USDJPY, “US Dollar vs. Japanese Yen”

On H4, USDJPY is traded above the consolidation area. We are expecting a breakout of 6/8 and further growth to the resistance at 7/8. The scenario may be canceled by a breakout of 5/8, which may let the quotations decline to the support at 3/8.

On M15, the upper line of the VoltyChannel is broken out. This confirms the probability of further growth to 7/8 from H4.

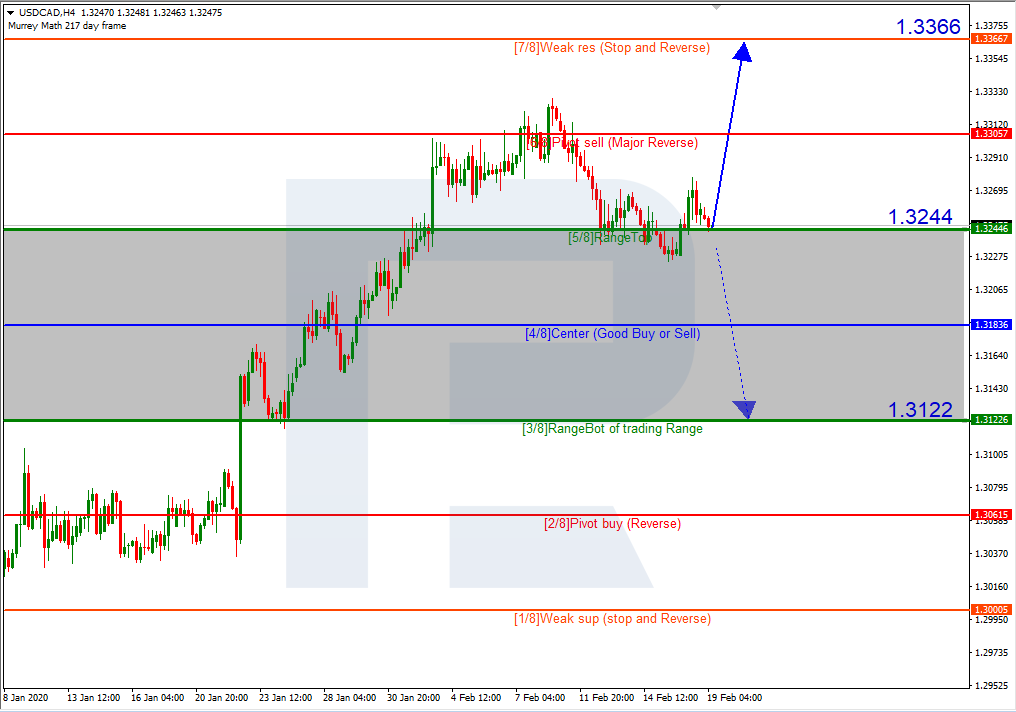

USDCAD, “US Dollar vs Canadian Dollar”

On H4, the pair is traded at 5/8. Currently, if the price pushes off this level, the quotations will grow to 7/8. However, a breakout of this level may lead to a decline to the support level of 3/8. At the moment we cannot be sure in which direction the price will be moving, so we need to switch to M15 and analyze further.

On M15, the price rests between the upper and lower lines of the VoltyChannel indicator, which also makes the future movement unpredictable. In this situation, a breakout of the upper line of the indicator will signify growth to 7/8 from H4. Respectively, a breakout of the lower line of the indicator will lead to a decline to 3/8 from H4. Hence, we need to wait for a breakout on VoltyChannel to be sure in which direction the price will go.