BRENT

As we can see in the H4 chart, after rebounding from the 200-day Moving Average, Brent is trading above it. In this case, the pair is expected to test 2/8, rebound from it, and then resume growing towards the resistance at 3/8. However, this scenario may no longer be valid if the price breaks 1/8 to the downside. After that, the instrument may continue falling to reach the support at 0/8.

In the M15 chart, the pair may break the upside line of the VoltyChannel indicator and, as a result, continue its growth.

S&P 500

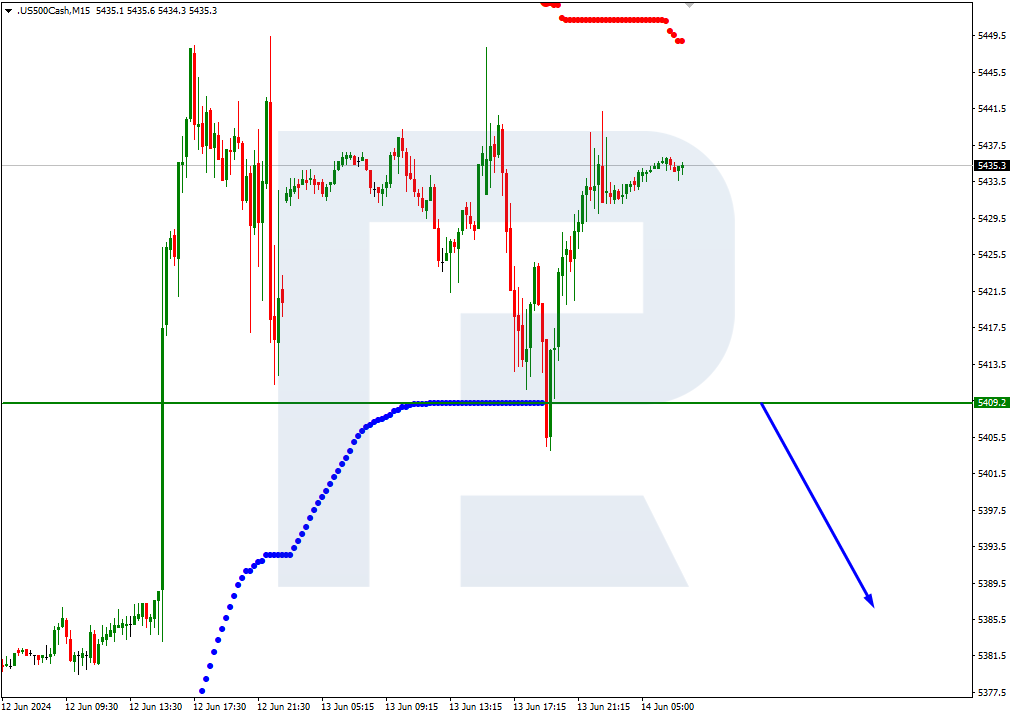

In the H4 chart, the S&P Index is still trading above the 200-day Moving Average, thus indicating an ascending tendency. In this case, the price is expected to continue growing towards the closest resistance at 6/8. However, this scenario may no longer be valid if the price breaks 5/8 to the downside. After that, the instrument may correct downwards and reach the support at 4/8.

As we can see in the M15 chart, the upside line of the VoltyChannel indicator is pretty far away from the price, that’s why one should closely watch the way it moves at 5/8 from the H4 chart. If the asset fails to break this support level in the nearest future, the price may grow towards the resistance at 6/8.