USDJPY, “US Dollar vs. Japanese Yen”

In the H4 chart, after breaking the 200-day Moving Average, USDJPY is trading above it, thus indicating a possible ascending tendency. In this case, the price is expected to test 4/8, break it, and continue growing to reach the resistance at 5/8. However, this scenario may no longer be valid if the price breaks 3/8 to the downside. After that, the instrument may reverse and fall towards the support at 2/8.

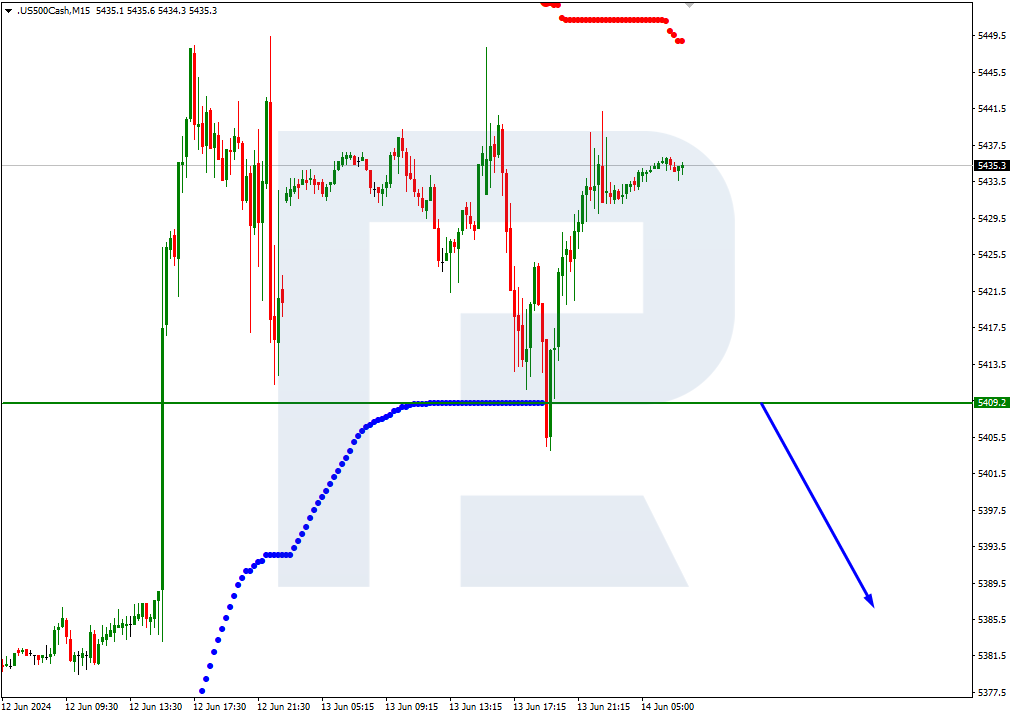

As we can see in the M15 chart, the pair has broken the upside line of the VoltyChannel indicator and, as a result, continue growing.

USDCAD, “US Dollar vs Canadian Dollar”

As we can see in the H4 chart, USDCAD is trading within the “overbought area”. In this case, the price is expected to test +1/8, break it, and continue falling towards the support at 8/8. Still, this scenario may no longer be valid if the price breaks the resistance at +2/8 to the upside. After that, the lines in the chart will be redrawn, thus helping us to define new upside targets.

In the M15 chart, the pair may break the downside line of the VoltyChannel indicator and, as a result, continue trading downwards.