BRENT

On H4, the quotes are under the 200-day Moving Average, which indicates the prevalence of a downtrend. The RSI has broken through the ascending trendline downwards. Hence, we should expect a test of 3/8 (84.38), a breakaway of it, and falling to the support level of 2/8 (81.25). The scenario can be cancelled by rising over the resistance level of 4/8 (87.50). In this case, the quotes may rise to 5/8 (90.62).

On M15, further decline of the price can be signaled by a breakaway of the lower line of VoltyChannel.

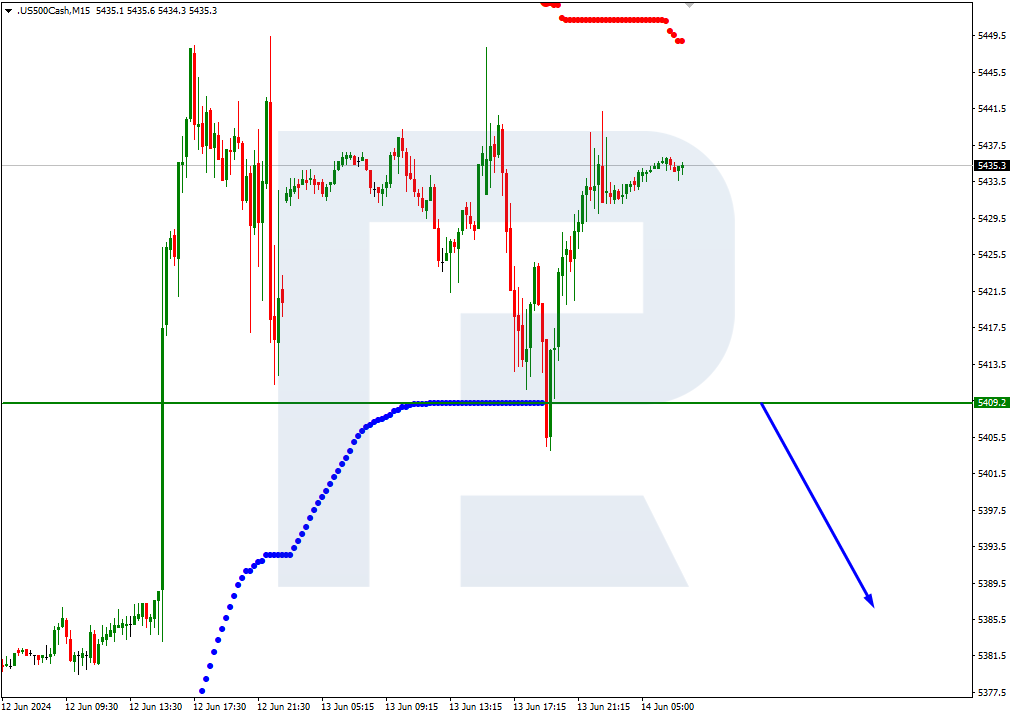

S&P 500

On H4, the quotes have broken through the 200-day Moving Average and rest above it, which indicates possible development of an uptrend. The RSI has bounced off the ascending trendline and continues going upwards. Hence, we should expect further growth of the quotes to the nearest resistance level of 3/8 (4218.8). The scenario can be cancelled by a downwards breakaway of the support level of 2/8 (4062.5). This might entail further falling of the quotes to 1/8 (3906.2).

On M15, the upper line of VoltyChannel is broken away, which increases the probability of price growth to 3/8 (4218.8) on H4.