Brent

On H4, the quotes are above the 200-day Moving Average, which indicates prevalence of an uptrend. The RSI has broken through the resistance line. The quotes are now expected to rise above 8/8 (87.50) and later reach the resistance level of +2/8 (90.62). The scenario can be cancelled by a downward breakaway of the support level of 7/8 (85.94). In this case, the quotes may drop to 5/8 (82.81).

On M15, the upper line of VoltyChannel is broken away, which confirms the uptrend and increases the probability of further growth.

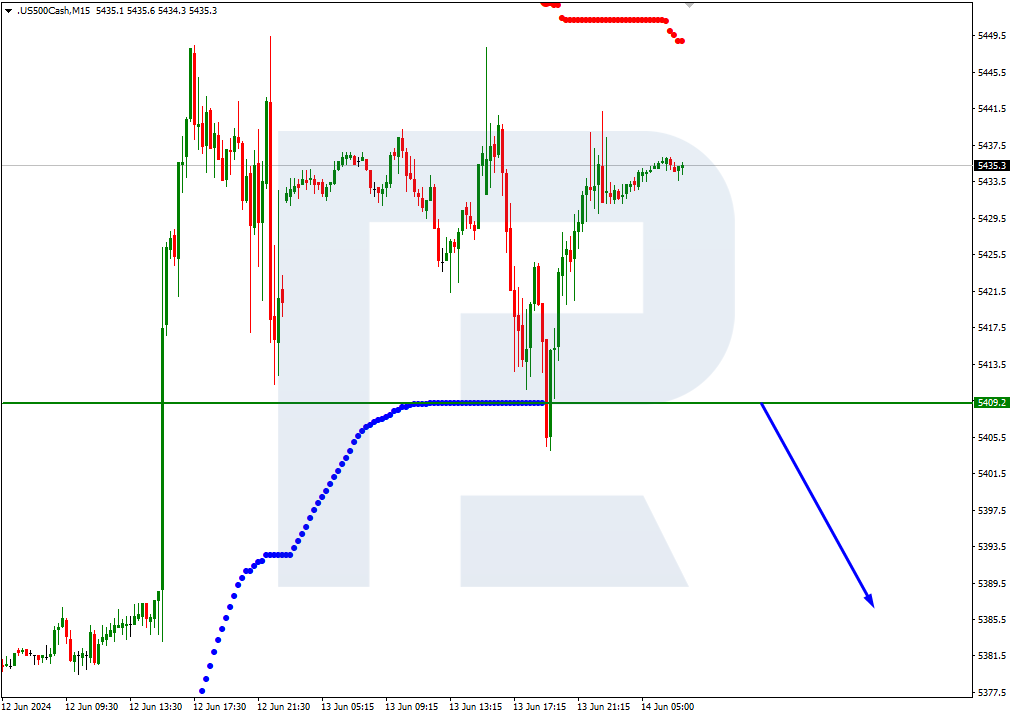

S&P 500

On H4, the quotes are above the 200-day Moving Average, which indicates an uptrend. A divergence has formed on the RSI, being a signal for a correction to start. As a result, a bounce off 4/8 (4062.5) should be expected, followed by falling of the support level of 2/8 (3906.2). The scenario can be cancelled by an upwards breakaway of the resistance level. In this case, the quotes might keep growing and reach 5/8 (4141.6).

On M15, an additional signal confirming the decline will be a breakaway of the lower border of VoltyChannel.