JPY finds temporary support but remains under pressure

The Japanese yen stabilised around 158.15 per US dollar but remains under pressure due to the interest rate differential between the Japanese and US central banks.

"Weak" yen boosts exports and tourism

Japan’s tourism sector has shown resilience, thriving with over 3 million visitors for the third consecutive month. Tourist arrivals increased significantly by 60% compared with May 2022, surpassing the 2019 record by 9.6%. The weak yen appears to be pivotal in maintaining record inbound tourism rates.

Bank of Japan Governor Kazuo Ueda is not ruling out raising interest rates in July if the available economic data supports this. He expressed concern about the potential negative impact of higher import costs on household spending due to the weak yen but also noted that rising wages could stimulate consumption.

While the Bank of Japan is considering a potential monetary tightening soon, investors believe it will proceed cautiously and gradually.

USDJPY technical analysis

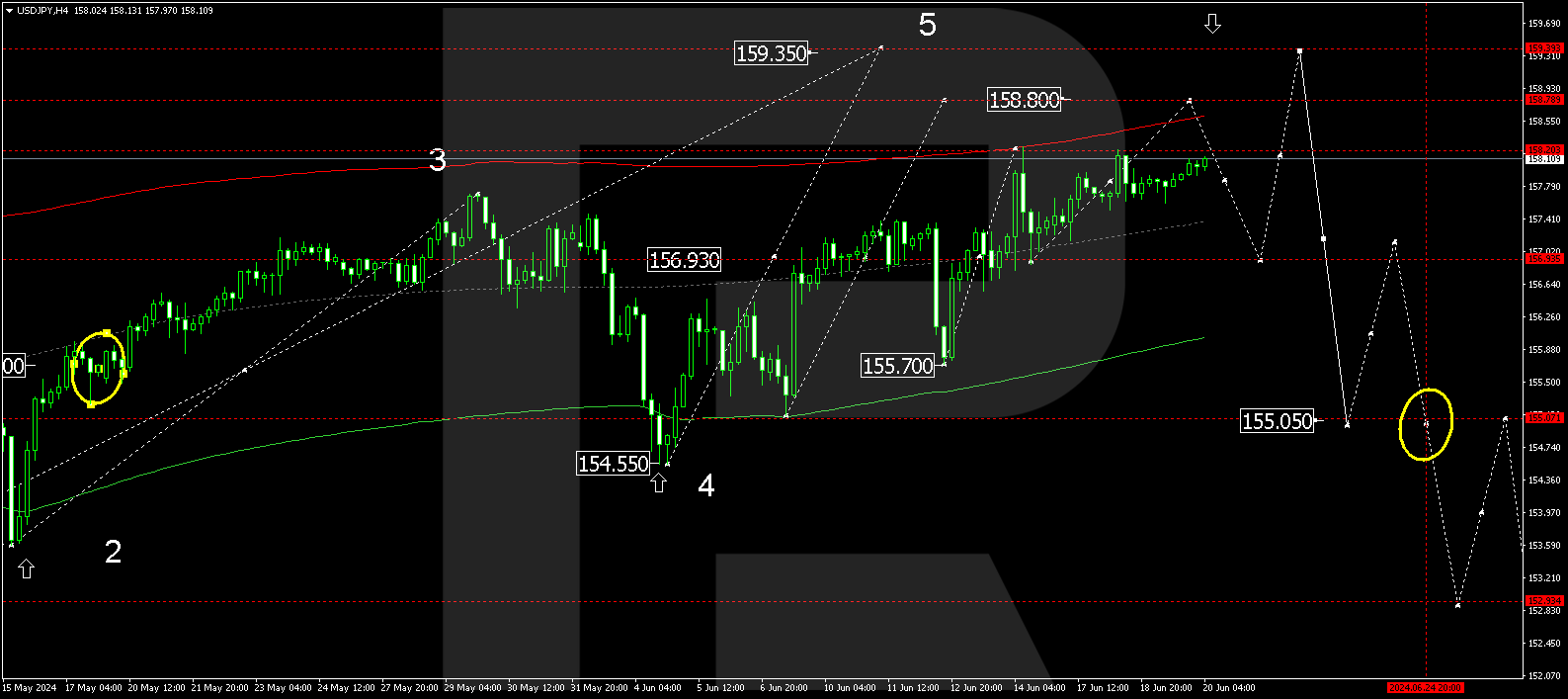

On the USDJPY H4 chart, the fifth corrective wave continues to develop, with a target at 159.35. A consolidation range has formed around 156.93, a crucial development for today’s USDJPY forecast. The range extended upwards to 158.22. Today, 20 June 2024, a rise to 158.80 is expected, potentially followed by a decline to 156.93 (testing from above). Subsequently, the price might increase to 159.35, representing the main target for correction. Once it reaches this level, a decline wave could begin, aiming for 155.50.

USDJPY technical analysis 20.06.2024

This USDJPY rate scenario is technically confirmed by the Elliott Wave structure and a wave matrix with a pivot point at 155.70. The market has declined to the Envelope’s lower boundary at 154.55 and is forming a growth structure, aiming for its upper boundary. The price is expected to touch the Envelope’s upper boundary at 158.80 again and technically return to its centre, 156.93. Following this, another growth wave structure might start, targeting 159.35.

Summary

The Bank of Japan may tighten monetary policy in the near term, which might increase the yen rate. The USDJPY technical analysis points to a potential further corrective wave towards 159.35, with onward decline targets at 155.05 and 152.93.