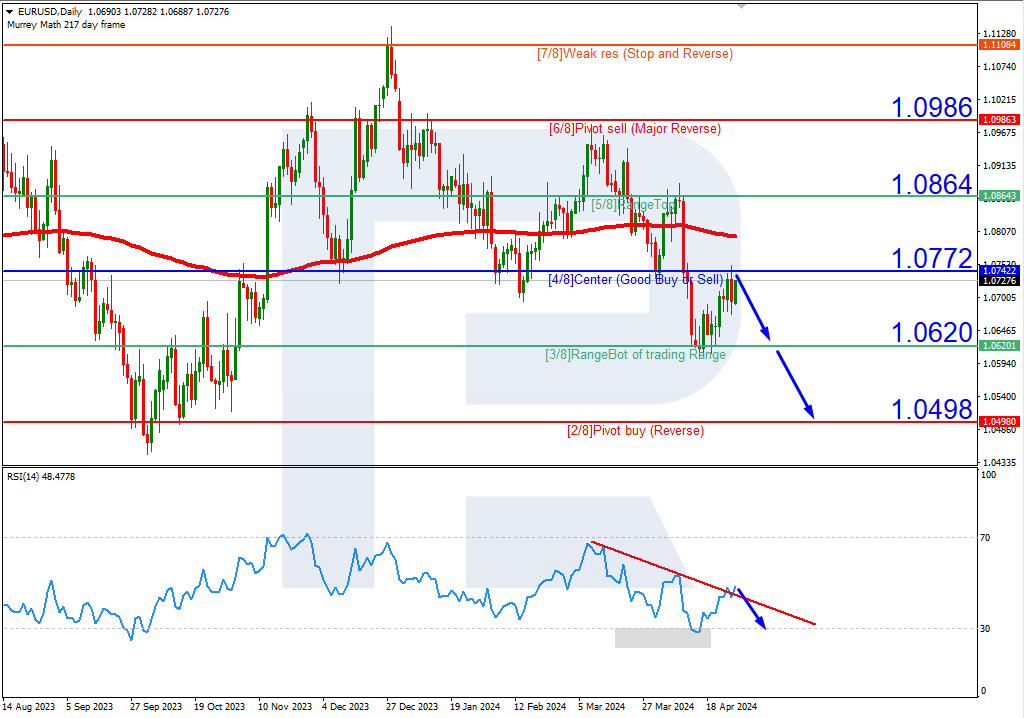

AUDUSD, “Australian Dollar vs US Dollar”

AUDUSD quotes have broken the 200-day Moving Average on D1 and are currently below it, which indicates the probability of a downtrend development. The RSI has broken the support line. In this situation, a breakout of 3/8 (0.6530) is expected, followed by a price decline to the support at 1/8 (0.6408). The scenario could be cancelled by a breakout of the 4/8 (0.6591) level, in which case the pair might rise to the resistance at 5/8 (0.6652).

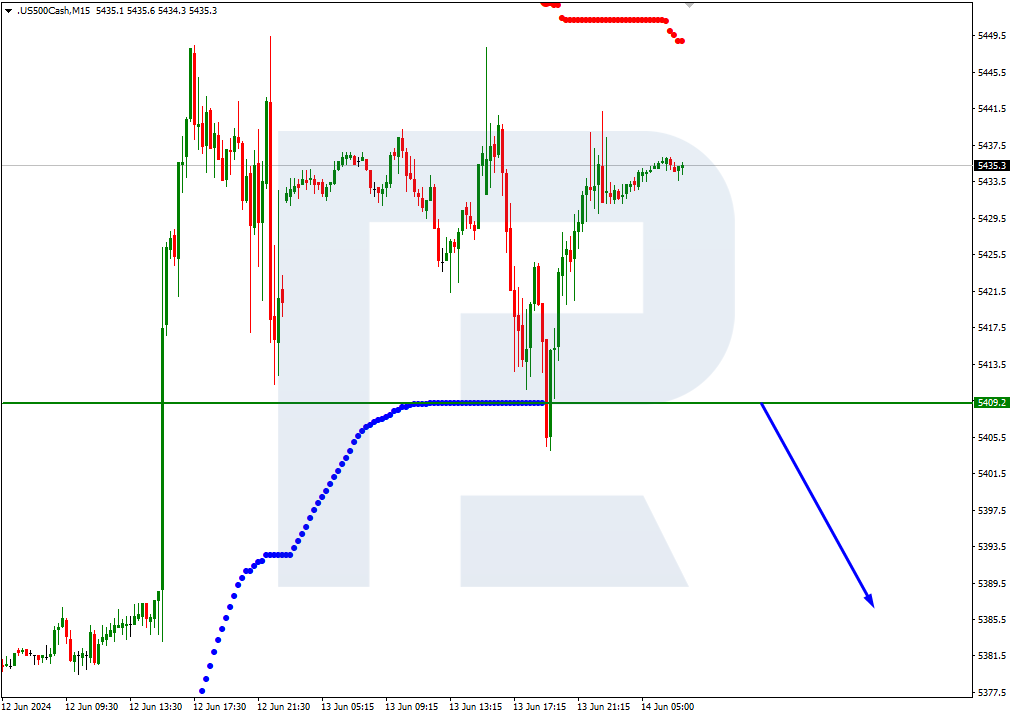

On M15, the price decline could be additionally supported by a breakout of the lower boundary of the VoltyChannel.

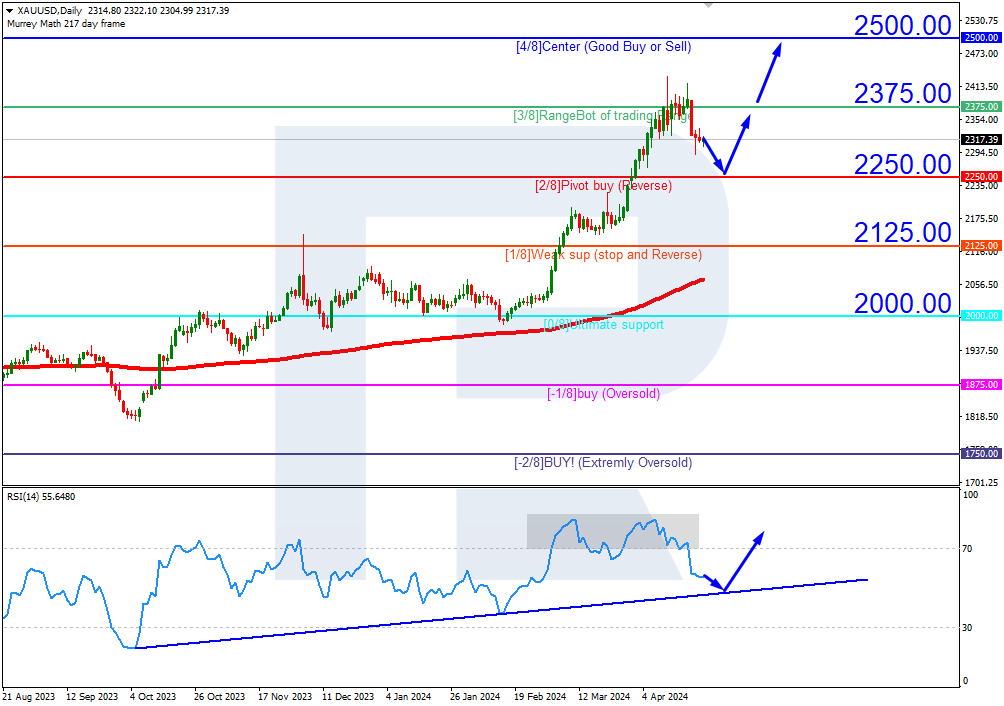

NZDUSD, “New Zealand Dollar vs US Dollar”

NZDUSD quotes are below the 200-day Moving Average on D1, revealing the prevalence of a downtrend. However, the RSI has reached the oversold area. As a result, in this situation, a test of 3/8 (0.6042) is expected, followed by a price rise towards the resistance at 4/8 (0.6103). This increase is interpreted as a correction within a downtrend. The scenario could be cancelled by a breakout of 2/8 (0.5981), in which case the quotes might drop to the support at 1/8 (0.5920).

On M15, a breakout of the upper boundary of the VoltyChannel might support a further price rise.