JP 225 forecast: the index enters a sideways channel

The JP 225 stock index is completing a downward correction within a broader uptrend. The JP 225 forecast for today is positive.

JP 225 forecast: key trading points

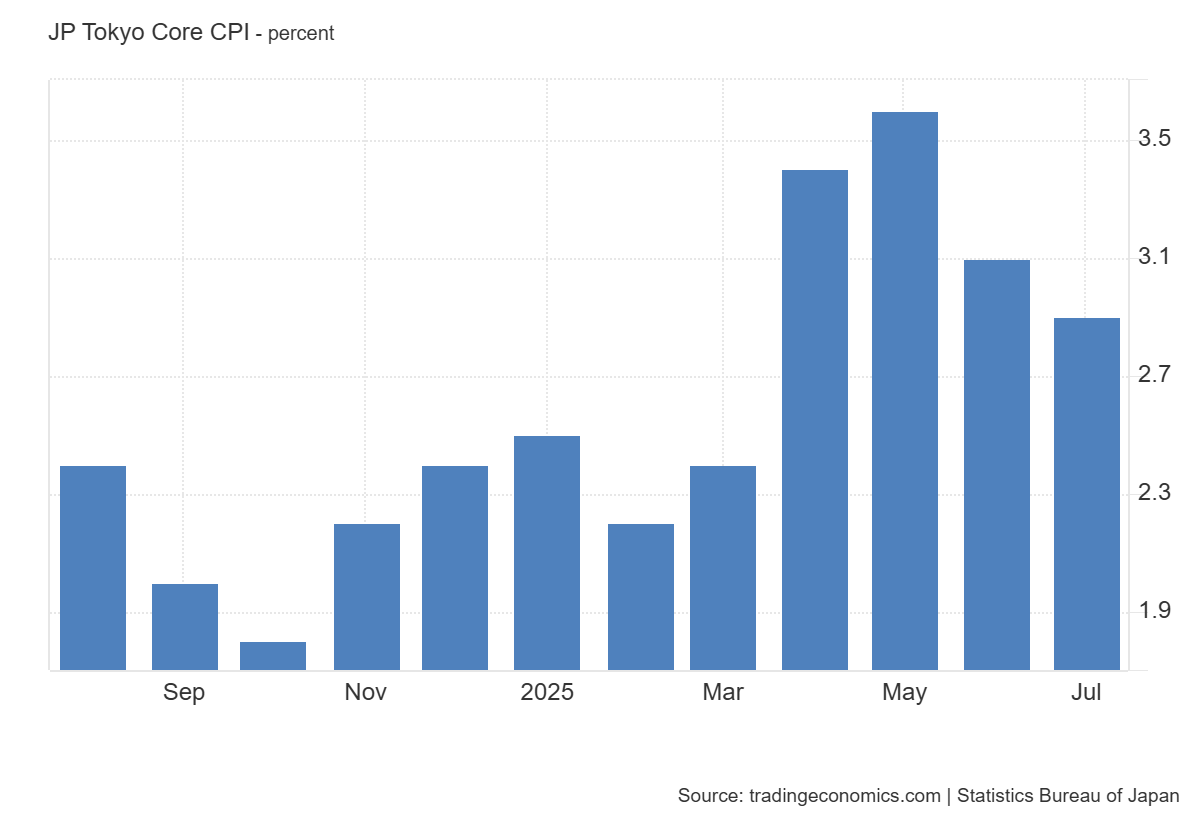

- Recent data: Tokyo core CPI in Japan preliminarily came in at 2.9% year-on-year in July

- Market impact: inflation falling below expectations may positively impact the stock market, as it reduces the likelihood of the Bank of Japan tightening monetary policy

JP 225 fundamental analysis

The Tokyo core CPI reflects inflation dynamics in Tokyo and serves as an important gauge of inflationary trends across Japan’s economy. The current reading of 2.9% is below both the previous value of 3.1% and the forecast of 3.0%. This indicates that inflationary pressure is easing, which could significantly influence the Japanese stock market, including the JP 225 index.

Inflation falling below expectations may boost the stock market as it lowers the likelihood of the Bank of Japan tightening its monetary policy. Investors may interpret this as a sign that the BoJ will continue with a loose monetary stance (low interest rates), which typically supports equities. However, the central bank has previously indicated plans to raise the key rate instead.

JP 225 technical analysis

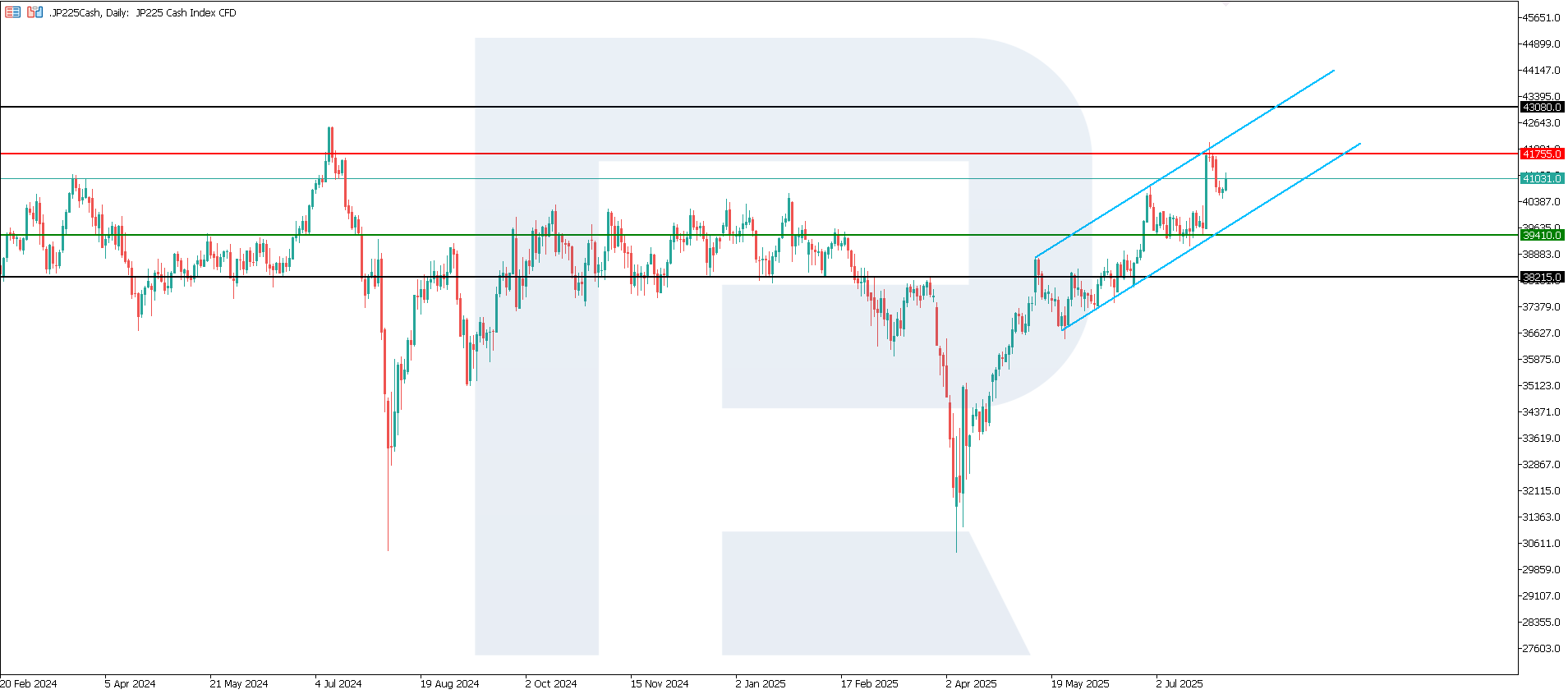

The JP 225 index has entered a downward correction within a broader uptrend. The support level has formed at 39,410.0, with resistance at 41,755.0. At present, there are no signals indicating a trend reversal. Therefore, a move to the all-time high remains likely.

The following scenarios are considered for the JP 225 price forecast:

- Pessimistic JP 225 scenario: a breakout below the 39,410.0 support level could send the index down to 37,455.0

- Optimistic JP 225 scenario: a breakout above the 41,755.0 resistance level could drive the index to 43,080.0

Summary

A moderate slowdown in inflation to a level below forecasts is generally perceived positively by the Japanese equity market, especially for export-oriented and consumer-focused companies. It may support a moderate rise in the JP 225 index in the short term.

The JP 225 index has formed an ascending channel within the ongoing uptrend, with the next upside target at 43,080.0.