XAUUSD, “Gold vs US Dollar”

As we can see in the H4 chart, the ascending tendency continues. Right now, after forming a Hammer pattern close to the support area, XAUUSD may reverse and resume growing towards the resistance level. In this case, the upside target will be at 1890.00. At the same time, an opposite scenario implies that the price may start another decline to reach 1835.00 before resuming its growth.

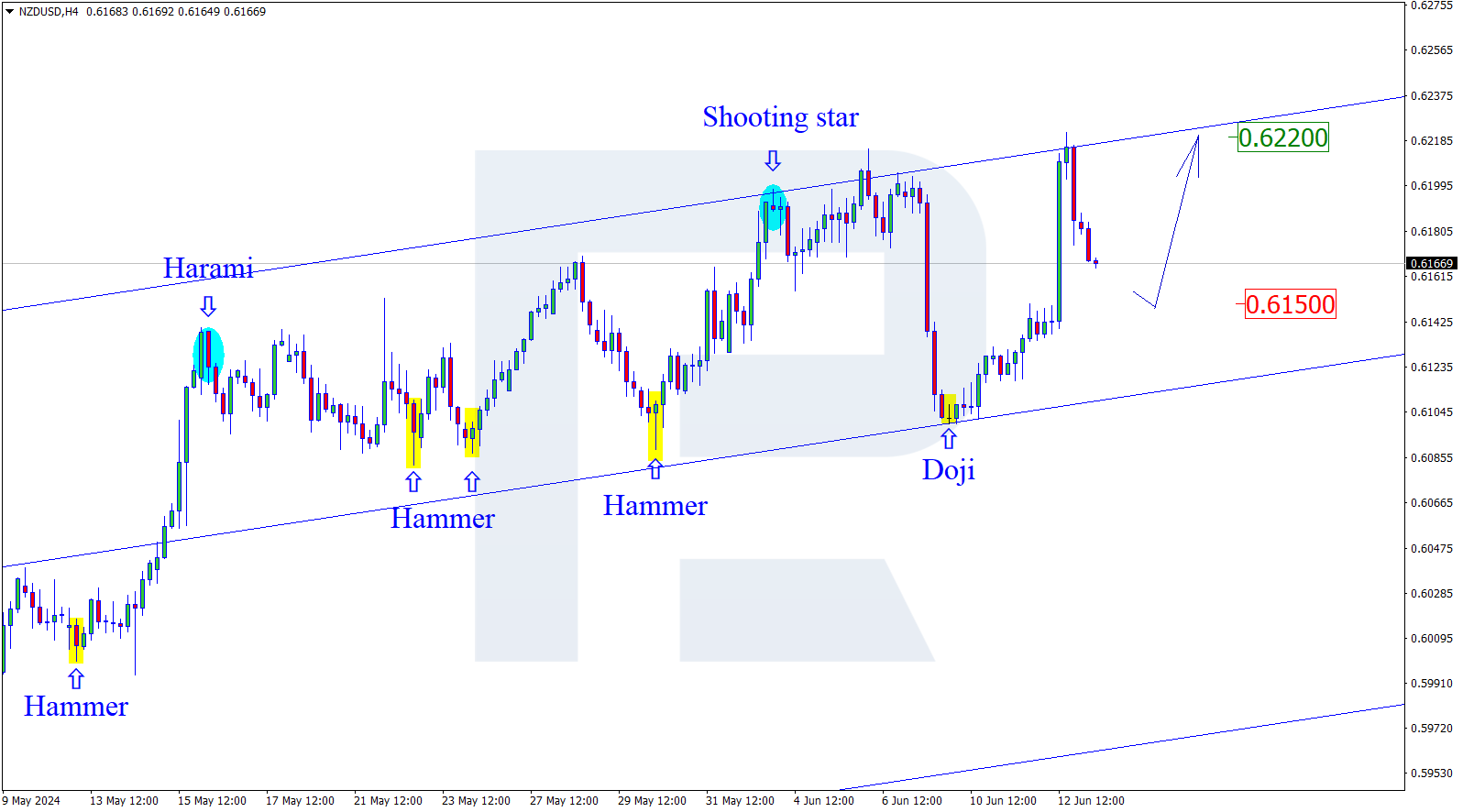

NZDUSD, “New Zealand vs. US Dollar”

As we can see in the H4 chart, NZDUSD is still moving upwards; right now, it is reversing after forming a Harami pattern close to the channel’s downside border. After completing another correction, the asset may resume trading upwards with the target at 0.7170. However, an alternative scenario implies that the price may start a new pullback towards 0.7040 before resuming the ascending tendency.

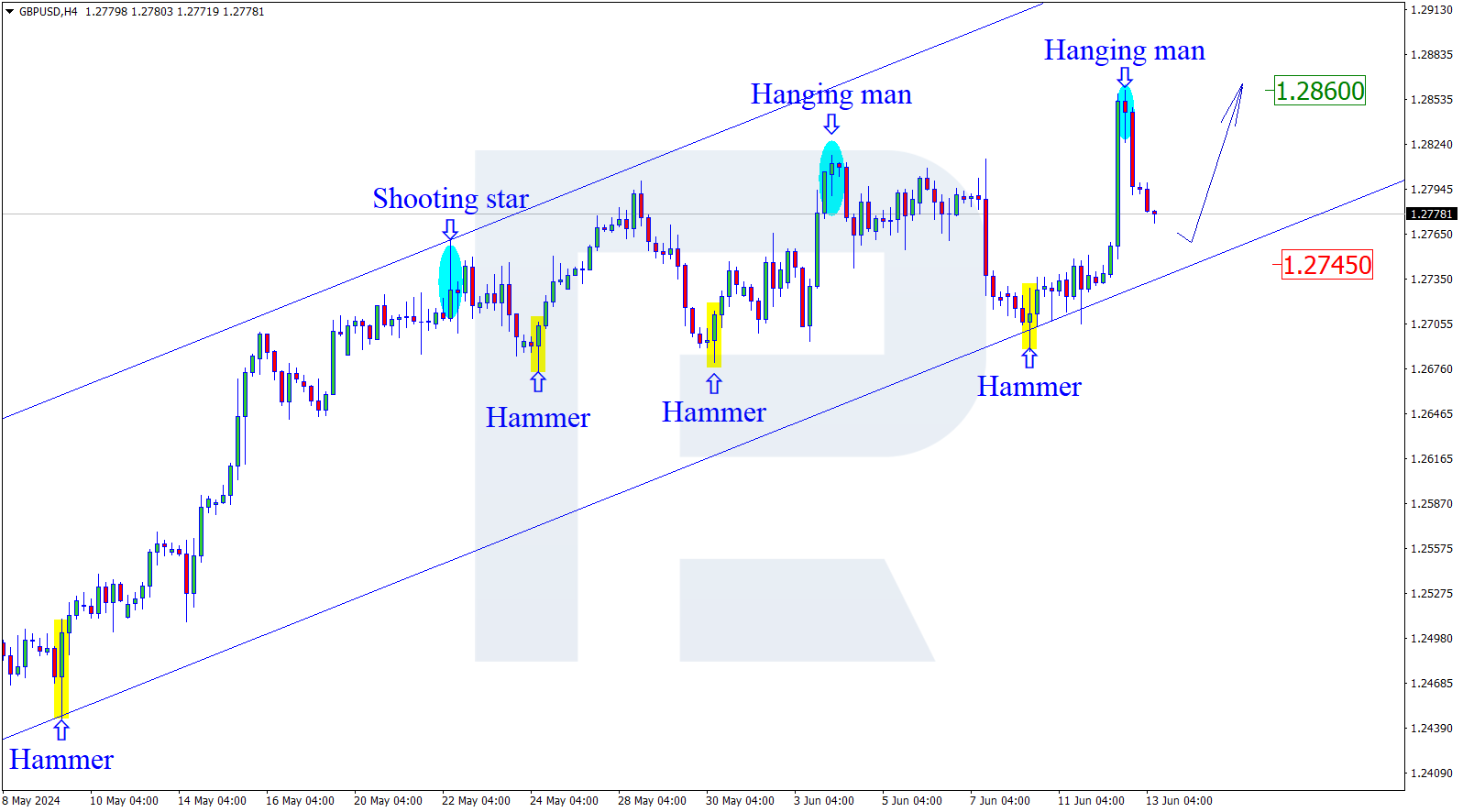

GBPUSD, “Great Britain Pound vs US Dollar”

As we can see in the H4 chart, the asset is forming another correction within the uptrend. Right now, after forming several reversal patterns, such as Harami, not far from the resistance area, GBPUSD is reversing. The correctional target is at 1.3360. After that, the instrument may rebound from the support level and then resume moving upwards. Still, there might be an alternative scenario, according to which the asset may grow to reach 1.3535 without reversing.