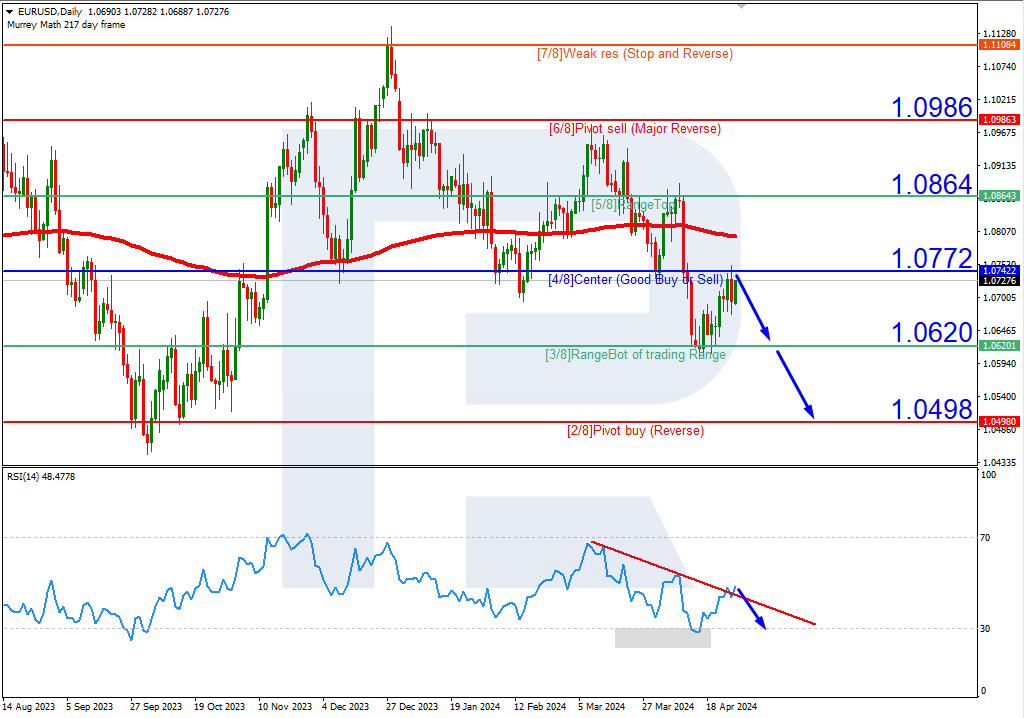

USDJPY, “US Dollar vs Japanese Yen”

On H4, the quotes are under the 200-day Moving Average, revealing the prevalence of a downtrend. The RSI is nearing the resistance line. As a result, we expect a test of 4/8 (131.25). Then it should break, and the price should fall to the support at 3/8 (129.68). The scenario can be canceled by an upward breakaway of the resistance at 5/8 (132.81). In this case, the pair might rise to 6/8 (134.37).

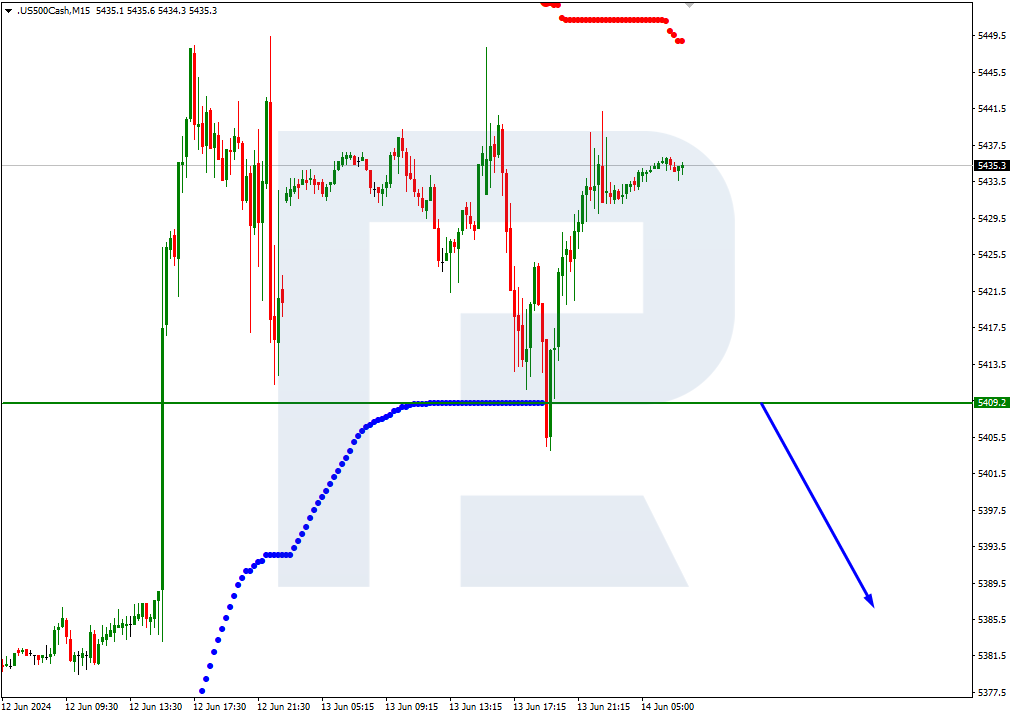

On M15, a breakaway of the lower line of the VoltyChannel indicator will increase the probability of further falling of the price.

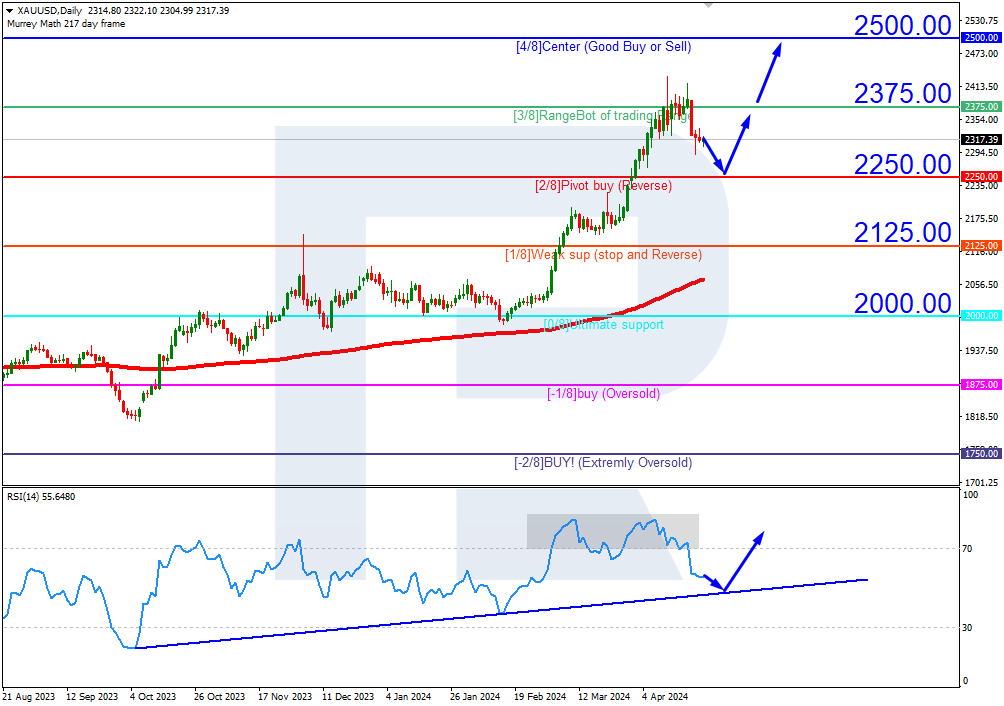

USDCAD, “US Dollar vs Canadian Dollar”

On H4, USDCAD quotes remain in the overbought area. The RSI has pushed off the resistance line. As a result, we should expect a downward breakaway of 8/8 (1.3671) and further falling of the price to the support level of 7/8 (1.3549). The scenario can be canceled by an upward breakaway of the resistance at +1/8 (1.3793). In this case, the quotes might rise to +2/8 (1.3916).

On M15, a further decline of the price can be additionally supported by a breakaway of the lower border of VoltyChannel.