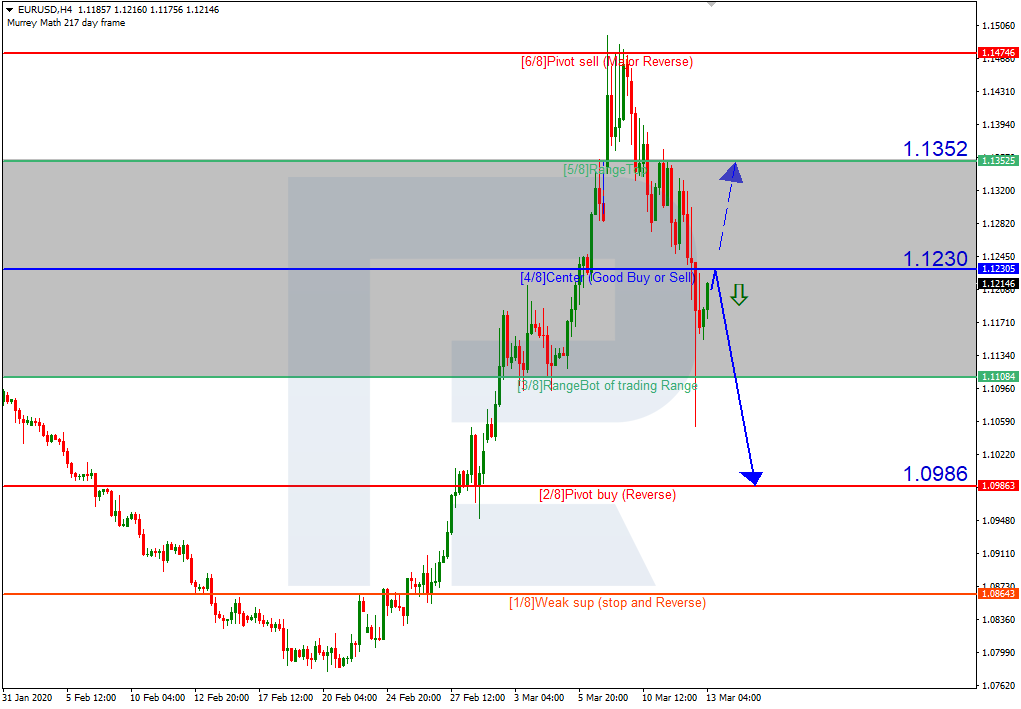

EUR USD, “Euro vs. US Dollar”

As we can see at the H4 chart, the EUR/USD pair has entered the consolidation range between the 3/8 and 5/8 levels, just as expected. At the moment, there are two possible scenarios and each of them says that the price may move upwards. According to the first one, the pair is expected to rebound from the 4/8 level (1.1718) and grow towards the resistance at 8/8 one (1.1962). The second scenario suggests that the instrument may fall to rebound from the 3/8 level (1.1657) first and then resume trading to the upside to reach the 8/8 one at 1.1962.

The lines at the H4 and H1 charts are completely the same. So, we should follow the pair to see which level it rebounds from before moving upwards to reach 1.1962.

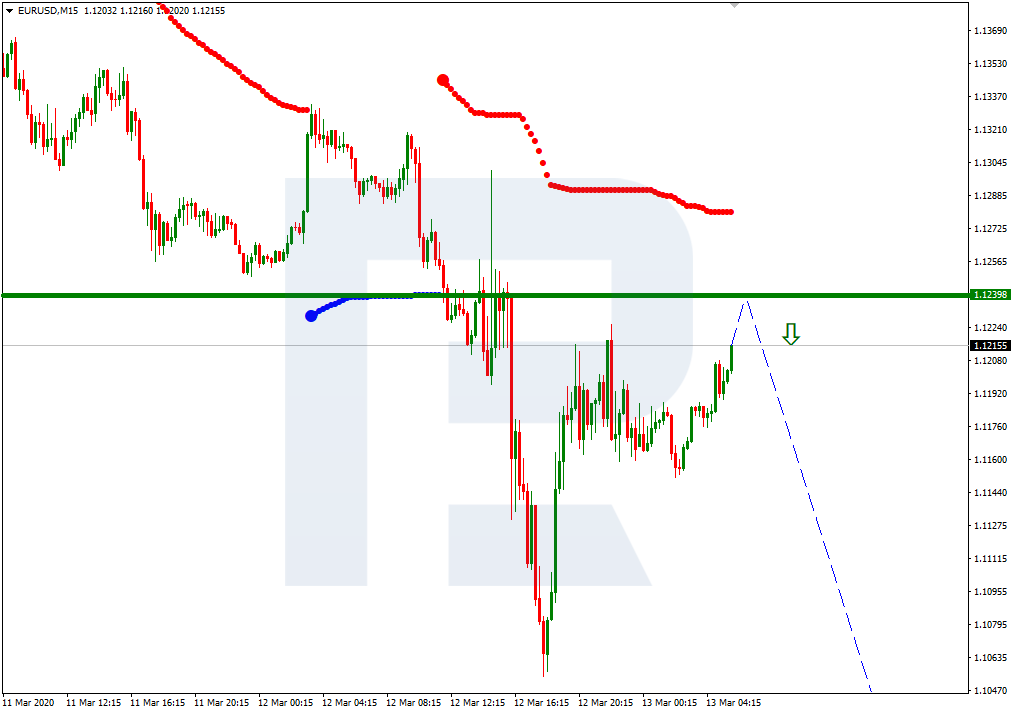

At the M15 chart, the pair may break the upside line of the VoltyChannel indicator and, as a result, continue trading to the upside and reach 1.1962.

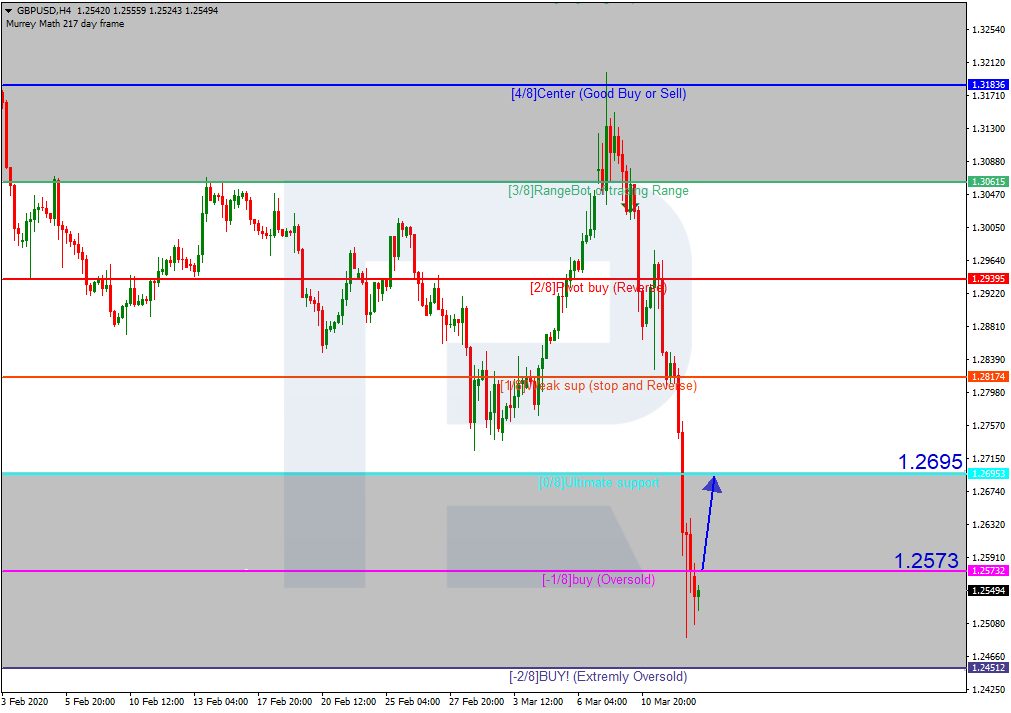

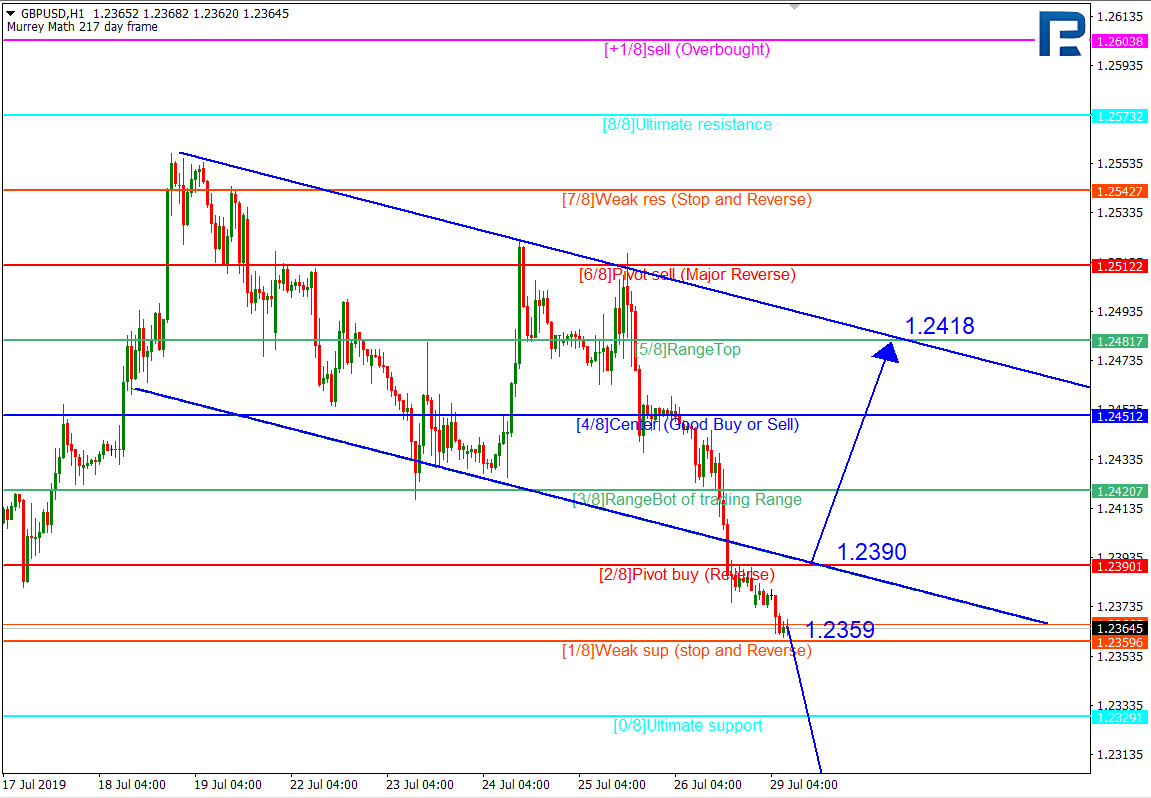

GBP USD, “Great Britain Pound vs US Dollar”

At the H4 chart, there are two possible scenarios. Right now, the tendency is bullish, because the GBP/USD pair is rebounding from the 4/8 level (1.3186) and may resume growing towards the 5/8 level (1.3244) with the next possible target at the 8/8 one (1.3427). However, if the pair breaks the 4/8 level, the instrument may continue falling towards the 1/8 one (1.2939).

As we can see at the H1 chart, the pair is also consolidating between the 3/8 and 5/8 levels, but here the range is a bit smaller in comparison with the H4 chart. In this case, we may guess the future scenario after the price breaks one of the border. If the instrument breaks the range to the upside, it may continue growing; if to the downside – continue moving downwards.

RoboForex Analytical Department