Brent

Crude oil quotes are above the 200-day Moving Average on H4, which reveals the prevalence of an uptrend. The RSI is testing the resistance line. In this situation, the quotes are expected to rise above 3/8 (84.38), later reaching the resistance level of 4/8 (87.50). The scenario can be cancelled by a downward breakout of the support at 2/8 (81.25), which could lead to a trend reversal and a price drop to 1/8 (78.12).

On M15, an additional signal confirming the rise might be a breakout of the upper boundary of the VoltyChannel.

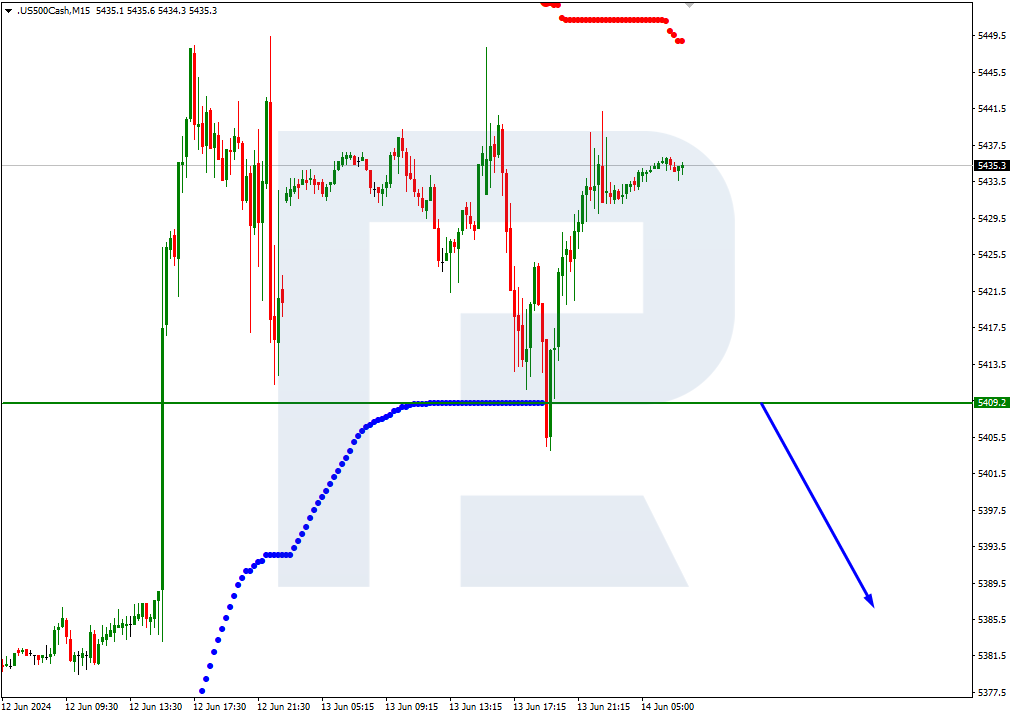

S&P 500

The stock index quotes and the RSI are in their corresponding oversold areas on H4. In this case, the quotes are expected to rise above 0/8 (4375.9), later reaching the resistance level of 1/8 (4414.1). The scenario can be cancelled by a downward breakout of the support at -1/8 (4335.9). In this case, the S&P 500 might drop to -2/8 (4296.9).

On M15, the upper boundary of the VoltyChannel is too far away from the current price, which means price growth can only be indicated by an upward breakout of 0/8 (4375.9) on H4.