JP 225 analysis: the index continues to trade in a sideways channel

With no demand from non-residents, the JP 225 index is trading in a sideways channel without a pronounced trend. As foreign investors reduce their positions, the outlook for the JP 225 appears to be negative.

JP 225 forecast: key trading points

- Recent data: non-residents sold 10.5bn USD worth of Japanese shares

- Economic indicators: demand for stock market assets is driven by both foreign and domestic investors

- Market impact: the reduction in non-residents’ positions signals a decrease in foreign investors’ interest in the Japanese stock market

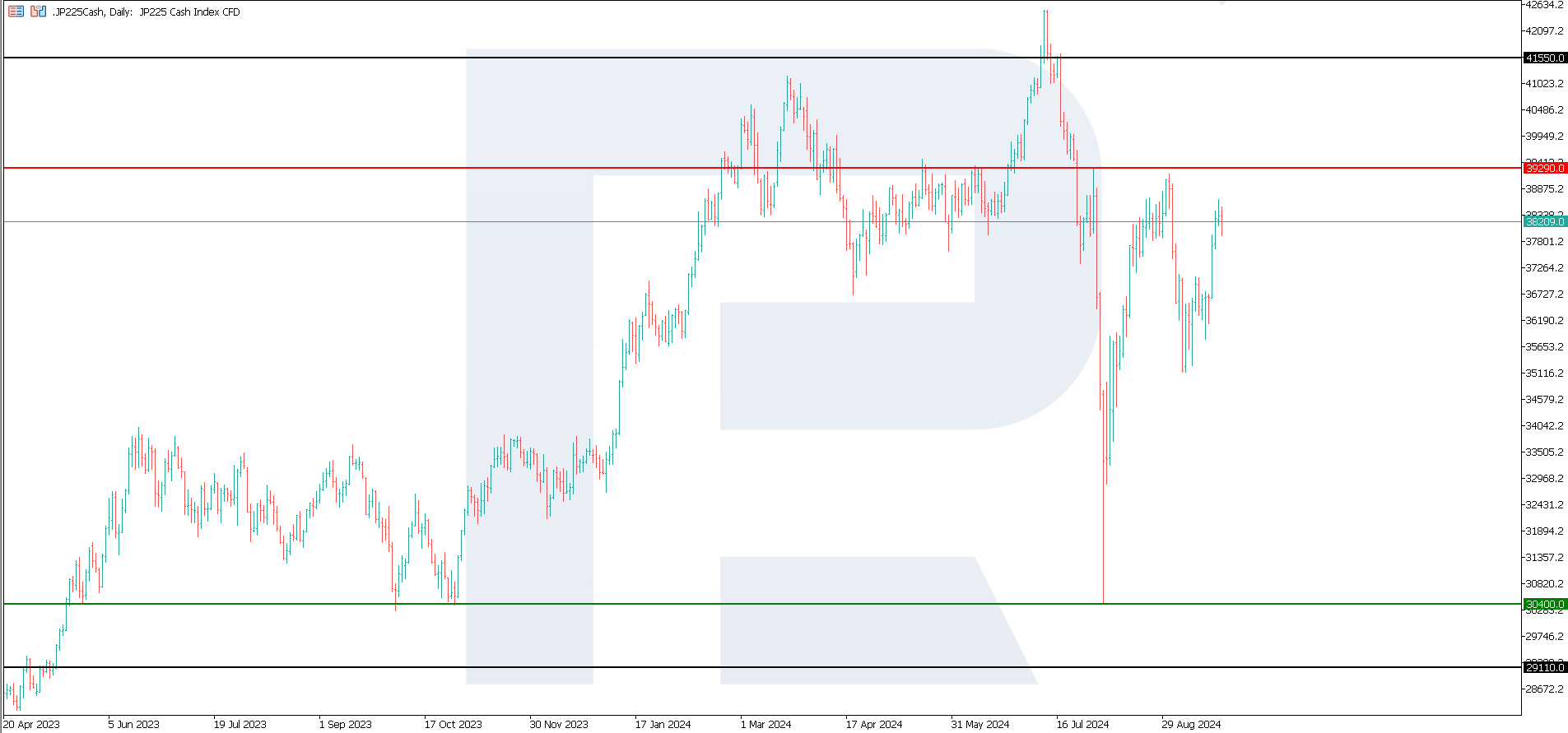

- Resistance: 39,290.0, Support: 30,400.0

- JP 225 index price forecast: 29,110.0

Fundamental analysis

Foreign investors sold a record number of Japanese stocks due to concerns about the yen, driven by upcoming decisions from major central banks in developed countries.

According to the Tokyo Stock Exchange, foreign investors sold Japanese shares worth 10.5 billion USD in the week ending 13 September, the highest level since 1993. At the same time, they bought 3.1 billion USD worth of shares on the futures market.

Data compiled by Bloomberg shows that since 1 April 2024, Honda Motor Co. and footwear maker Asics Corp. have conducted at least 80 transactions, including initial public offerings, additional stock sales and issuance of equity-linked bonds, totalling about 20.5 billion USD. This is a record volume for such transactions since 2004, and several analysts suggest that the annual total could double from current values. Thus, Japanese stock prices are supported by demand from domestic investors. For this reason, the forecast for JP 225 for the next week is moderately negative.

JP 225 technical analysis

The JP 225 stock index has been trading in a sideways channel for almost two months, defined by the current support and resistance levels. There has been no clearly defined trend since the most significant decline at the beginning of August of this year. From a technical analysis perspective, the JP 225 will likely decline further and form a long-term downtrend.

The JP 225 price prediction assumes the following scenarios:

- Optimistic forecast for JP 225: if the resistance level of 39,290.0 is breached, the index may rise to 41,550.0

- Pessimistic forecast for JP 225: if the 30,400.0 support level is breached, the probable downside target could be 29,110.0.

Summary

According to the Tokyo Stock Exchange, overseas investors sold 10.5bn USD worth of Japanese stocks, a record high since 1993. Meanwhile, domestic investors bought 20.5bn USD worth of securities from Japanese companies. Now that demand is supported solely by residents; the JP 225 index will likely fall further.