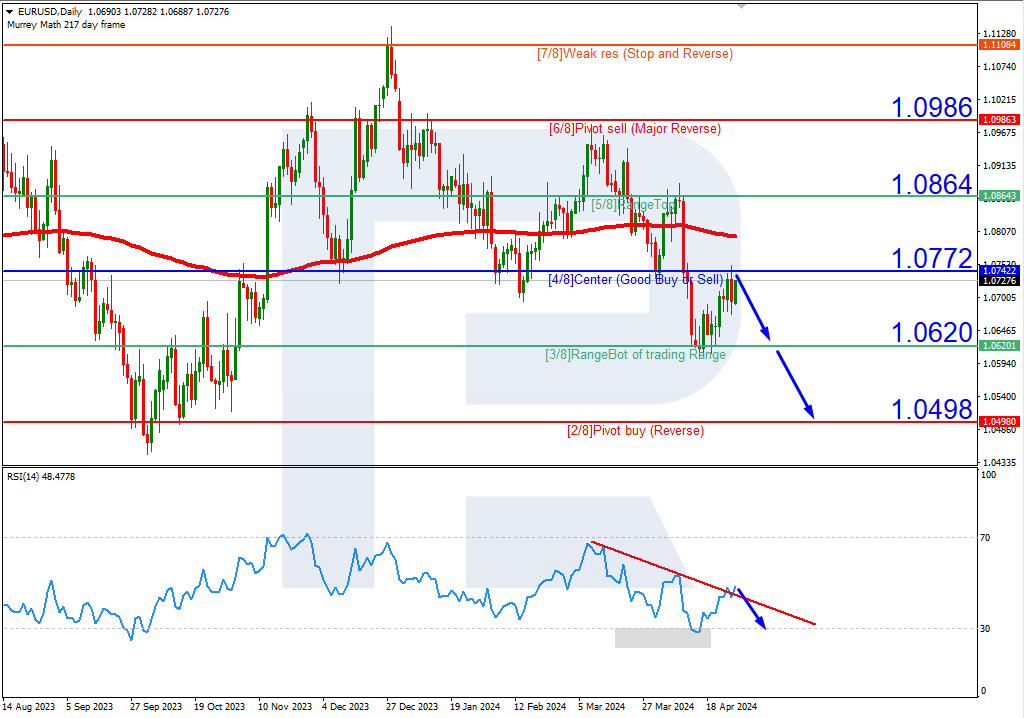

USDCHF, “US Dollar vs Swiss Franc”

As we can see in the H4 chart, USDCHF is trading below the 200-day Moving Average, thus indicating a descending tendency. In this case, the price is expected to test 5/8, break it, and then continue falling to reach the support at 4/8. However, this scenario may be cancelled if the price breaks the resistance at 6/8 to the upside. After that, the instrument may continue growing towards 7/8.

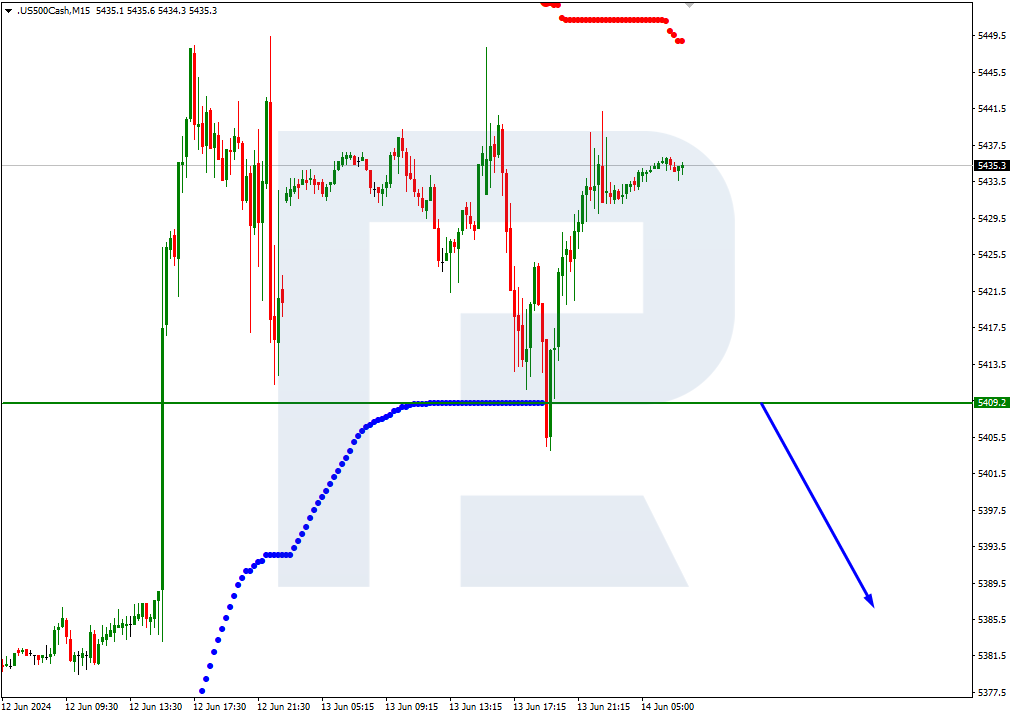

In the M15 chart, the pair may break the downside line of the VoltyChannel indicator and, as a result, continue trading downwards.

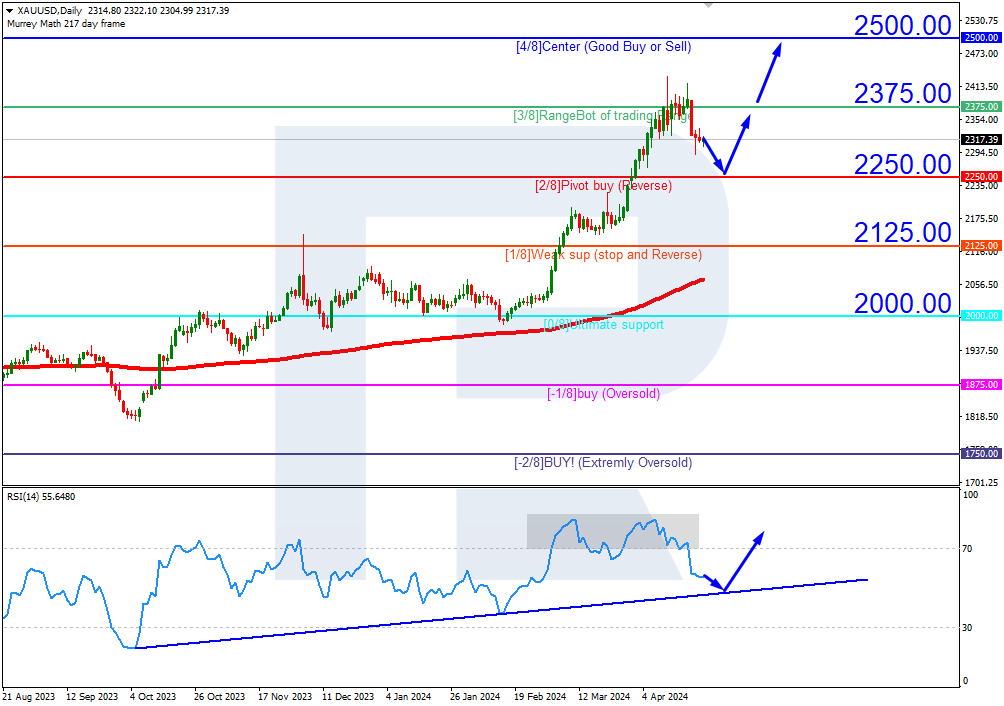

XAUUSD, “Gold vs US Dollar”

In the H4 chart, after breaking the 200-day Moving Average, XAUUSD is trading below it, thus indicating a descending tendency. In this case, the price is expected to test 1/8, break it, and then continue moving downwards to reach the support at 0/8. However, this scenario may no longer be valid if the price breaks 2/8 to the upside. After that, the instrument may reverse and grow towards the resistance at 3/8.

As we can see in the M15 chart, the pair has broken the downside line of the VoltyChannel indicator and, as a result, may continue its decline.