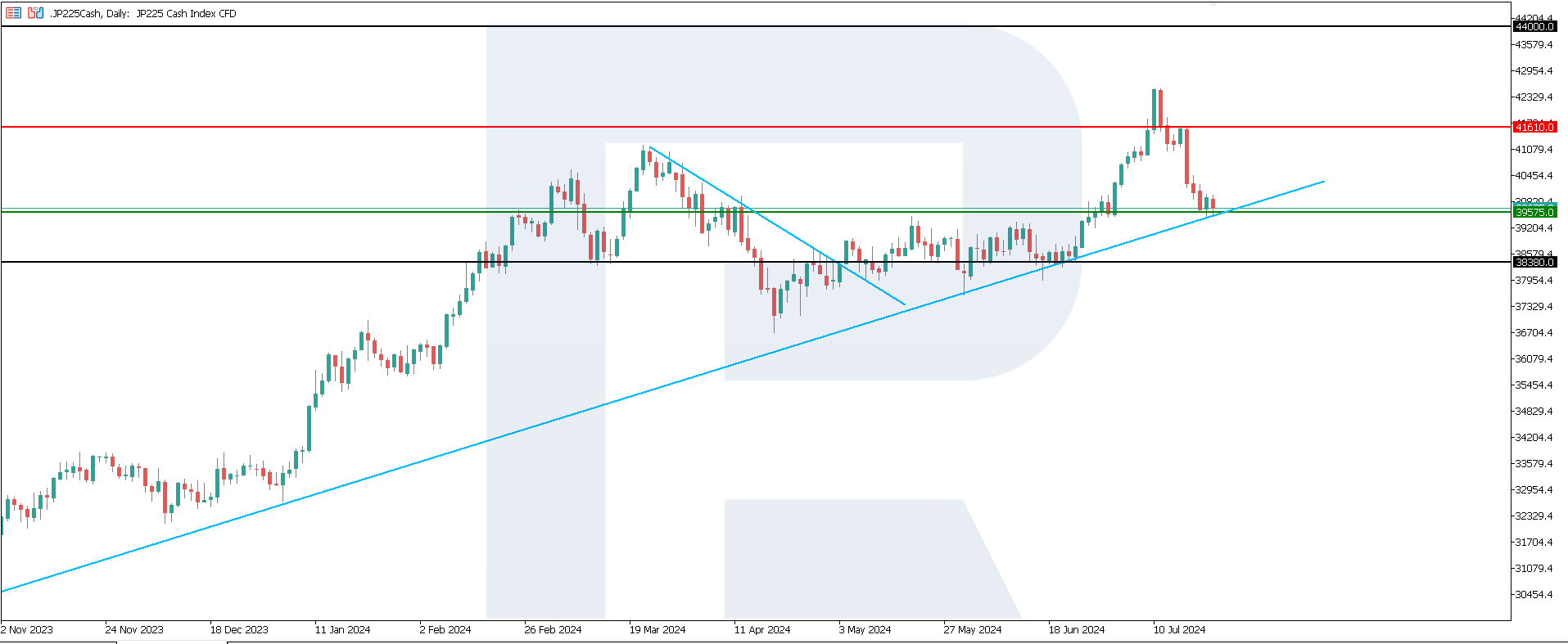

The JP 225 stock index declined by 7% immediately after reaching a new all-time high. However, the support level of the uptrend has not yet been breached.

JP 225 trading key points

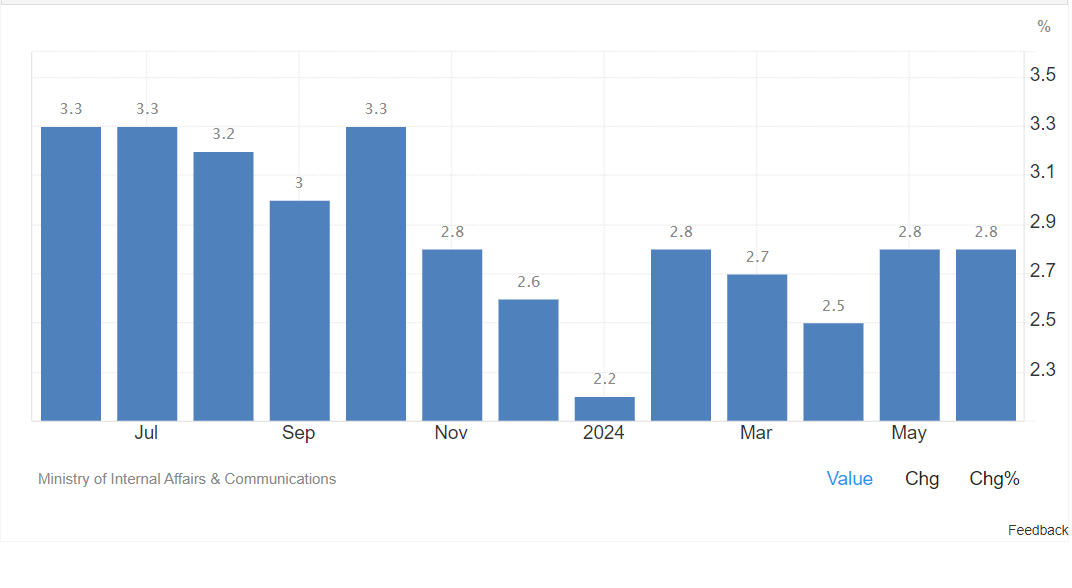

- Recent data: Japan’s CPI consumer inflation reached 2.8% year-over-year in June

- Economic indicators: rising inflation amid a weakening yen is prompting the Bank of Japan to raise the key rate

- Market impact: domestic investors are becoming the primary buyers of Japanese stocks

- Resistance: 41,610.0, Support: 39,575.0

- JP 225 price target: 38,380.0

Fundamental analysis

Japan’s consumer inflation in June reached 2.8% year-over-year, aligning with analyst forecasts. Prices increased by 0.3% compared to May, surpassing the expected rise of 0.2%. This reflects the harmful effects of yen depreciation.

Source: https://tradingeconomics.com/japan/inflation-cpi

The Japanese yen has fallen to its lowest level since 1967 (adjusted for inflation). This decline was against a broad basket of 64 currencies but is primarily attributed to the US dollar. The Japanese currency has nominally depreciated 25% against the US dollar over the past 18 months.

The Bank of Japan has no room for manoeuvre and is compelled to raise the interest rate. This action will inevitably boost demand for government bonds.

JP 225 technical analysis

The JP 225 stock index broke below the support level, correcting by 7%. The quotes are currently testing the support line. If this support level is breached, the trend will likely shift to a downtrend, which could persist for an extended period.

Key JP 225 levels to watch until the end of this week include:

- Resistance level: 41,610.0 – a breakout above this level may propel the index towards 44,000.0

- Support level: 39,575.0 – a breakout below the support level could drive the price towards 38,380.0

Summary

The JP 225 stock index has decreased 7% from its all-time high. The quotes are now testing the uptrend’s support line. If the current support level breaks, the trend will likely shift to a downtrend. Amid rising inflation, the Bank of Japan will likely be forced to raise the key rate, potentially leading to increased demand from domestic investors.