JPY falling due to fundamental discrepancies in Fed and BoJ policies

The USDJPY rate declined on Thursday, 27 June 2024, unable to hold at the 38-year high of 160.85 reached on Wednesday.

The Japanese authorities are concerned about a rise in the USDJPY pair

The Japanese authorities expressed concerns about the sharp decline in the yen. The country’s major financial policymaker, Masato Kanda, said they were closely watching the situation and were ready to act. Renowned currency analyst Masafumi Yamamoto warns that the USDJPY rate may rise to 162.00 if the Japanese authorities do not take prompt action to support the national currency.

However, traders are unsure whether the Japanese authorities’ verbal or actual actions can halt the yen’s decline. The yen’s weakness is attributed to investor uncertainty about the pace of Fed interest rate cuts. The opinion is that if the BoJ slightly adjusts its zero-rate policy at the 30-31 July meeting, this will unlikely significantly impact the yen rate.

USDJPY technical analysis

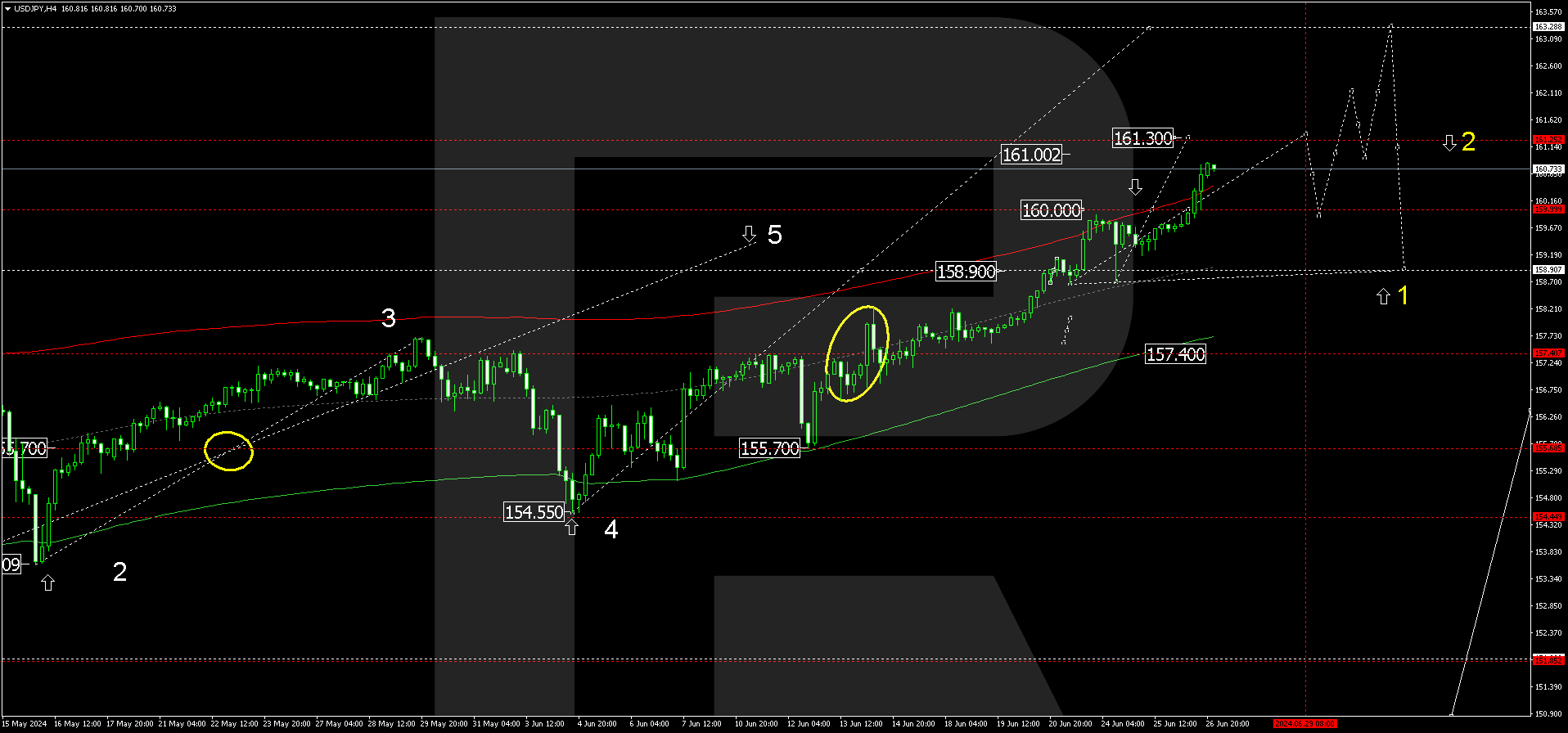

On the USDJPY H4 chart, the market received support at 160.00. Today, 27 June 2024, a rise to 161.30 is possible, followed by a correction to 160.00 (testing from above). Subsequently, the price could rise to 162.00, potentially continuing the uptrend to 163.30. Once this wave is complete, a decline might start, aiming for 158.90 as the first target.

USDJPY technical analysis 27.06.2024

The Elliott Wave structure and a wave matrix with a 158.90 pivot point technically confirm this USDJPY scenario. The market has received support at the Envelope’s central line and continues growth to its upper boundary. A decline wave is expected from the 161.30 level to the Envelope’s centre at 160.00. Subsequently, a consolidation range could form around this level. With an upward breakout, the growth wave might expand to 163.30. A decline wave aiming for the Envelope’s lower boundary is expected only after the price reaches this level.

Summary

The decline in the yen is caused by a difference in the US and Japan’s monetary policies; the authorities are monitoring the situation and are prepared to intervene immediately if necessary. The USDJPY technical analysis suggests the expansion of the growth wave towards 163.30 with a subsequent downtrend towards the 158.90 and 157.40 targets.