The USDJPY rate is declining ahead of Friday’s US nonfarm payrolls report.

USDJPY trading key points

- The Federal Reserve’s June meeting minutes confirm US economic slowdown

- The likelihood of a Federal Reserve interest rate cut in September increased to 68% from 56%

- Traders are awaiting the release of Friday’s US nonfarm payrolls report

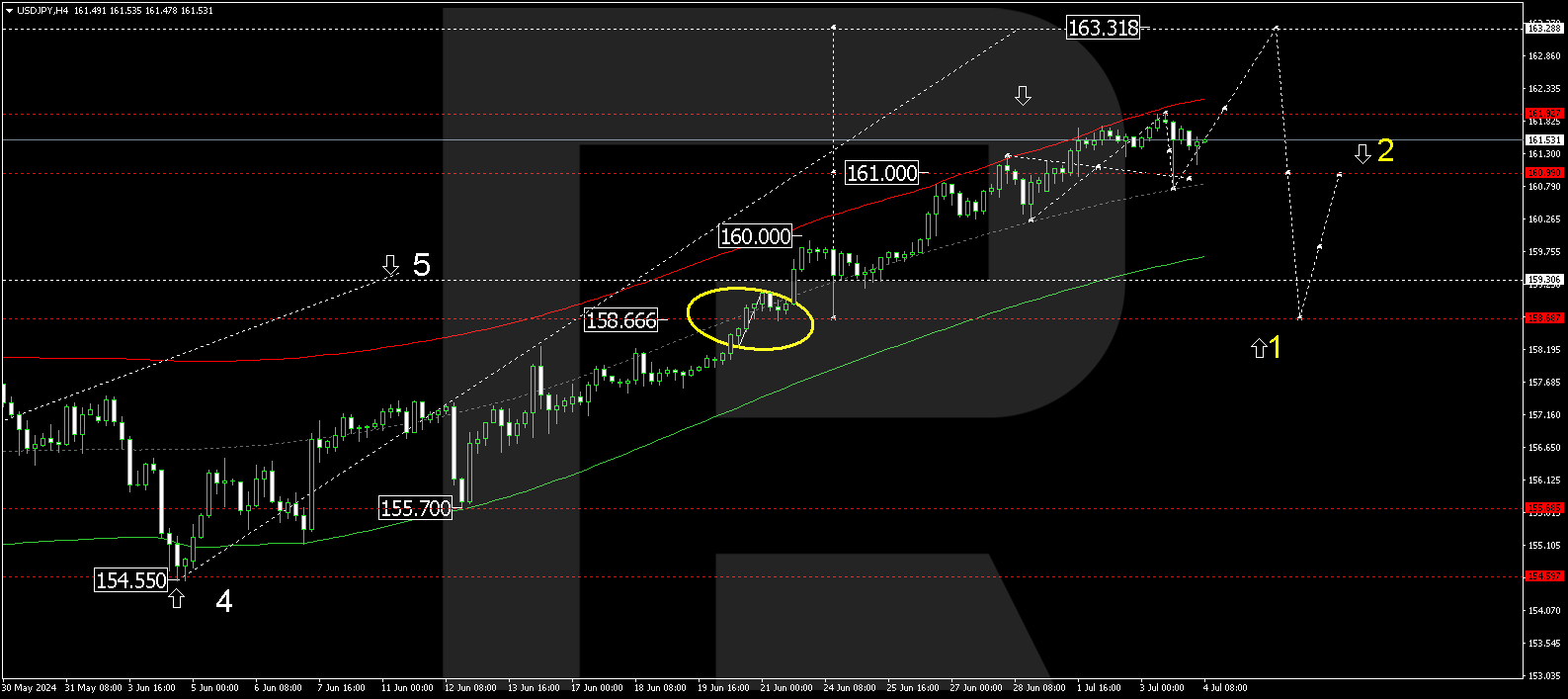

- USDJPY targets: 163.30, 158.90, 157.40

USDJPY fundamental analysis

The US dollar declines on Thursday, influenced by weak economic indicators. Investors believe there is a gradual turn in the flow of US economic data, and the Federal Reserve’s June meeting minutes confirm economic slowdown and easing inflationary pressure. Market expectations about a potential Federal Reserve interest rate cut in September rose to 68% from 56% a week earlier.

Traders may adjust positions in anticipation of Friday’s US nonfarm payrolls report, a key indicator for assessing the economy’s state. This may be the primary reason behind the USDJPY pair’s current decline.

Overall, investors continue to monitor the JPY closely, considering the possibility of a currency intervention by the Japanese government. However, Japan’s Ministry of Finance stated that the goal of a potential intervention will not be the yen rate but its excessive volatility. Current market conditions do not meet the criteria for Japanese authorities to intervene.

USDJPY technical analysis

On the H4 chart, USDJPY has corrected to 160.77. Today, 4 July 2024, a new growth structure could start, aiming for 162.00. Breaking above this level will open the potential for a growth wave towards 163.30, representing the wave’s main target. A decline wave might develop after the price reaches this target, aiming for 161.00.

Summary

The US dollar is under pressure due to concerns about US economic slowdown. Technical analysis for today’s USDJPY forecast suggests the completion of the growth wave at the 163.30 level, followed by a correction towards the 161.00, 158.90, and 157.40 targets.