Johnson & Johnson management is optimistic about 2025: could the shares hit a new historical high?

Johnson & Johnson’s Q1 2025 report surpassed expectations. The shares have been trading within a sideways range since 2022, and the management’s upbeat forecast for 2025 could prompt a breakout above the upper boundary of this range.

Johnson & Johnson (NYSE: JNJ) reported a 2.4% increase in sales in Q1 2025 to 21.9 billion USD, with operational growth of 4.2%. Earnings per share rose to 2.77 USD, surpassing Wall Street forecasts. The company raised its full-year 2025 operational sales guidance, reflecting confidence stemming from the acquisition of Intra-Cellular Therapies and progress in drug development, such as the approval of TREMFYA for the treatment of Crohn’s disease. Despite the strong earnings beat, investor reaction on the first trading day was mixed, with shares rising by 0.89% in pre-market trading. Still, they ended the session down 0.5%, possibly reflecting concerns over tariff-related expenses and share dilution linked to the acquisition. However, market sentiment had shifted to optimism, and JNJ shares began to rise.

This article presents reports for Q2, Q3 and Q4 2024, as well as Q1 2025, and includes a technical analysis of JNJ shares, which forms the basis for the Johnson & Johnson stock forecast for 2025. It also examines the company’s business model, revenue sources, and expert projections for Johnson & Johnson stock in 2025.

About Johnson & Johnson

Founded in 1886 in the US, Johnson & Johnson manufactures medical products, pharmaceuticals, and health-related items, including personal care products and medical devices. J&J is renowned for its well-known brands, such as Band-Aid, Neutrogena, Tylenol, and others. The company went public in 1944 and is now one of the largest healthcare corporations in the world.

Image of the Johnson & Johnson company nameJohnson & Johnson’s business model

Johnson & Johnson is one of the world’s largest companies, engaged in the healthcare and consumer goods sector. It has a diversified business model and sells its products in three main segments:

- Pharmaceutical Segment: the main revenue stream is the sale of prescription drugs. The key areas include oncology, immunology, neurology, infectious diseases, cardiology, metabolism, and vaccines

- Medical Devices Segment: the main revenue stream comes from selling medical equipment and devices. The key areas include surgery, orthopaedics, interventional solutions, and eye surgery

- Consumer Health Segment: the main revenue stream is the sale of health and personal care products. The key areas include skin care products, baby products, oral care products, dietary supplements, and over-the-counter drugs

Johnson & Johnson’s business model is based on diversifying revenues across three segments, enabling the company to earn not only from pharmaceuticals but also from the production and sale of medical equipment.

The consumer segment is also a significant area for revenue diversification as it covers products sold outside medical centres that do not require prescriptions.

Johnson & Johnson Q2 2024 report

Johnson & Johnson published its Q2 2024 report on 17 July 2024. In addition to the key financial metrics, the company disclosed segmental data for Innovative Medicine (including pharmaceuticals, health products, and personal care items) and MedTech (comprising medical devices and equipment). Below are the figures compared to the same period last year:

- Revenue: 22.45 billion USD (+4.3%)

- Net profit: 4.68 billion USD (-12.8%)

- Earnings per share: 2.82 USD (+10.2%)

- Innovative Medicine revenue: 14.49 billion USD (+5.5%)

- US: 8.51 billion USD (+8.9%)

- Rest of the world: 5.98 billion USD (+1.1%)

- #. MedTech revenue: 7.96 billion USD (+2.2%)

- US: 4.05 billion USD (+5.7%)

- Rest of the world: 3.89 billion USD (-1.3%)

Johnson & Johnson’s management described its Q2 2024 results as strong. In particular, Chairman and CEO Joaquin Duato highlighted that the second-quarter figures reflect the company’s ongoing focus on advancing the next wave of medical innovations, which has driven significant sales growth and an adjustment in operating earnings per share. With a robust product portfolio, the integration of Shockwave, and the continued expansion of its pharmaceutical range, the company has a solid foundation for both short- and long-term growth.

Johnson & Johnson issued an upbeat outlook for 2024, expecting continued growth across its core segments – Innovative Medicine and MedTech.

The company projected full-year revenue between 89.30 and 90.30 billion USD, being a year-on-year increase of 4.0-5.0%. Earnings per share (EPS) were forecasted to range from 10.70 to 10.80 USD, marking a 2.5-3.5% increase compared to 2023.

Johnson & Johnson’s management emphasised that the company is well-positioned for long-term growth, supported by its diversified product portfolio and active investments in innovation.

Johnson & Johnson Q3 2024 report

On 15 October 2024, Johnson & Johnson released its Q3 2024 results, showing revenues again exceeded those of the same period in 2023. Below are the key figures compared to Q3 2023:

- Revenue: 22.47 billion USD (+5.2%)

- Net profit: 2.69 billion USD (-37.5%)

- Earnings per share (EPS): 2.42 USD (-9.0%)

- Innovative Medicine revenue: 14.58 billion USD (+4.9%)

- US: 8.87 billion USD (+7.5%)

- Rest of the world: 5.70 billion USD (+1.2%)

- #. MedTech revenue: 7.89 billion USD (+7.1%)

- US: 4.03 billion USD (+5.7%)

- Rest of the world: 3.85 billion USD (+3.9%)

Joaquin Duato stated that J&J’s Q3 2024 results reflect the distinct diversity of the company’s business model and J&J’s commitment to innovation in healthcare. He highlighted the progress in advancing treatments for diseases with high unmet needs, positioning J&J for sustainable growth.

The earnings commentary emphasised noteworthy progress in expanding the product portfolio, including regulatory approvals for TREMFYA in ulcerative colitis and combining RYBREVANT with LAZCLUZE for treating non-small cell lung cancer. It also mentioned the submission of an application for exclusive rights related to the development of the OTTAVA general-purpose robotic surgery system.

The company attributed the decline in net profit to one-off research and development expenses associated with the acquisition of M-Wave’s research outcomes.

Johnson & Johnson Q4 2024 report

On 22 January 2025, Johnson & Johnson released its Q4 2024 results, which exceeded expectations, although the key indicator dynamics were mixed:

- Revenue: 22.52 billion USD (+5.3%)

- Net profit: 3.43 billion USD (-17.5%)

- Earnings per share (EPS): 2.04 USD (-10.9%)

- Revenue from Innovative Medicine: 14.33 billion USD (+4.4%)

- US: 8.97 billion USD (+11.1%)

- Rest of the world: 5.35 billion USD (-5.1%)

- #. Revenue from MedTech: 8.18 billion USD (+6.7%)

- US: 4.22 billion USD (+7.6%)

- Rest of the world: 3.96 billion USD (+5.8%)

Joaquin Duato described 2024 as a "year of transformation" for Johnson & Johnson, highlighting robust growth and accelerated progress in the company’s product portfolio. J&J achieved annual sales of 88.80 billion USD and an EPS of 9.98 USD, representing growth compared to 2023, but was slightly below the forecast it provided in its Q2 2024 earnings commentary.

The decline in net profit was attributed to increased costs related to acquisitions, operating activities, adverse foreign exchange movements, and legal settlement expenses.

For 2025, the company provided a cautious outlook, expecting sales to range between 89.20 billion USD and 90.00 billion USD, below analysts’ expectations of 91.04 billion USD. The adjusted EPS forecast was set at 10.50-10.70 USD per market expectations.

Following the earnings release, J&J’s stock price declined, likely due to the conservative 2025 sales forecast.

Johnson & Johnson Q1 2025 report

On 15 April 2025, Johnson & Johnson released its Q1 2025 results, which exceeded expectations. The key figures are presented below, compared to Q1 2024:

- Revenue: 21.89 billion USD (+2.4%)

- Net profit: 6.71 billion USD (+1.9%)

- Earnings per share (EPS): 2.77 USD (+2.2%)

- Innovative Medicine revenue: 13.87 billion USD (+2.3%)

- US: 8.09 billion USD (+6.3%)

- Rest of the world: 5.78 billion USD (–2.9%)

- #. MedTech revenue: 8.02 billion USD (+2.5%)

- US: 4.21 billion USD (+5.1%)

- Rest of the world: 3.81 billion USD (–0.2%)

The company delivered strong results, beating Wall Street estimates for both earnings per share and revenue. This performance was supported by steady growth in the Innovative Medicine and MedTech segments. Johnson & Johnson’s ability to maintain robust performance despite challenges, such as biosimilar competition for Stelara and macroeconomic pressures in key markets, underscores its strategic resilience and operational effectiveness.

Johnson & Johnson continues to enhance its portfolio through strategic acquisitions. The 14.6 billion USD deal to acquire Intra-Cellular Therapies is nearing completion, strengthening J&J’s position in neurology. Progress in product development – including the approval of TREMFYA for the treatment of Crohn’s disease and positive clinical results for RYBREVANT in lung cancer therapy – reaffirms the company’s commitment to innovation. Additionally, the launch of clinical trials for the OTTAVA surgical robotic system positions J&J as a potential competitor to leading players in the medical technology sector, such as Intuitive Surgical.

From a financial perspective, Johnson & Johnson remains highly resilient. The company increased its quarterly dividend to 1.30 USD per share,

marking the 63rd consecutive year of dividend growth. It also raised its full-year 2025 revenue forecast to 91.0-91.8 billion USD, reflecting anticipated tariffs of around 400 million USD and the expected impact of the pending Intra-Cellular Therapies acquisition.

Nevertheless, certain challenges remain. The company continues to face legal risks related to talc-based product litigation and declining Stelara sales due to intensifying competition from biosimilars.

The combination of financial stability, innovative capability, and strategic acquisitions makes Johnson & Johnson shares an attractive investment. For those focused on short-term positions, caution is advised until there is greater clarity regarding the impact of tariffs and legal risks. Overall, the Q1 results confirm that Johnson & Johnson continues to strengthen its position by executing strategic initiatives to ensure sustained growth.

Arguments in favour of investing in JNJ stock

- Drug portfolio: Johnson & Johnson has a broad and diversified drug portfolio that spans various therapeutic areas, including oncology, immunology, neurology, infectious and cardiovascular diseases. Their critical importance to patients ensures steady demand, making revenues from these medicines less susceptible to economic fluctuations and more sustainable in the long term

- JNJ stock is a dividend aristocrat, having increased dividend payouts for over 50 consecutive years. This makes the company’s shares attractive to long-term investors, particularly those seeking stable earnings. The company’s robust dividend policy demonstrates its financial stability and confidence in future earnings, which is important for investors focused on stable and predictable investments

- Recognisable brand: Johnson & Johnson is one of the world’s most recognisable brands, and it is associated with quality and safety. With its long history and market credibility, the company has earned the unique trust of consumers and medical professionals. This brand equity plays an important role in maintaining and expanding the company’s market share and successfully introducing new products. Brand recognition also helps J&J compete well and maintain elevated levels of loyalty among consumers

Arguments against investing in JNJ stock

- Intense competition: the pharmaceutical sector is highly competitive. Johnson & Johnson faces serious rivals such as Merck & Co Inc (NYSE: MRK), Novartis AG (NYSE: NVS), Pfizer Inc. (NYSE: PFE) and others, which are also actively developing new drugs and solutions to treat diseases. Competitors may offer more effective or less expensive alternatives, which could reduce J&J’s market share and exert pressure on prices, ultimately affecting the company’s margins and profitability

- Expiry of drug licences: like other pharmaceutical companies, Johnson & Johnson runs the risk of patent expiration on key drugs. When patents expire, the company loses the exclusive right to sell these drugs, and generic products enter the market, slashing prices and revenues from these products. The expiry of patent protection for crucial drugs may result in significant revenue losses unless the company can offset them with new products

- High research and development costs: innovation in the pharmaceutical and medical industry requires significant investment in research and development (R&D). Johnson & Johnson’s R&D costs reached approximately 17.00 billion USD in 2024, accounting for 20% of total revenues. High spending is necessary to maintain competitiveness and develop new products, but it also comes with increased risks. Research does not always meet expectations, and clinical trials can fail, leading to substantial losses

Expert forecasts for Johnson & Johnson stock for 2025

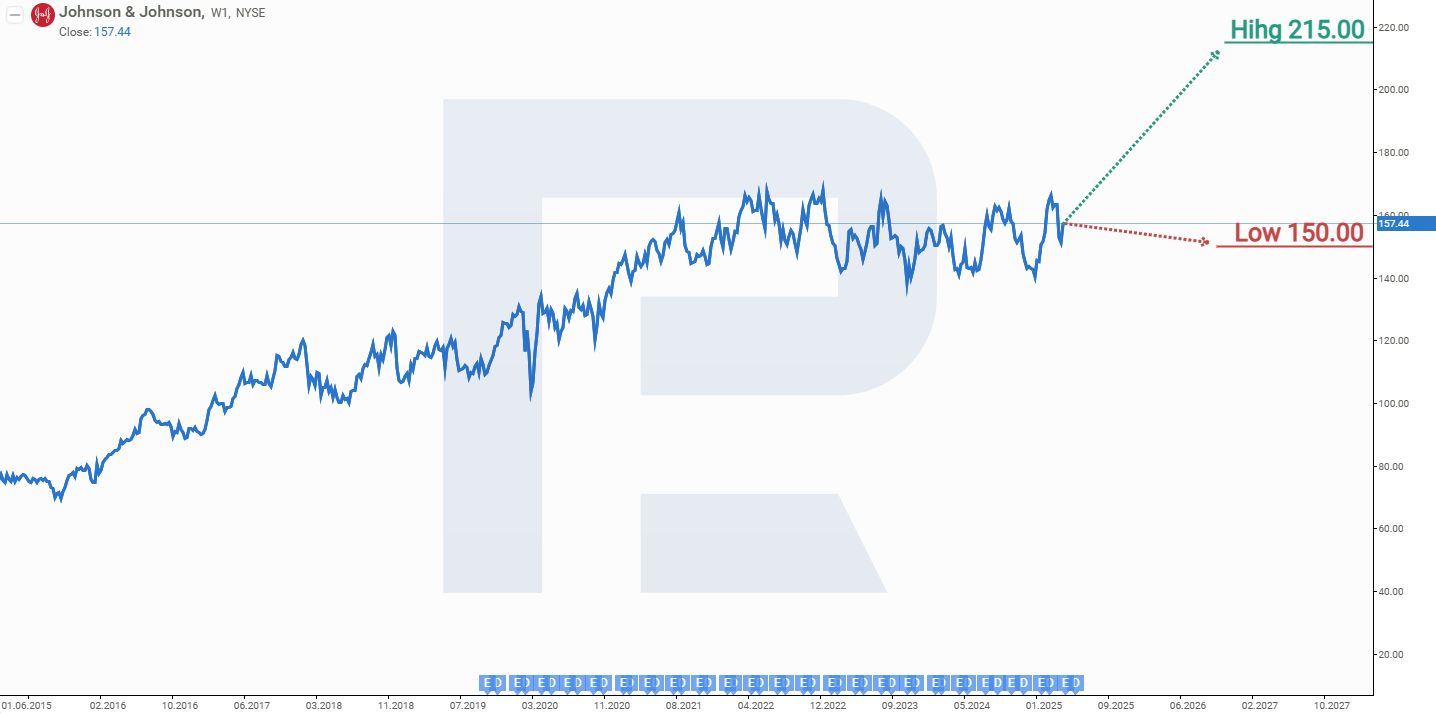

- Barchart: nine of 22 analysts rated Johnson & Johnson’s shares as a Strong Buy, two as a Buy, and 11 as a Hold. The forecast range spans from 150 USD to 185 USD

- MarketBeat: nine of 18 analysts gave the stock a Buy rating and nine recommended Hold. The forecast range is 150 USD to 215 USD

- TipRanks: eight out of 16 professionals recommended Buy, and eight recommended Hold. The forecast range is 155 USD to 185 USD

- Stock Analysis: four out of 17 experts rated the shares as a Strong Buy, five as a Buy, and eight as a Hold. The forecast range is 150 USD to 215 USD

None of the experts recommended selling Johnson & Johnson shares.

Expert forecasts for Johnson & Johnson shares for 2025Johnson & Johnson stock price forecast for 2025

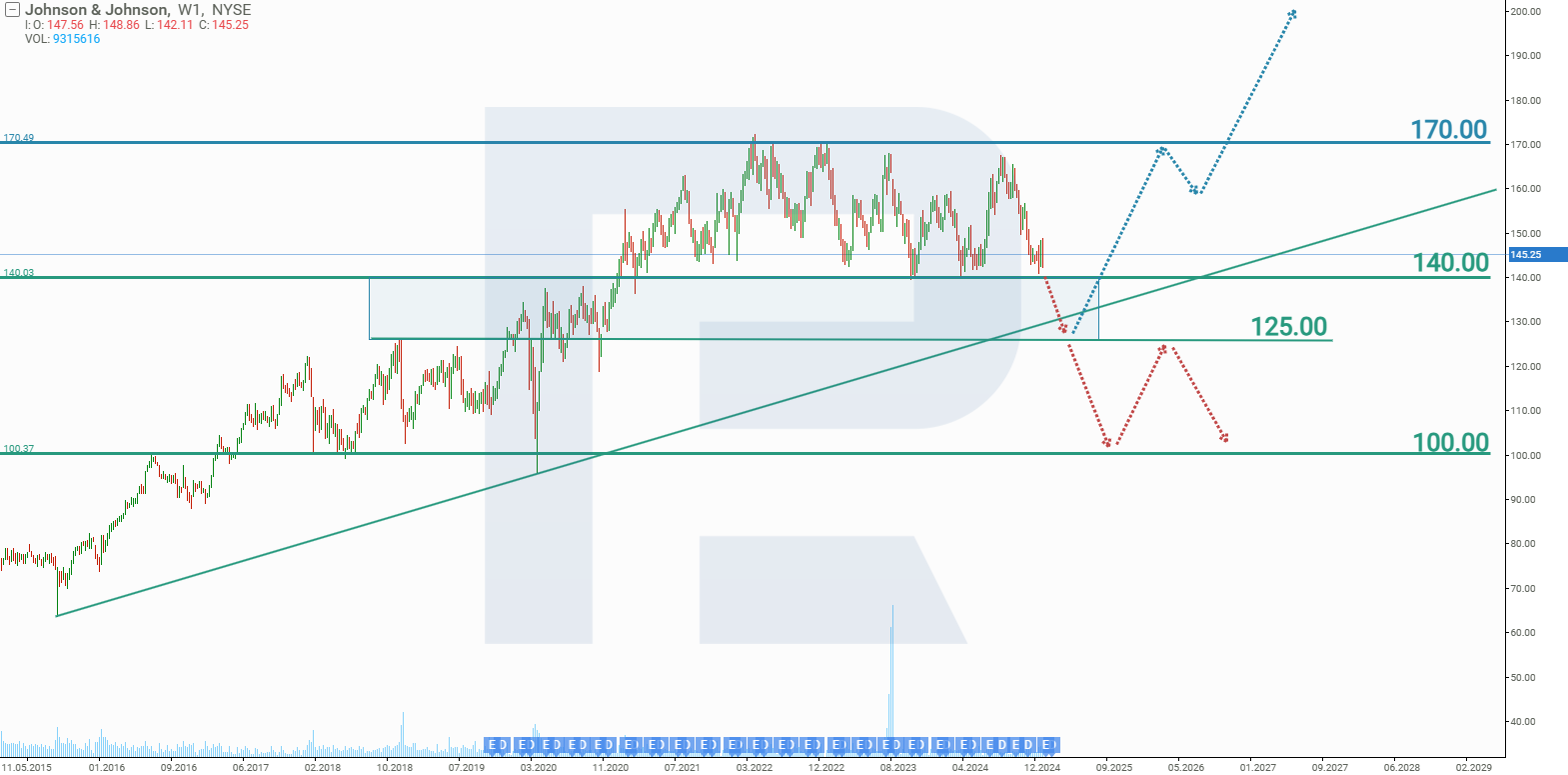

On the weekly timeframe, Johnson & Johnson shares are trading within an upward channel. In May 2022, a correction of the long-term uptrend began, unfolding as a sideways movement bounded by the 170 and 140 USD levels. A breakout above the upper boundary of this range – the 170 USD level – would signal the end of the prolonged correction, which has lasted for nearly three years, and indicate a further rise in JNJ’s share price. Based on the current dynamics of Johnson & Johnson shares, the potential price movements in 2025 are as follows:

The optimistic Johnson & Johnson stock price forecast assumes a breakout above the 170 USD resistance level, followed by a rise towards the upper boundary of the channel at 200 USD. This scenario is supported by the company’s positive revenue guidance for 2025.

The pessimistic Johnson & Johnson share price forecast assumes a break below the 140 USD support level, followed by a breach of the trendline. In this case, JNJ’s share price could fall to 100 USD.

Johnson & Johnson stock analysis and forecast for 2025