The USDJPY pair is close to 38-year highs. The market doubts the Bank of Japan taking decisive action at its July meeting.

USDJPY trading key points

- The US Federal Reserve is gathering data to lower interest rates

- The Bank of Japan is expected to decide on reducing bond purchases

- USDJPY price targets: 161.83, 162.00

Fundamental analysis

The Japanese yen is falling again, nearly reaching another 38-year low. On Wednesday, the USDJPY pair rose to 161.42.

This happened after US Federal Reserve Chair Jerome Powell confirmed maintaining a cautious monetary policy approach. The monetary policymaker delivered a speech to Congress yesterday, and a second one is due today.

Powell noted that the Federal Reserve needed more data to strengthen confidence that inflation is falling to the 2% target. The economy and the employment market show signs of cooling, which is another reason to lower the rate.

The yen is also declining ahead of the upcoming Bank of Japan meeting. Although there is little faith that the central bank will take decisive fiscal action, an interest rate hike remains likely. The main expectation this time is statements on the reduction of bond purchases by the Bank of Japan. This step would mark the first actual action towards normalising monetary policy. The weak yen increases inflation risks, which leads to rising import costs, among other things. This is an issue the Bank of Japan needs to address.

USDJPY technical analysis

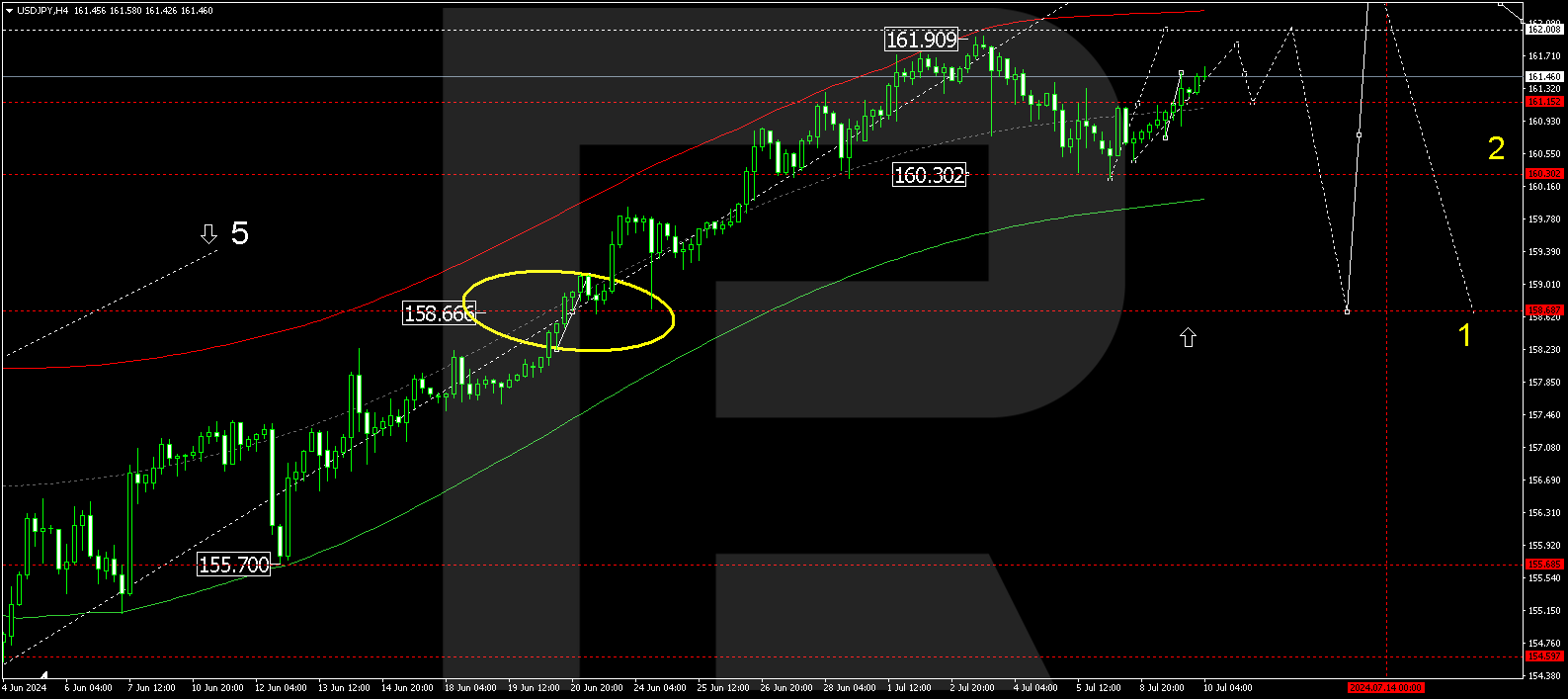

On the USDJPY H4 chart, a consolidation range is developing around 161.15. Today, 10 July 2024, the price might rise to 161.83, then decline to 161.15 (testing from above). Subsequently, a rise to 162.00 is expected. Once the price reaches this level, a new decline wave could start, aiming for 160.30 as the first target.

Summary

The Japanese yen is falling to another 38-year low. Technical analysis for today’s USDJPY forecast suggests growth to the 161.83 and 162.00 targets.