USDJPY, “US Dollar vs Japanese Yen”

USDJPY quotes are below the 200-day Moving Average on H4, which reveals the prevalence of a downtrend. The RSI has rebounded from the resistance line. In this situation, a test of 3/8 (142.18) is expected, followed by a breakout from it and a decline to the support at 2/8 (140.62). The scenario could be cancelled by rising above 4/8 (143.75). In this situation, the quotes might grow to the resistance at 5/8 (146.09).

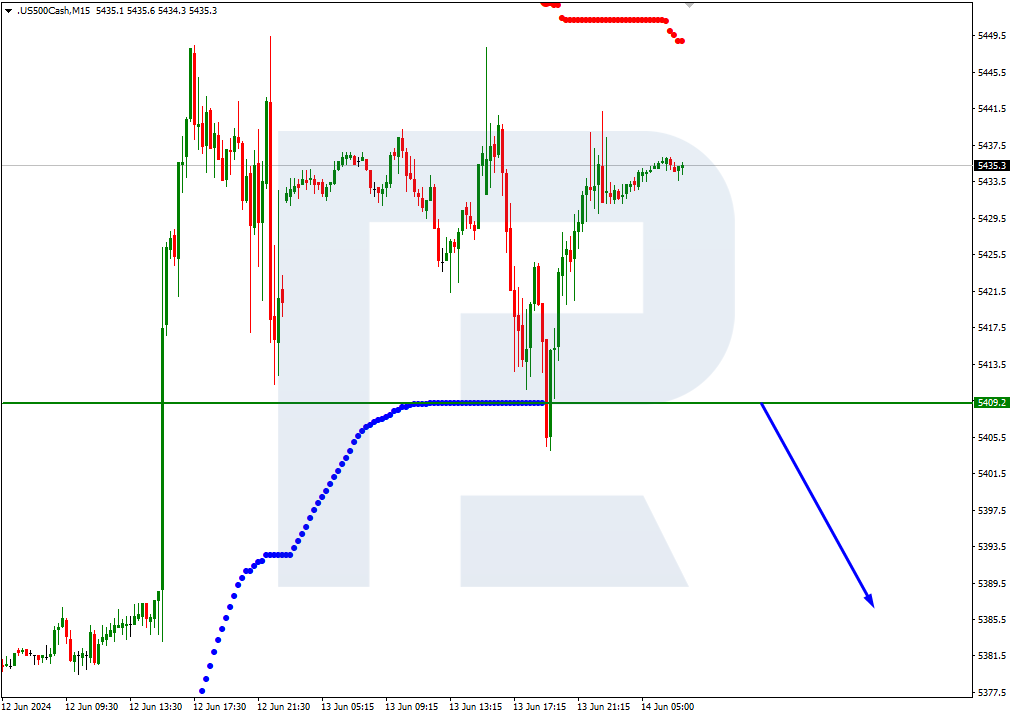

On M15, a breakout of the lower boundary of the VoltyChannel could increase the probability of the price decline.

USDCAD, “US Dollar vs Canadian Dollar”

USDCAD quotes are below the 200-day Moving Average, which implies the prevalence of a downtrend. However, the RSI has formed a convergence, signaling a possible price rise. In the end, in these circumstances, a test of the 6/8 (1.3427) level is expected, followed by a breakout of this mark and a price growth to the resistance at 7/8 (1.3549). The scenario could be cancelled by a downward breakout of 5/8 (1.3305), in which case the quotes might drop to the support at 4/8 (1.3183).

On M15, the price rise could be additionally supported by a breakout of the upper boundary of the VoltyChannel.