USDCHF, “US Dollar vs Swiss Franc”

On H4, the quotes are under the 200-day Moving Average, which indicates the prevalence of a downtrend. The RSI has rebounded from the resistance line. In this situation, a further price fall to the nearest support at 0/8 (0.8789) is expected. The scenario can be cancelled by rising above the resistance at 2/8 (0.9033). In this case, the pair could correct to 3/8 (0.9155).

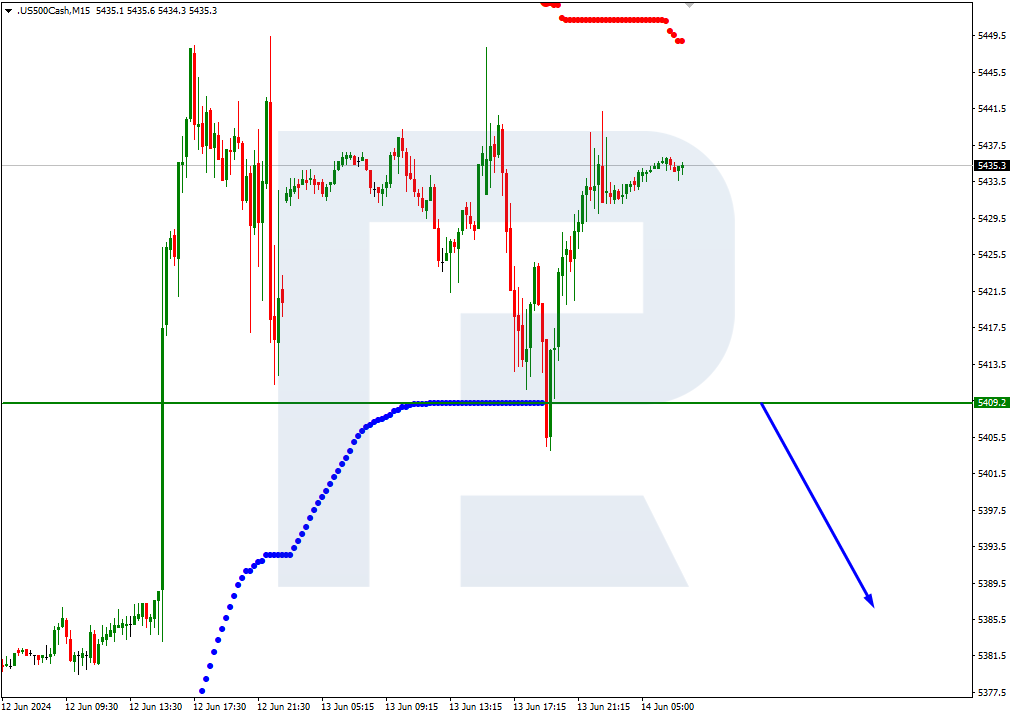

On M15, a breakout of the lower border of the VoltyChannel indicator could serve as an additional signal confirming the drop.

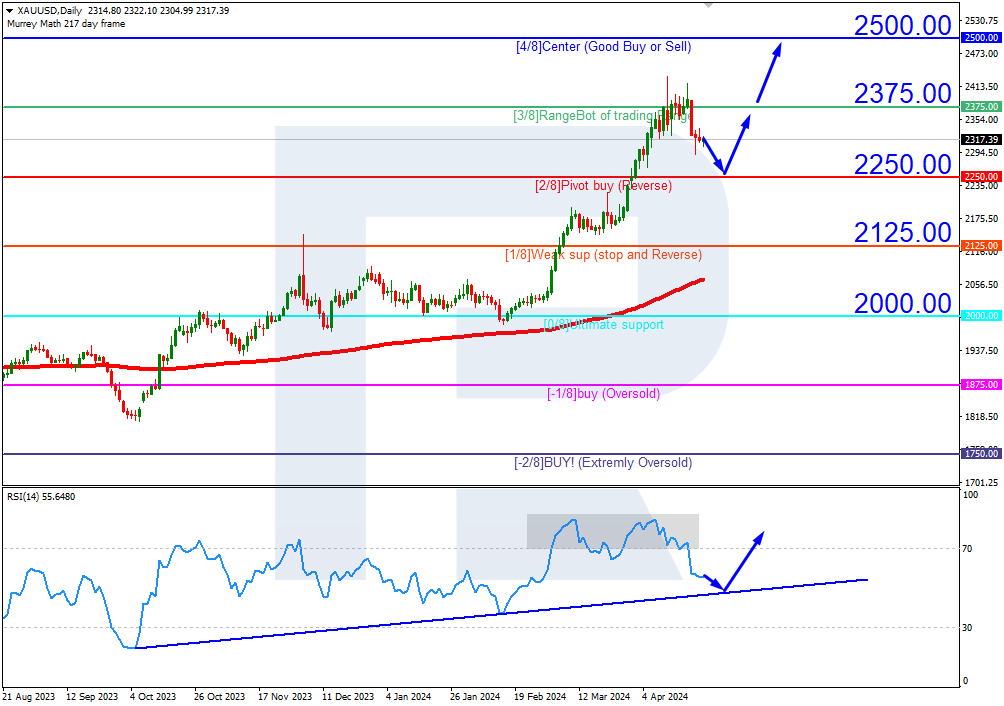

XAUUSD, “Gold vs US Dollar”

On H4, gold quotes are above the 200-day Moving Average, which reveals the prevalence of an uptrend. However, the RSI has reached the overbought area. As a result, in these circumstances, a breakout of 5/8 (2031.25) is expected, followed by a decline to the support level of 4/8 (2000.00). The scenario can be cancelled by rising above the resistance at 6/8 (2062.50). In this case, the quotes could rise to 7/8 (2093.75).

On M15, a breakout of the lower border of the VoltyChannel will increase the probability of a decline to 4/8 (2000.00) on H4.