BRENT

On H4, the quotations are trading above the 200-days Moving Average, which indicates an uptrend. Currently, we expect a test of 5/8, a breakaway through it, and growth to the resistance level of 7/8. The scenario can be canceled by a breakaway of 4/8 downwards. This can lead to a trend reversal and falling to the support level of 3/8.

On M15, the price growth can be confirmed by a breakaway of the upper line of VoltyChannel.

S&P 500

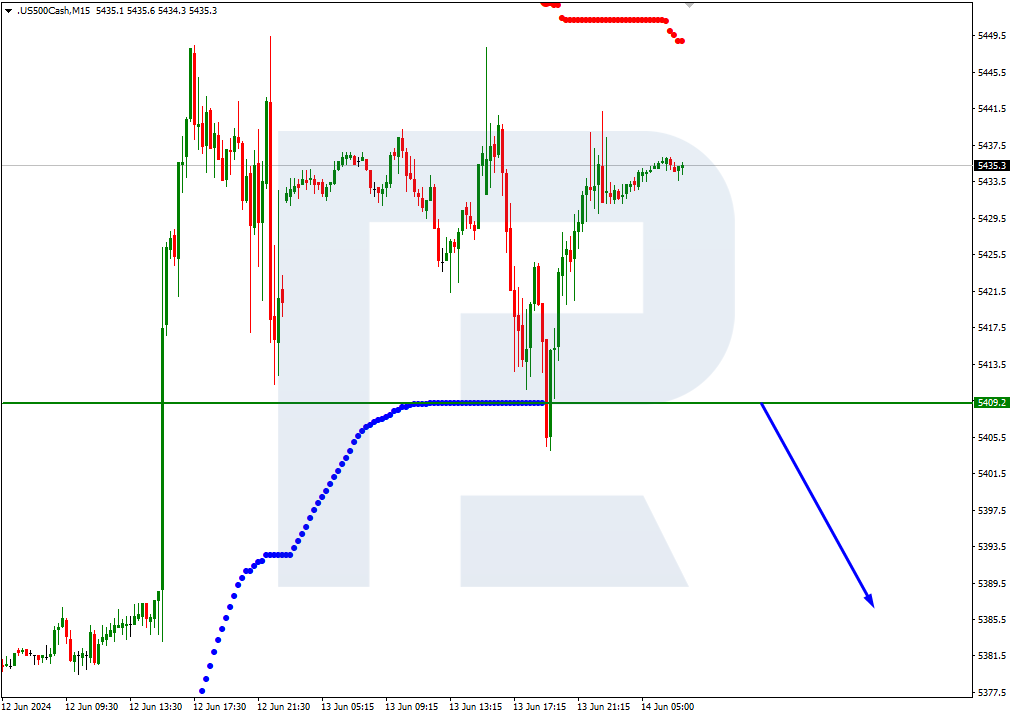

On H4, the quotations are trading above the 200-days Moving Average, which indicates an uptrend. However, there is currently a correction on the chart that can lead to falling to the support level of 3/8. Hence, we expect a test of 3/8, a bounce off it, and growth to the resistance level of 4/8. This scenario can be canceled by a breakaway of 3/8 downwards. In this case, the quotations will go on falling and can reach the support level of 2/8.

On M15, a bounce off the upper border of VoltyChannel will make growth to 4/8n on H4 more probable.