AUDUSD, “Australian Dollar vs US Dollar”

On H4, the quotes are under the 200-day Moving Average, indicating the prevalence of a downtrend. The RSI is testing the resistance line. In this situation, a downward breakout of 5/8 (0.6652) is expected, after which the price could drop to the support at 4/8 (0.6591). The scenario can be canceled if the quotes rise above the resistance at 6/8 (0.6713), which can lead to a trend reversal and growth of the pair to 7/8 (0.6774).

On M15, the decline in the price can be additionally supported by a breakaway of the lower line of the VoltyChannel indicator.

NZDUSD, “New Zealand Dollar vs US Dollar”

On the NZDUSD chart, the situation is similar. On H4, the quotes are under the 200-day Moving Average, revealing the prevalence of a downtrend, and the RSI is testing the resistance line. In these circumstances, a downwards breakout of 4/8 (0.6225) is to be expected, after which the price could fall to the support at 2/8 (0.6164). The scenario can be canceled by the price rising above the resistance at 5/8 (0.6256), which can end up in a trend reversal and growth of the pair to 7/8 (0.6317).

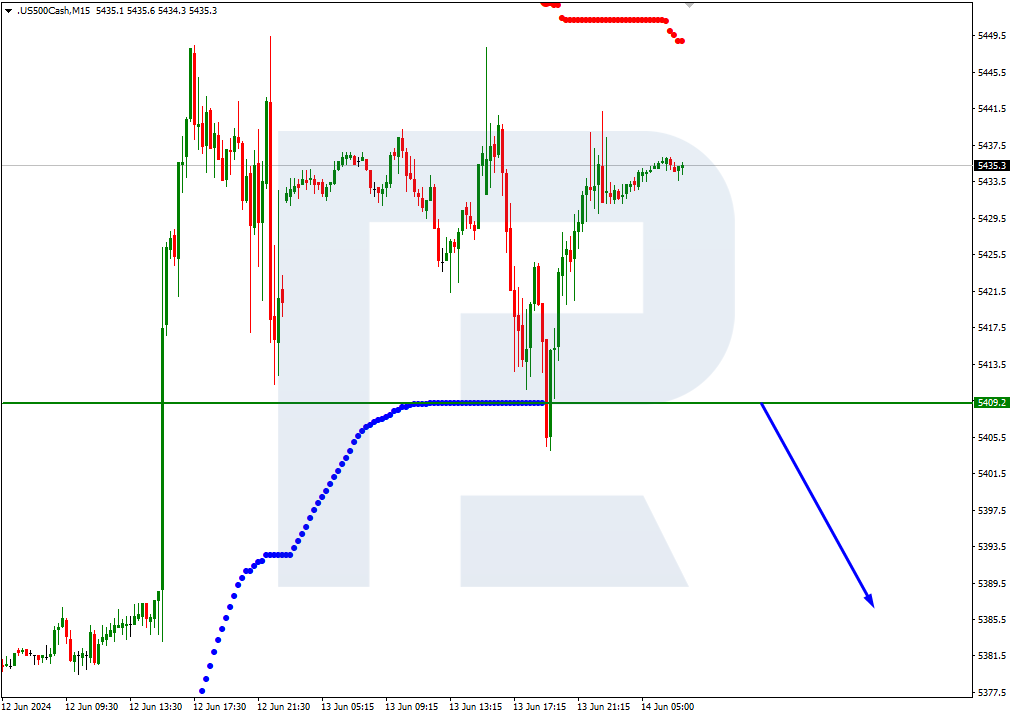

On M15, the lower line of VoltyChannel is broken, which confirms the downtrend and increases the probability of further price falling.