Johnson & Johnson stock forecast: strong earnings report beats expectations, yet shares decline

Johnson & Johnson (NYSE: JNJ) concluded Q4 2024 with a 5% increase in revenue and a 17% decline in net profit. In addition, the company’s management issued a cautious forecast for 2025. Investors responded negatively to this news, resulting in a drop in Johnson & Johnson’s stock price.

This article provides the Q2, Q3, and Q4 2024 reports, offers a technical analysis of JNJ shares, and presents a forecast for Johnson & Johnson’s stock in 2025. Additionally, it covers the company’s business model, the sources of its revenue, and expert predictions for Johnson & Johnson’s stock performance in 2025.

About Johnson & Johnson

Founded in 1886 in the US, Johnson & Johnson manufactures medical products, pharmaceuticals, and health-related items, including personal care products and medical devices. J&J is renowned for its brands such as Band-Aid, Neutrogena, Tylenol, and others. The company went public in 1944 and is now one of the largest healthcare corporations in the world.

Johnson & Johnson’s business model

Johnson & Johnson is one of the world’s largest companies engaged in the healthcare and consumer goods sector. It has a diversified business model and sells its products in three main segments:

- Pharmaceutical Segment: the main revenue stream is the sale of prescription drugs. The key areas include oncology, immunology, neurology, infectious diseases, cardiology, metabolism, and vaccines

- Medical Devices Segment: the main revenue stream comes from selling medical equipment and devices. The key areas include surgery, orthopaedics, interventional solutions, and eye surgery

- Consumer Health Segment: the main revenue stream is the sale of health and personal care products. The key areas include skin care products, baby products, oral care products, dietary supplements, and over-the-counter drugs

Johnson & Johnson’s business model is based on diversifying revenues across three segments, enabling the company to earn not only from pharmaceuticals but also from the production and sale of medical equipment.

The consumer segment is also a significant area for revenue diversification as it covers products sold outside medical centres that do not require prescriptions.

Johnson & Johnson’s Q2 2024 report

Johnson & Johnson published its Q2 2024 report on 17 July 2024. In addition to the key financial metrics, the company disclosed segmental data for Innovative Medicine (pharmaceuticals, health products, and personal care items) and MedTech (medical devices and equipment). Below are the figures compared to the same period last year:

- Revenue: 22.45 billion USD (+4.3%)

- Net profit: 4.68 billion USD (-12.8%)

- Earnings per share: 2.82 USD (+10.2%)

- Innovative Medicine revenue: 14.49 billion USD (+5.5%)

- US: 8.51 billion USD (+8.9%)

- Rest of the world: 5.98 billion USD (+1.1%)

- MedTech revenue: 7.96 billion USD (+2.2%)

- US: 4.05 billion USD (+5.7%)

- Rest of the world: 3.89 billion USD (-1.3%)

Johnson & Johnson’s management described its Q2 2024 results as strong. In particular, Chairman and CEO Joaquin Duato highlighted that the second-quarter figures reflect the company’s ongoing focus on advancing the next wave of medical innovations, which has driven significant sales growth and an adjustment in operating earnings per share. With a robust product portfolio, the integration of Shockwave, and the continued expansion of its pharmaceutical range, the company has a solid foundation for both short- and long-term growth.

Johnson & Johnson issued an upbeat outlook for 2024, expecting continued growth across its core segments – Innovative Medicine and MedTech.

The company projected full-year revenue between 89.30 and 90.30 billion USD, representing a year-on-year increase of approximately 4.0-5.0%. Earnings per share (EPS) were forecasted to range from 10.70 to 10.80 USD, marking a 2.5-3.5% increase compared to 2023.

Johnson & Johnson’s management emphasised that the company is well-positioned for long-term growth, supported by its diversified product portfolio and active investments in innovation.

Johnson & Johnson’s Q3 2024 report

On 15 October 2024, Johnson & Johnson released its Q3 2024 results, showing revenues again exceeded those of the same period in 2023. Below are the key figures compared to Q3 2023:

- Revenue: 22.47 billion USD (+5.2%)

- Net profit: 2.69 billion USD (-37.5%)

- Earnings per share (EPS): 2.42 USD (-9.0%)

- Innovative Medicine revenue: 14.58 billion USD (+4.9%)

- US: 8.87 billion USD (+7.5%)

- Rest of the world: 5.70 billion USD (+1.2%)

- MedTech revenue: 7.89 billion USD (+7.1%)

- US: 4.03 billion USD (+5.7%)

- Rest of the world: 3.85 billion USD (+3.9%)

Joaquin Duato stated that J&J’s Q3 2024 results reflect the unique diversity of the company’s business model and its commitment to innovation in healthcare. He highlighted the company’s progress in advancing treatments for diseases with high unmet needs, reinforcing J&J’s position for sustainable growth.

The earnings report emphasised noteworthy progress in expanding the product portfolio, including regulatory approvals for TREMFYA in ulcerative colitis and combining RYBREVANT with LAZCLUZE for treating non-small cell lung cancer. It also mentioned the submission of an application for exclusive rights related to the development of the OTTAVA general-purpose robotic surgery system.

The decline in net profit was attributed to one-off expenses related to acquired research and development outcomes following the purchase of M-Wave.

Johnson & Johnson’s Q4 2024 report

On 22 January 2025, Johnson & Johnson released its Q4 2024 results, which exceeded expectations, although the key indicator dynamics were mixed:

- Revenue: 22.52 billion USD (+5.3%)

- Net profit: 3.43 billion USD (-17.5%)

- Earnings per share (EPS): 2.04 USD (-10.9%)

- Revenue from Innovative Medicine: 14.33 billion USD (+4.4%)

- US: 8.97 billion USD (+11.1%)

- Rest of the world: 5.35 billion USD (-5.1%)

- Revenue from MedTech: 8.18 billion USD (+6.7%)

- US: 4.22 billion USD (+7.6%)

- Rest of the world: 3.96 billion USD (+5.8%)

Joaquin Duato described 2024 as a "year of transformation" for Johnson & Johnson, highlighting robust growth and accelerated progress in the company’s product portfolio. J&J achieved annual sales of 88.80 billion USD and an EPS of 9.98 USD, representing growth compared to 2023 but was slightly below the forecast it provided in its Q2 2024 earnings commentary.

The decline in net profit was attributed to increased costs related to acquisitions, operating activities, adverse foreign exchange movements, and legal settlement expenses.

For 2025, the company provided a cautious outlook, expecting sales to range between 89.20 billion USD and 90.00 billion USD, below analysts’ expectations of 91.04 billion USD. The adjusted EPS forecast was set at 10.50-10.70 USD per market expectations.

Following the earnings release, J&J’s stock price declined, likely due to the conservative 2025 sales forecast.

Arguments in favour of investing in JNJ stock

- Drug portfolio: Johnson & Johnson has a broad and diversified drug portfolio that covers various therapeutic areas such as oncology, immunology, neurology, and infectious and cardiovascular diseases. Their critical importance to patients ensures steady demand, making revenues from these medicines less susceptible to economic fluctuations and more sustainable in the long term

- Dividend aristocrat: JNJ stock is a dividend aristocrat, increasing dividend payouts for over 50 consecutive years. This makes the company’s shares attractive to long-term investors, particularly those seeking stable earnings. The company’s robust dividend policy demonstrates its financial stability and confidence in future earnings, which is important for investors focused on stable and predictable investments

- Recognisable brand: Johnson & Johnson is one of the world’s most recognisable brands, and it is associated with quality and safety. With its long history and market credibility, the company has earned the unique trust of consumers and medical professionals. This brand equity plays an important role in maintaining and expanding the company’s market share and successfully bringing new products. Brand recognition also helps J&J compete well and maintain elevated levels of loyalty among consumers

Arguments against investing in JNJ stock

- Intense competition: the pharmaceutical sector is highly competitive. Johnson & Johnson faces serious rivals such as Merck & Co Inc (NYSE: MRK), Novartis AG (NYSE: NVS), Pfizer Inc. (NYSE: PFE) and others, which are also actively developing new drugs and solutions to treat diseases. Competitors may offer more effective or less expensive alternatives, which could reduce J&J’s market share and exert pressure on prices, ultimately affecting the company’s margins and profitability

- Expiry of drug licences: like other pharmaceutical companies, Johnson & Johnson runs the risk of patent expiration on key drugs. When patents expire, the company loses the exclusive right to sell these drugs, and generic products enter the market, slashing prices and revenues from these products. The expiry of patent protection for crucial drugs may result in significant revenue losses unless the company can offset them with new products

- High research and development costs: innovation in the pharmaceutical and medical industry requires significant investment in research and development (R&D). Johnson & Johnson’s R&D costs reached approximately 17.00 billion USD in 2024, accounting for 20% of total revenues. High spending is necessary to maintain competitiveness and develop new products, but it also comes with increased risks. Research does not always meet expectations, and clinical trials can fail, leading to substantial losses

Expert forecasts for Johnson & Johnson stock for 2025

- Barchart: seven out of 21 analysts rate Johnson & Johnson’s shares as a Strong Buy, two as Buy, and 12 as Hold. The target price is 190 USD

- MarketBeat: six out of 14 specialists rate the stock as Buy, while eight recommend Hold. The target price for appreciation is 215 USD

- TipRanks: four out of 11 professionals advise Buy, and seven recommend Hold. The target price for appreciation is 185 USD

- Stock Analysis: three out of 13 experts rated the stock as a Strong Buy, three rated it a Buy, and seven rated it a Hold. The target price is 215 USD

None of the experts recommend selling Johnson & Johnson’s shares.

Johnson & Johnson stock price forecast for 2025

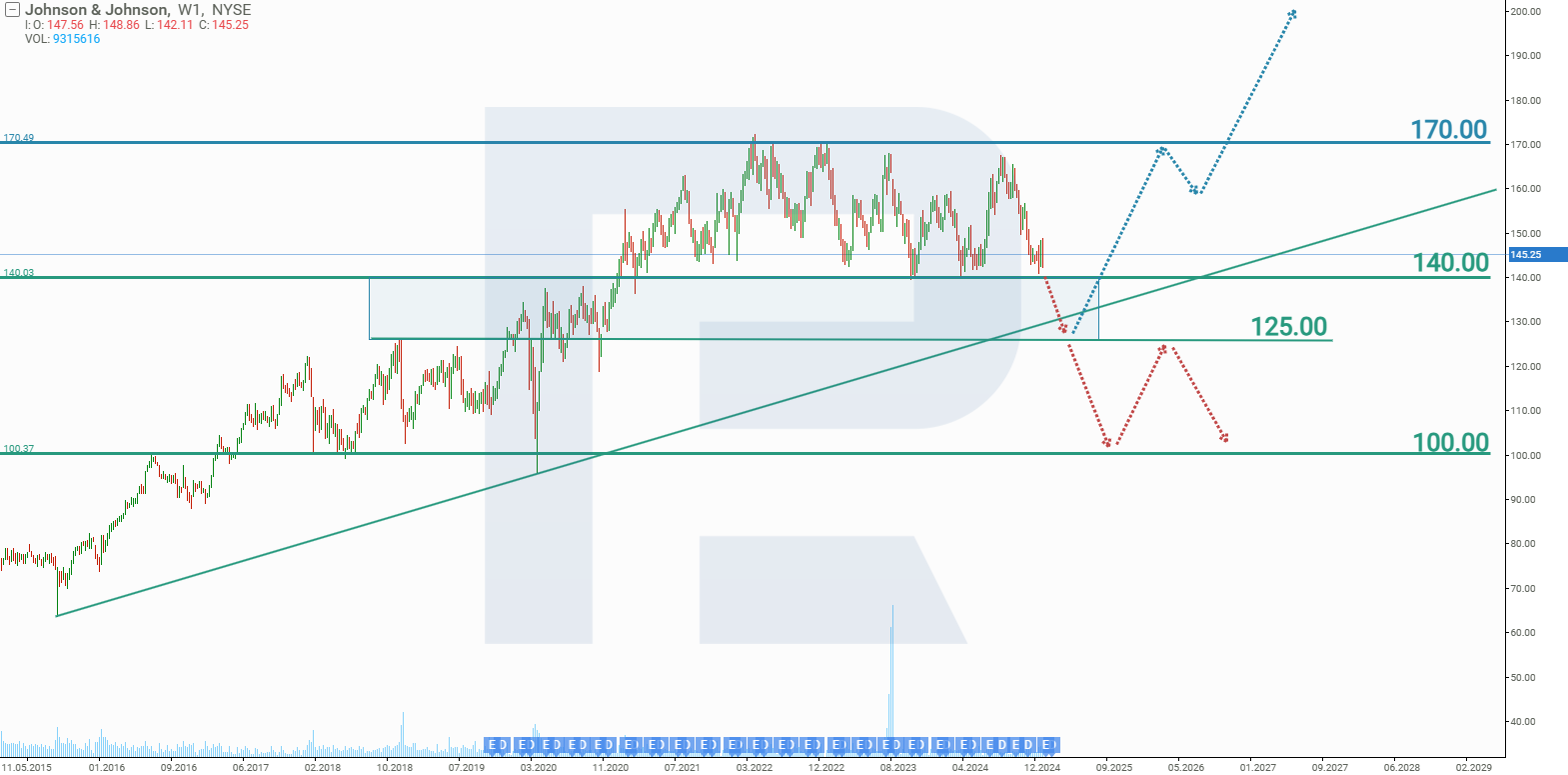

Since January 2021, Johnson & Johnson shares have been trading between 140 and 170 USD. With each attempt to push towards the upper boundary of the range, the highs have gradually decreased, reflecting weak investor demand as the price approaches the 170 USD level. Meanwhile, the stock prices tend to linger near the lower boundary of the range for more extended periods than at the upper boundary. Based on these observations, it can be inferred that investors rush to realise profits when the price reaches the upper boundary. In contrast, there is a struggle for market leadership near the lower boundary. Considering this dynamic, let’s examine Johnson & Johnson’s potential stock performance in 2025.

The Johnson & Johnson stock forecast suggests a ‘false breakout’ at the 140 USD support level, followed by a rise towards 170 USD. Should conditions develop favourably, the stock could break through this resistance, signalling further price growth towards 200 USD. This scenario is the most likely, as investors reacted negatively to the quarterly earnings report, leading to an immediate 4% drop, with the stock price reaching 142 USD. Given this, while a breach of the support level is possible, it may prove to be a false breakout, as the company expects improvements in its financial performance.

The pessimistic forecast for Johnson & Johnson stock anticipates a breakdown of the 140 USD support level, followed by a potential drop to 125 USD. In such a scenario, the stock price could decline as low as 100 USD.

Johnson & Johnson stock analysis and forecast for 2025Summary

Johnson & Johnson is a well-established company with a rich history and a track record of stable dividend payments rather than a high-growth startup. It is often favoured by conservative investors seeking reliable income from dividends. While the company’s profit growth is relatively slow (which may not be particularly attractive to a broader base of investors), no expert recommends selling its shares. Therefore, investing in Johnson & Johnson shares can be viewed as a long-term strategy for generating income.