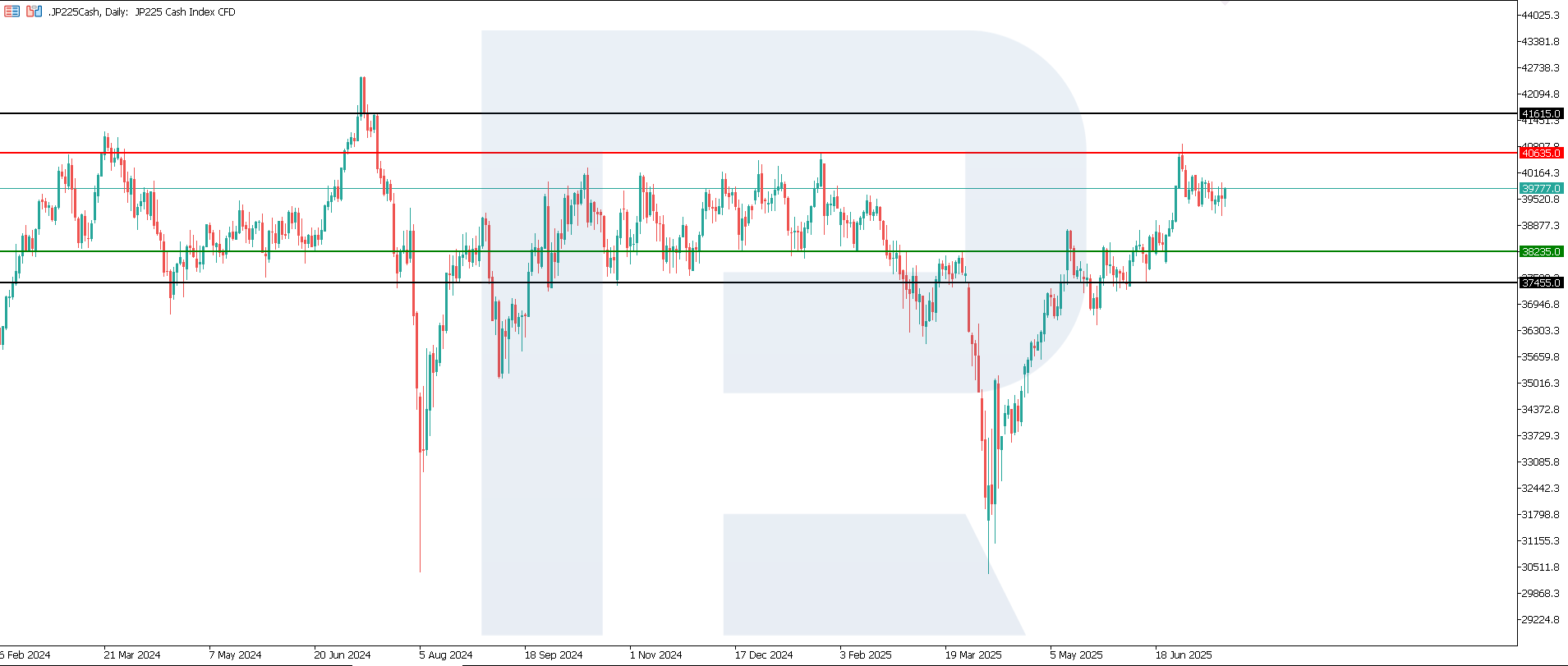

JP 225 forecast: price enters sideways channel

The JP 225 stock index has entered a sideways channel within an uptrend. The JP 225 outlook for today is positive.

JP 225 forecast: key trading points

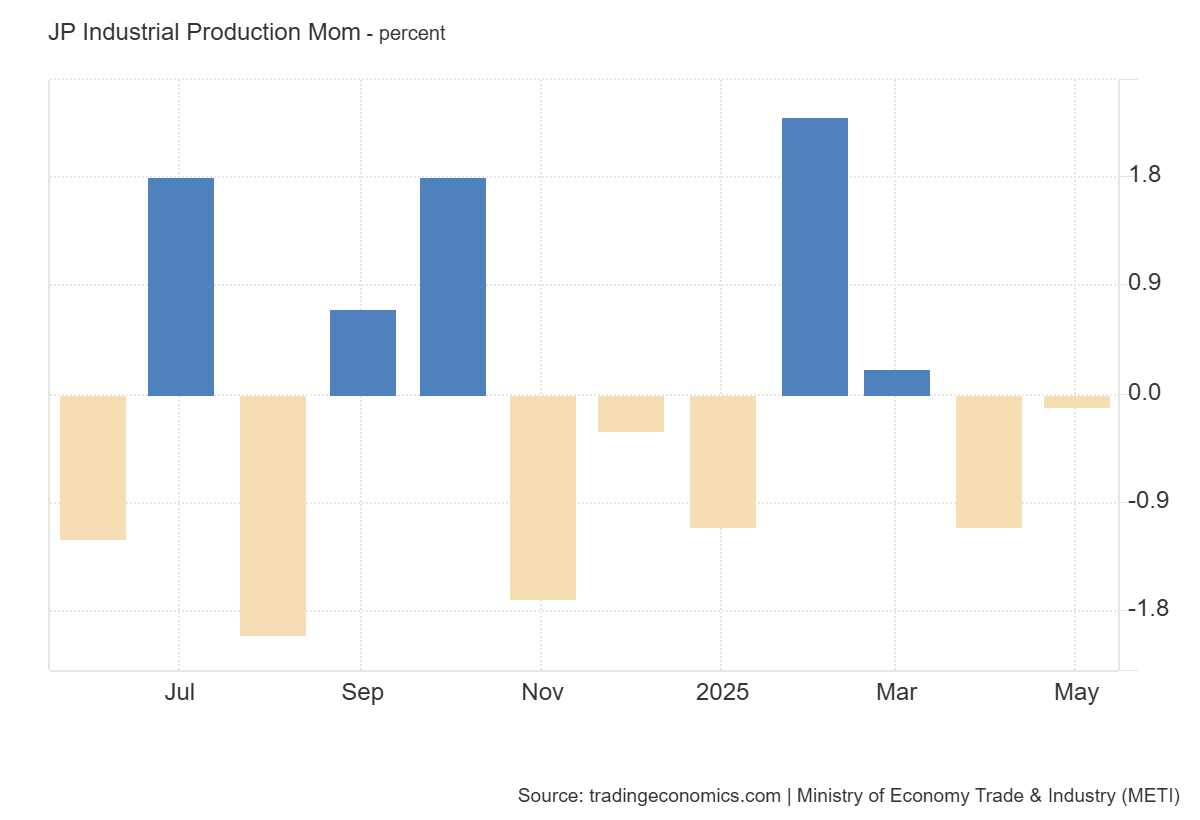

- Recent data: Japan’s industrial production came in at -0.1% in June

- Market impact: this may signal investor caution for Japanese equities and the JP 225 index, especially in sectors closely tied to industrial production and exports

JP 225 fundamental analysis

Japan’s industrial production declined by 0.1% in June, falling short of the expected 0.5% growth. The previous reading stood at -1.1%, so the smaller decline suggests a deceleration in the recovery pace of the industrial sector. These weak figures could exert short-term pressure on stocks from machinery, automotive, electronics, and equipment industries.

However, since the decline is relatively minor and follows an even weaker previous month, investor sentiment might remain moderately optimistic, particularly if signs of accelerating economic growth emerge in the coming months. Overall, the indicator reflects current caution but not a deep downturn, although some short-term volatility is possible.

Japan industrial production MoM: https://tradingeconomics.com/japan/industrial-production-momJP 225 technical analysis

The JP 225 index maintains its upward momentum with a stable trend. The support level has formed at 38,235.0, with resistance at 40,635.0. A correction is underway at the moment, but it is unlikely to develop into a full-fledged downtrend. Currently, there are no market signals indicating a trend reversal.

The following scenarios are considered for the JP 225 price forecast:

- Pessimistic JP 225 scenario: a breakout below the 38,235.0 support level could send the index down to 37,455.0

- Optimistic JP 225 scenario: a breakout above the 40,635.0 resistance level could boost the index to 41,615.0

Summary

Japan’s industrial production fell by 0.1% in June, falling short of the expected 0.5% increase. This could prompt investor caution in sectors like machinery, automotive, electronics, and equipment. However, the JP 225 continues to trade within a channel aligned with an uptrend. The next upside target lies at 41,615.0, and there are currently no signs of a possible trend reversal.