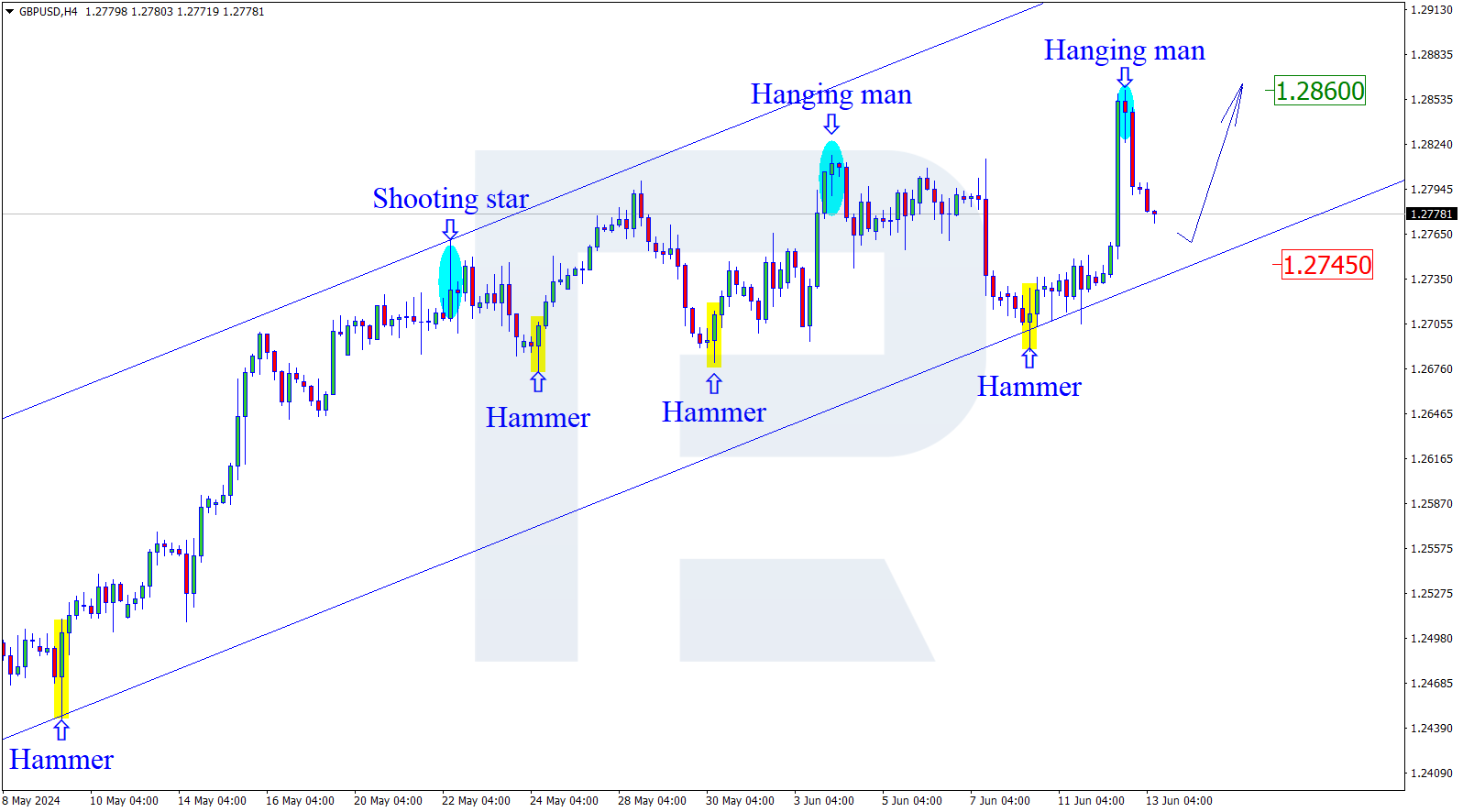

GBPUSD, “Great Britain Pound vs US Dollar”

On H4, GBPUSD has formed a Inverted Hammer pattern near the support level. At this stage, the signal from the reversal pattern can be implemented by a descending wave. Resistance around 1.2135 may be the target for the pullback. At the same time we should not exclude the possibility of a price fall to the level of 1.2015 and continuation of downtrend without correction to the resistance.