USDJPY, “US Dollar vs Japanese Yen”

On H4, the quotes are under the 200-day Moving Average, which indicates prevalence of a downtrend. The RSI has bounced off the resistance line. As a result, 3/8 (129.68) is expected to be broken away, after which the quotes should fall to the support level of 2/8 (128.12). The scenario can be cancelled by rising over the resistance level of 4/8 (131.25), which might lead to a trend reversal and growth to 5/8 (132.81).

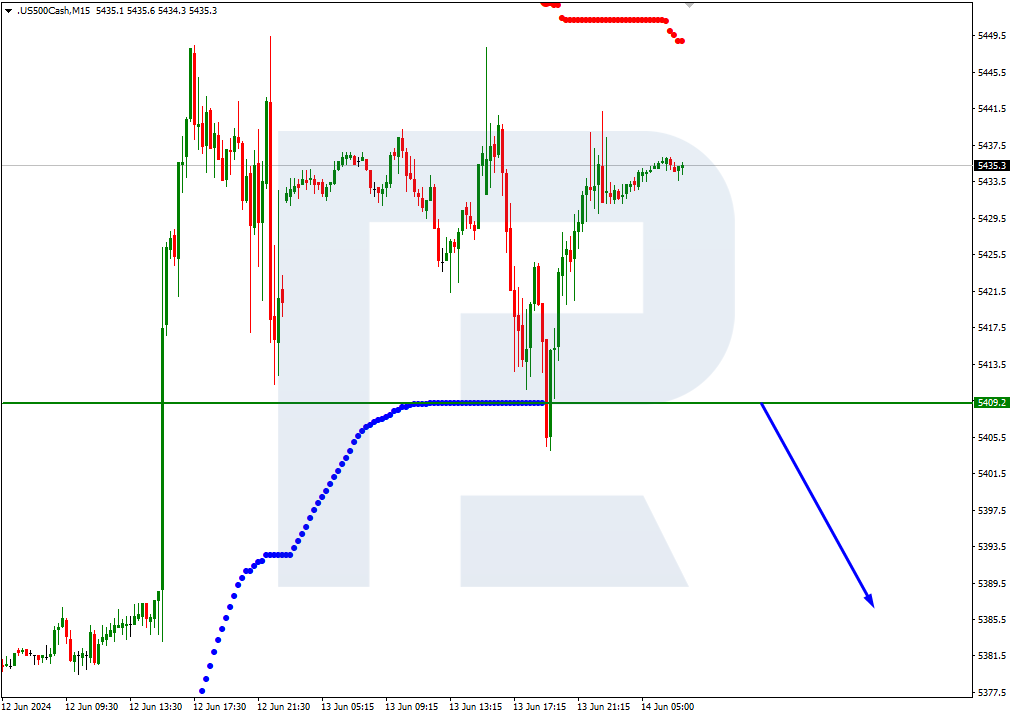

On M15, a new breakaway of the lower border of VoltyChannel will increase the probability of further decline of the price.

USDCAD, “US Dollar vs Canadian Dollar”

On H4, the quotes are under the 200-day Moving Average, which indicates prevalence of a downtrend. The RSI has bounced off the support line. As a result, we should expect a downward breakaway of 2/8 (1.3305) and further falling to the support level of 0/8 (1.3183). The scenario can be cancelled by rising above 3/8 (1.3366), after which the pair may rise to 4/8 (1.3427).

On M15, the lower line of VoltyChannel is broken away. This indicates presence of a downtrend and a high probability of further falling of the price.