USDJPY, “US Dollar vs Japanese Yen”

USDJPY quotes are above the 200-day Moving Average on H4, indicating a prevailing uptrend. However, the RSI has reached the overbought area. As a result, in this situation, the quotes are expected to break the 5/8 (150.78) level downwards and fall to the support at 4/8 (150.00). The scenario can be cancelled by rising above 6/8 (151.56). In this case, the pair could reach 7/8 (152.34).

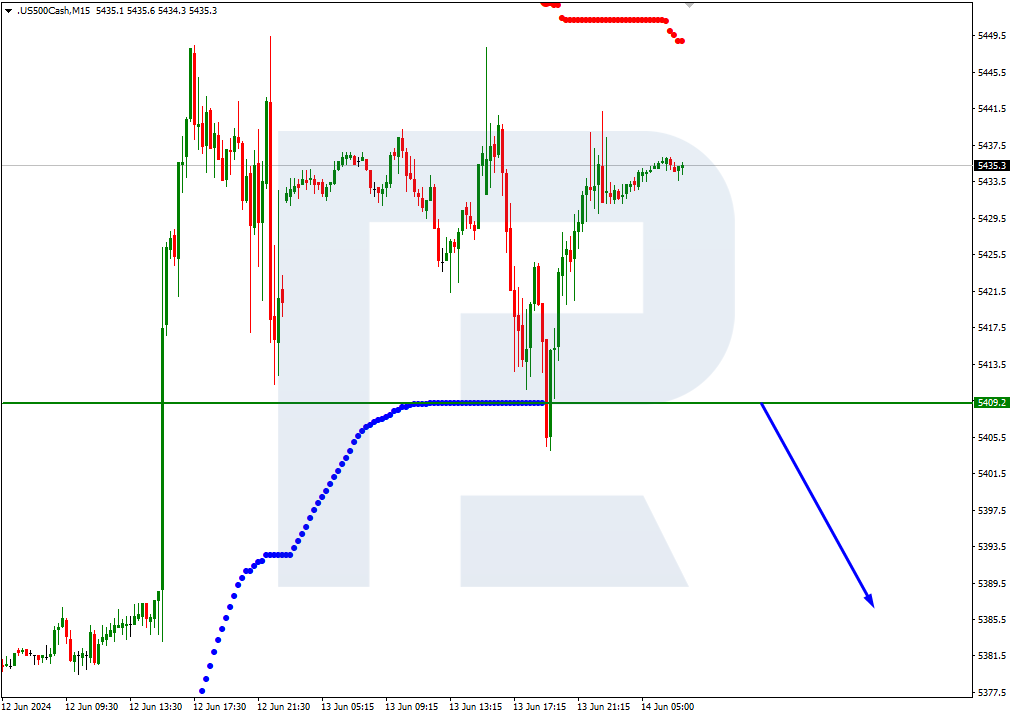

On M15, the decline could be additionally supported by a breakout of the lower boundary of the VoltyChannel.

USDCAD, “US Dollar vs Canadian Dollar”

USDCAD quotes are in the overbought area on H4 with the RSI approaching the overbought area. In this situation, the price is expected to test the +2/8 (1.3916) level, rebound from it, and fall to the support at +1/8 (1.3793). The scenario can be cancelled by rising above +2/8 (1.3916), which will reshuffle the Murrey lines and set new price targets.

On M15, the lower boundary of the VoltyChannel is too far away from the current price, so the price decline could be supported by a rebound from the +2/8 (1.3916) level on H4.