JP 225 analysis: the index is rising, but investors are awaiting signals from the Fed and Japan’s inflation data

The JP 225 index is attempting to gain a foothold above the resistance level on Tuesday. Find out more in our analysis dated 20 August 2024.

JP 225 forecast: key trading points

- Analysts forecast a fall in inflation in Japan, which may impact the BoJ’s decisions

- Released data on machinery orders and Q2 GDP growth indicate the strengthening of the Japanese economy

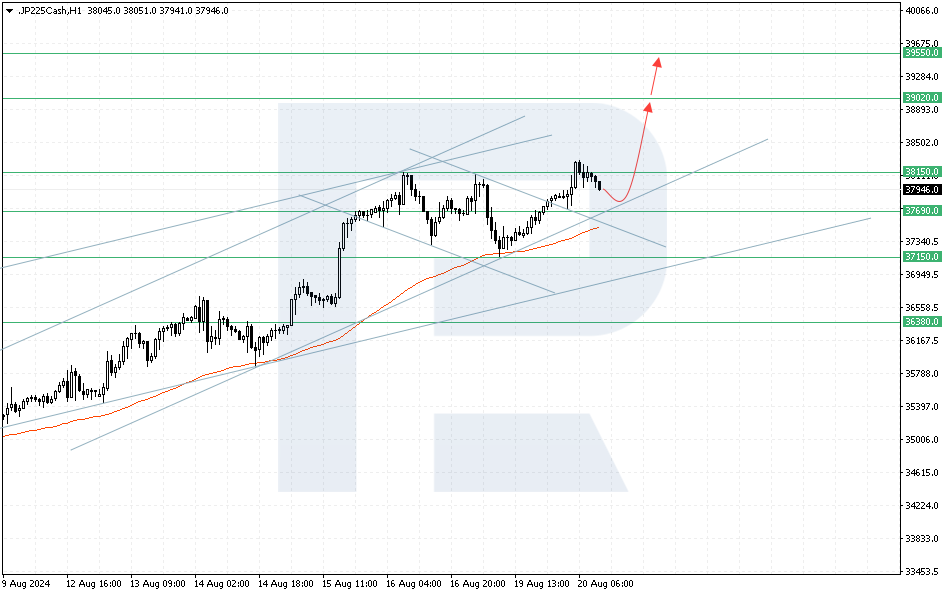

- Resistance: 38,150.0, Support: 37,690.0

- JP 225 price forecast: 39,020.0 and 39,550.0

Fundamental analysis

Although the JP 225 index rose to 38,141 points, it failed to hold above the resistance level. Investors await a speech by Federal Reserve Chair Jerome Powell at the Jackson Hole Symposium at the end of the week to obtain information on the possible timing of interest rate cuts. Traders are also keeping a close eye on currency fluctuations as they are concerned that a stronger yen may lead to a winding down of popular carry trades.

Japan has previously released data on machinery orders, which gauge capital expenditures. They rose by 2.1% month-over-month in June, exceeding the projected 1.1%. The Japanese economy grew by 3.1% year-over-year in Q2 following a 2.3% decline in Q1 and exceeding the forecasts of 2.1%. Such positive dynamics of the Japanese economy send a clear signal for growth according to the JP 225 index forecast for next week.

https://tradingeconomics.com/japan/gdp-growth-annualized

The market will focus on Japan’s inflation data on Friday. Analysts are optimistic, expecting inflation to ease modestly in July. Preliminary data may indicate a potential decline in both headline inflation across the country and the core inflation ratio monitored by the Bank of Japan.

JP 225 technical analysis

Buyers are holding the price above the moving average, indicating a short-term uptrend in the index. The JP 225 analysis suggests a downward correction to 37,690.0, followed by a rise to 39,020.0. A rebound from the moving average will be an additional signal in favour of this scenario. An earlier test of this line pushed the index price up by more than 3%. However, if quotes secure below the 37,150.0 level, this will indicate a breakout below the lower boundary of the ascending channel and a further decline to 36,380.0. In this case, the current uptrend will become irrelevant.

Key JP 225 levels to watch include:

- Resistance level: 38,150.0 – if the price breaks above this level, it could target 39,550.0

- Support level: 37,690.0 – a breakout below this level will signal a trend reversal, with the target at 37,150.0

Summary

Such positive dynamics of the Japanese economy support growth in the JP 225 index. Investors’ decision on further actions will depend on key developments such as the Federal Reserve chair’s speech and Japan’s inflation data. The JP 225 price forecast suggests a correction, with the price testing the 37,690.0 level, followed by a further rise to 39,020.0 and 39,550.0. If the price secures below the 37,150.0 level, this will indicate the completion of the uptrend.