USDJPY, “US Dollar vs. Japanese Yen”

As we can see in the H4 chart, USDJPY is trading inside the “overbought zone”. In this case, it is expected to resume falling to reach the 8/8 level.

In the H1 chart, the price may break the 3/8 level and then continue falling towards the support at the 0/8 one.

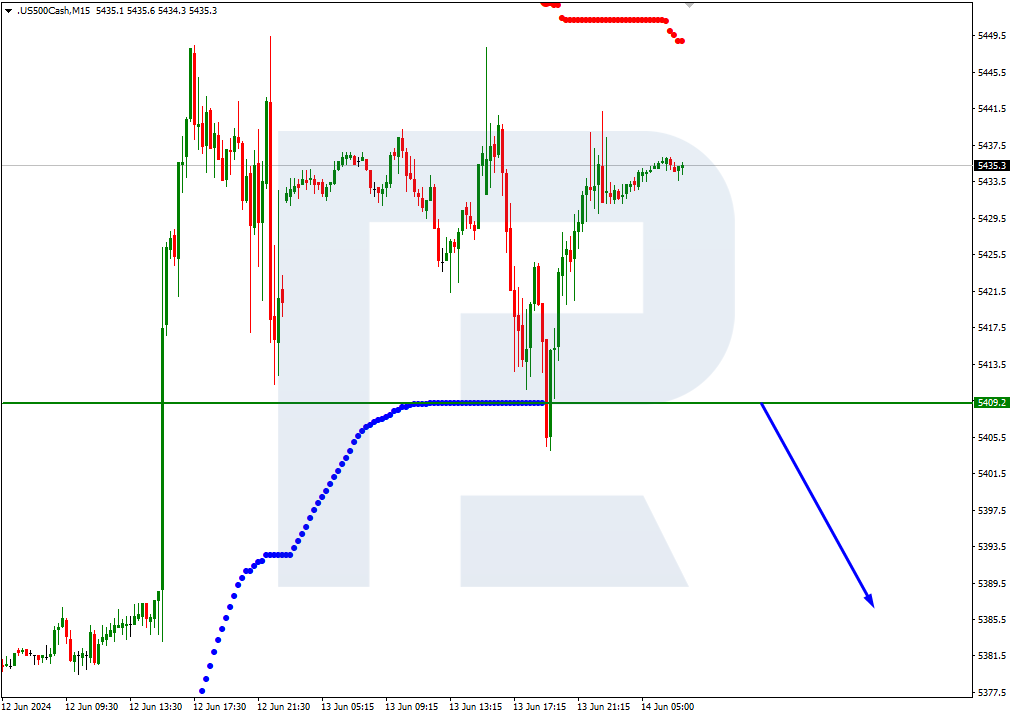

As we can see in the M15 chart, the pair has broken the downside line of the VoltyChannel indicator and, as a result, may continue moving downwards.

USDCAD, “US Dollar vs Canadian Dollar”

In the H4 chart, USDCAD is trading below the 3/8 level. In this case, the price is expected to fall towards the support at the 0/8 level.

As we can see in the H1 chart, the price is trading at the 0/8 level. If the pair rebounds from this level, the instrument may start a new correction to the upside to reach the resistance at the 3/8 one, which may later be followed by another decline.