USDJPY, “US Dollar vs. Japanese Yen”

In the H4 chart, after breaking the 200-day Moving Average, USDJPY is trading above it, thus indicating a possible ascending tendency. In this case, the price is expected to break 3/8 and then continue growing to reach the resistance at 4/8. However, this scenario may no longer be valid if the price rebounds from 2/8 to the downside. After that, the instrument may continue falling towards the support at 1/8.

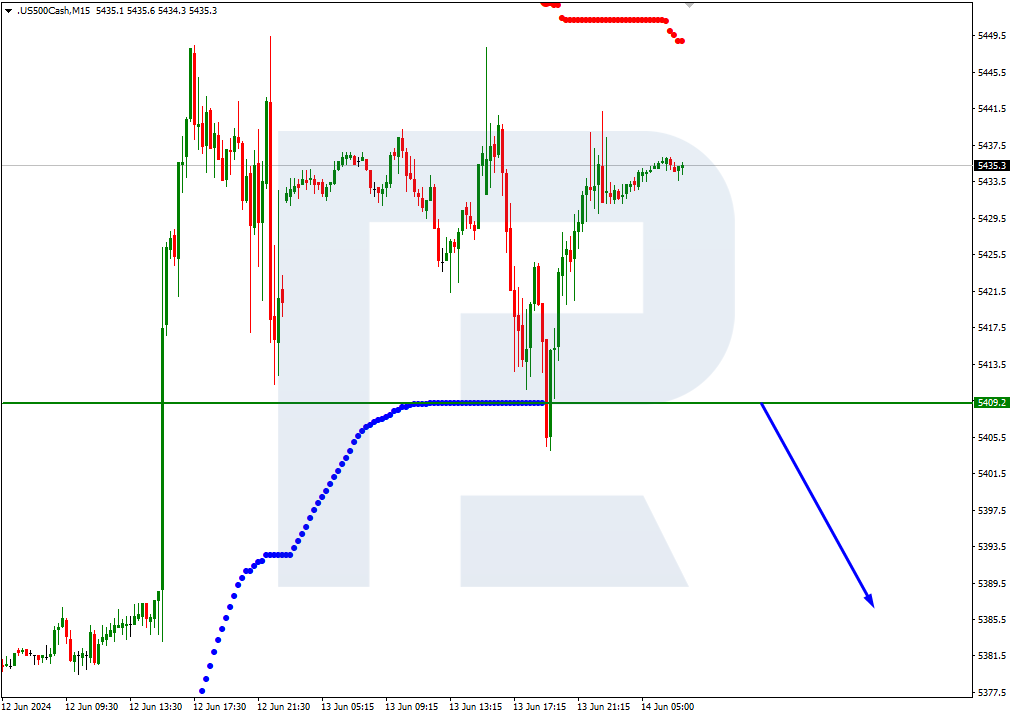

As we can see in the M15 chart, the pair has broken the upside line of the VoltyChannel indicator and, as a result, may continue the ascending tendency.

USDCAD, “US Dollar vs Canadian Dollar”

In the H4 chart, USDCAD is trading below the 200-day Moving Average not far from 3/8. Given the current descending tendency in the chart, the price is expected to break 3/8 and then continue falling towards the support at 2/8. Still, this scenario may no longer be valid if the price breaks 4/8 to the upside. After that, the instrument may correct upwards to reach the resistance at 5/8.

As we can see in the M15 chart, the pair has broken the downside line of the VoltyChannel indicator and, as a result, may continue trading downwards.