JP 225 analysis: the index continues to fall

The JP 225 stock index remains in a downtrend, with a deep correction likely to persist. The JP 225 forecast for next week is negative.

JP 225 forecast: key trading points

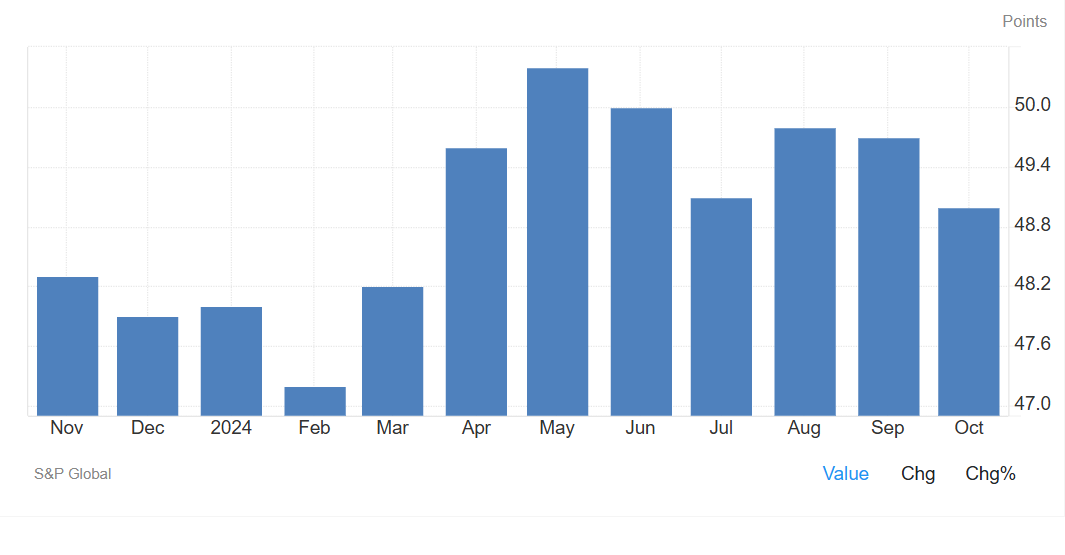

- Recent data: Japan’s manufacturing PMI was 49.0 points in October based on preliminary data

- Economic indicators: this is a gauge of business activity in the manufacturing sector

- Market impact: a fall below 50 points indicates an economic downturn and a risk of recession

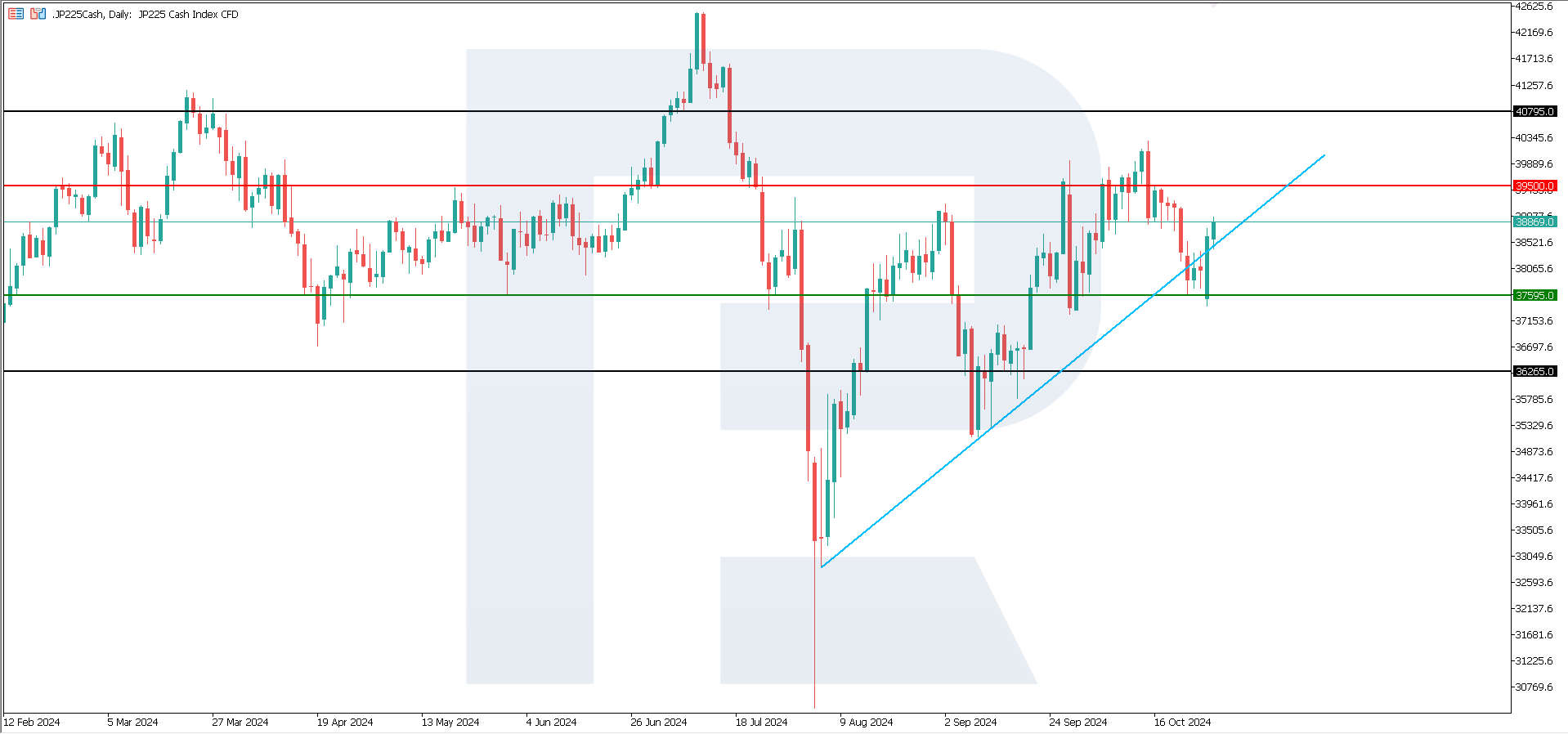

- Resistance: 39,500.0, Support: 37,595.0

- JP 225 price forecast: 36,265.0

Fundamental analysis

The manufacturing PMI decreased from 49.7 to 49.0, showing contracting activity in the manufacturing sector. The services PMI fell markedly from 53.1 to 49.3, indicating a downturn in the services sector, possibly due to reduced demand for services or general economic instability.

Source: https://tradingeconomics.com/japan/manufacturing-pmi

The composite PMI, which combines data from both sectors, also decreased, currently at 49.4. This indicates general economic contraction. The decline in all three indicators below 50 may raise concerns among investors and push down the quotes in the Japanese stock market, signalling a potential economic slowdown.

The decline in the services PMI is particularly significant, as the services sector typically has a substantial impact on the labour market and consumer demand. The downturn may affect companies focused on the domestic market, such as telecommunications, transport, retail, and finance. The decrease in all PMI indicators signals that the Japanese economy is struggling. This may lead to a correction in the Japanese stock market, especially if investors become wary of a deteriorating economic situation. The JP 255 index forecast is negative.

JP 225 technical analysis

The JP 225 stock index is in a downtrend as part of a correction after a slight rise. The decline will likely continue. The index is gradually breaking through support levels. According to the JP 225 technical analysis, a breakout below the 37,595.0 support level will signal a further decline.

The following scenarios are considered for the JP 225 price forecast:

- Pessimistic JP 225 forecast: a breakout below the 37,595.0 support level could push the index down to 36,265.0

- Optimistic JP 225 forecast: a breakout above the 39,500.0 resistance level could drive the price to 40,795.0

Summary

If the downtrend in business activity persists, this may weaken confidence in the Japanese economy, reducing the investment appeal of the Japanese assets. Therefore, the current correction may become a long-term downtrend.